Global M2 Suggests Bitcoin May Peak by September, Say Analysts

A pullback in global M2 has analysts debating whether crypto’s bull run is near its peak, with projections centered on early fall.

New macro signals emerging in early August may shape the market’s broader trend. Most notably, global M2 supply—a key indicator reflecting liquidity in the global economy—has just confirmed a pullback after reaching an all-time high.

What does this new M2 signal mean? Here are the latest insights from analysts.

Could the Crypto Bull Run Be Nearing Its End as Global M2 Pulls Back?

Data from shows that global M2 supply peaked at $114.8 trillion in late June. By early August, it had declined to $112.7 trillion—a 1.8% drop.

Although the decline isn’t drastic, investor Brett points out that global M2 has formed both a “lower high” and a “lower low.” This pattern suggests a potential downtrend may be emerging.

Bitcoin Price and M2 Supply with 84-Day Offset. Source:

Bitcoin Price and M2 Supply with 84-Day Offset. Source:

A chart provided by ₿rett illustrates a strong correlation between Bitcoin price cycles and global M2, with a lag of 84 days. Based on this, he predicts that Bitcoin may reach its cycle top by late September.

“Global M2 has formed a lower high and lower low. Using the 84-day offset, the current peak is expected by late September. As noted in my December post below, the past three Bitcoin peaks occurred 525–532 days post-halving. Global M2’s current peak is 518 days after the halving. Coincidence?” ₿rett said.

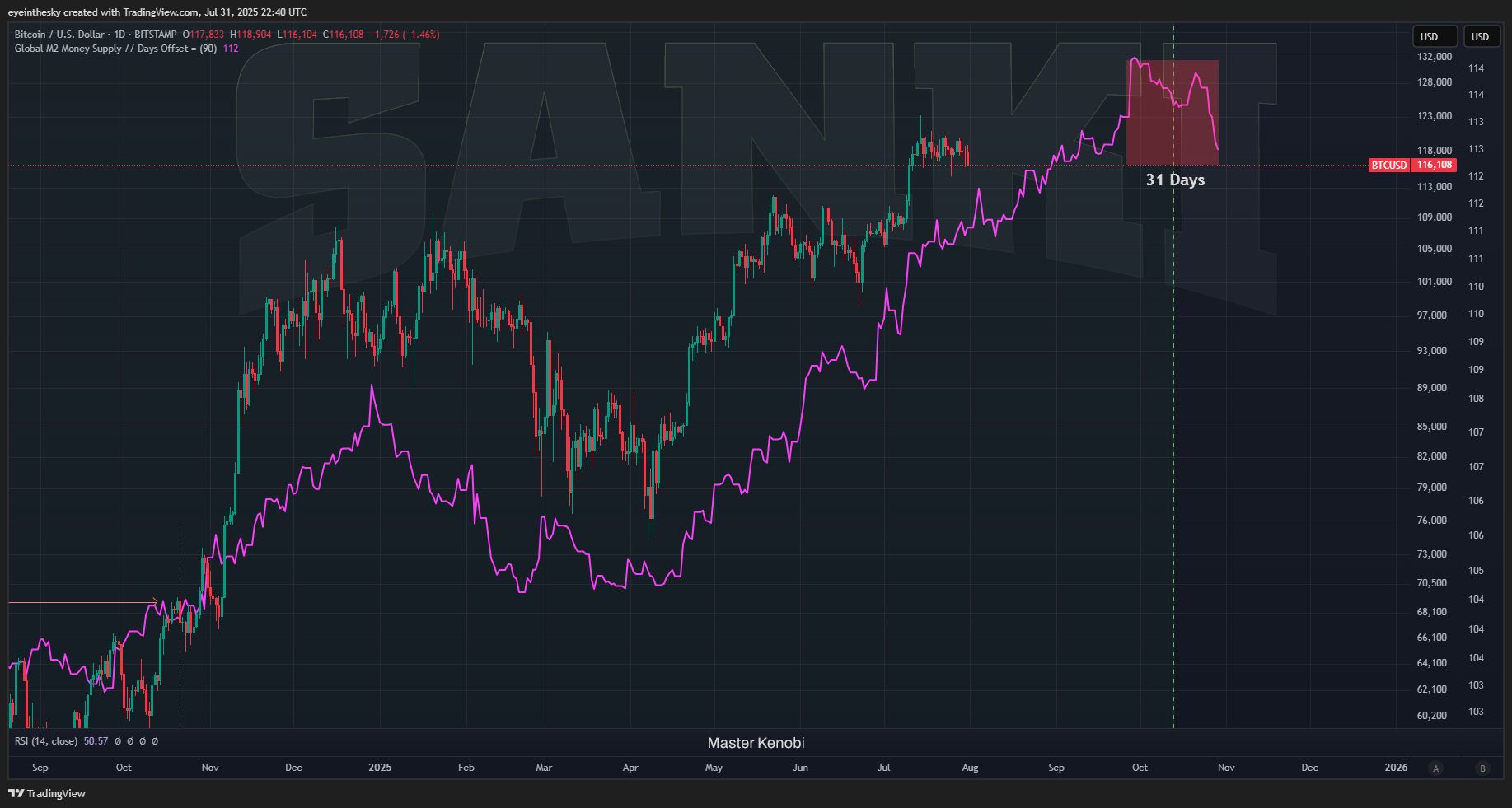

Analyst Master Kenobi offers a similar prediction. He compares Bitcoin’s price to global M2 supply using a 90-day offset. Based on this model, he expects the current Bitcoin cycle to end in October 2025, followed by a significant correction.

Bitcoin Price and M2 Supply with 84-Day Offset. Source:

Bitcoin Price and M2 Supply with 84-Day Offset. Source:

“The Money Supply appears to have reached its local peak 31 days ago and has entered a period of decline…Based on M2 and current data, the pump signaling the cycle’s end should occur between late September and early October.” – Master Kenobi predicted.

The recent downturn in M2 seems to be prompting analysts to be more cautious.

Not all analysts rush to conclusions. Colin Talks Crypto agrees that the recent M2 pullback is the sharpest in the past seven months. However, he also notes that the current data may not be reliable.

Global M2 Money Supply vs BTCThe largest decline in global M2 has just occured (see top-right of global M2 line) in the last 7 months.Since we've pushed the global M2 line forward by 90 days, this means this drop in global liquidity could reflect itself in BTC around late…

— Colin Talks Crypto(@ColinTCrypto) July 30, 2025

Colin also agrees that September and October could be sensitive periods. Yet he doesn’t rule out the possibility that this is just a sub-peak.

“Rather than jumping to conclusions with premature data, I think a continued watchful eye of the global M2 line during the next several weeks is our best course of action,” Colin Talks Crypto said.

Although forecasts based on the 84–90 day offset and the halving cycle offer an intriguing picture, the crypto market remains highly influenced by other factors. Key economic events, such as potential Fed rate cuts, geopolitical developments, and global investor sentiment, could all shift the current trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

French Banking Titan Launches Groundbreaking Stablecoin Tied to the Euro

In Brief ODDO BHF launches Euro-pegged stablecoin EUROD on Bit2Me for broad market access. EUROD aligns with E.U.'s MiCA framework, enhancing trust with bank support. EUROD aims to fill corporate demand and diversify currency in a dollar-dominated arena.

Top 3 Altcoins Set for Huge Gains — Buy Before the Next Rally

XRP Tests Critical $2.21 Level While Oversold RSI Suggests Possible Short-Term Reboun

XRP Liquidity Map Highlights Major $3.6 Cluster as Price Holds Above Support