HBAR Bulls Get Burned as Long Liquidations Dominate Futures Market

HBAR is struggling with significant losses as long-position liquidations and smart money exits signal growing bearish momentum, pushing the token toward key support levels.

Hedera Hashgraph’s HBAR has noted a sharp downturn this week, with its price slipping by over 17% since Sunday.

As sentiment across the crypto sector remains muted, HBAR has not been spared. On-chain data shows that bullish traders are now bearing the brunt of its ongoing price decline.

HBAR Faces Long Liquidations as Bearish Pressure Climbs

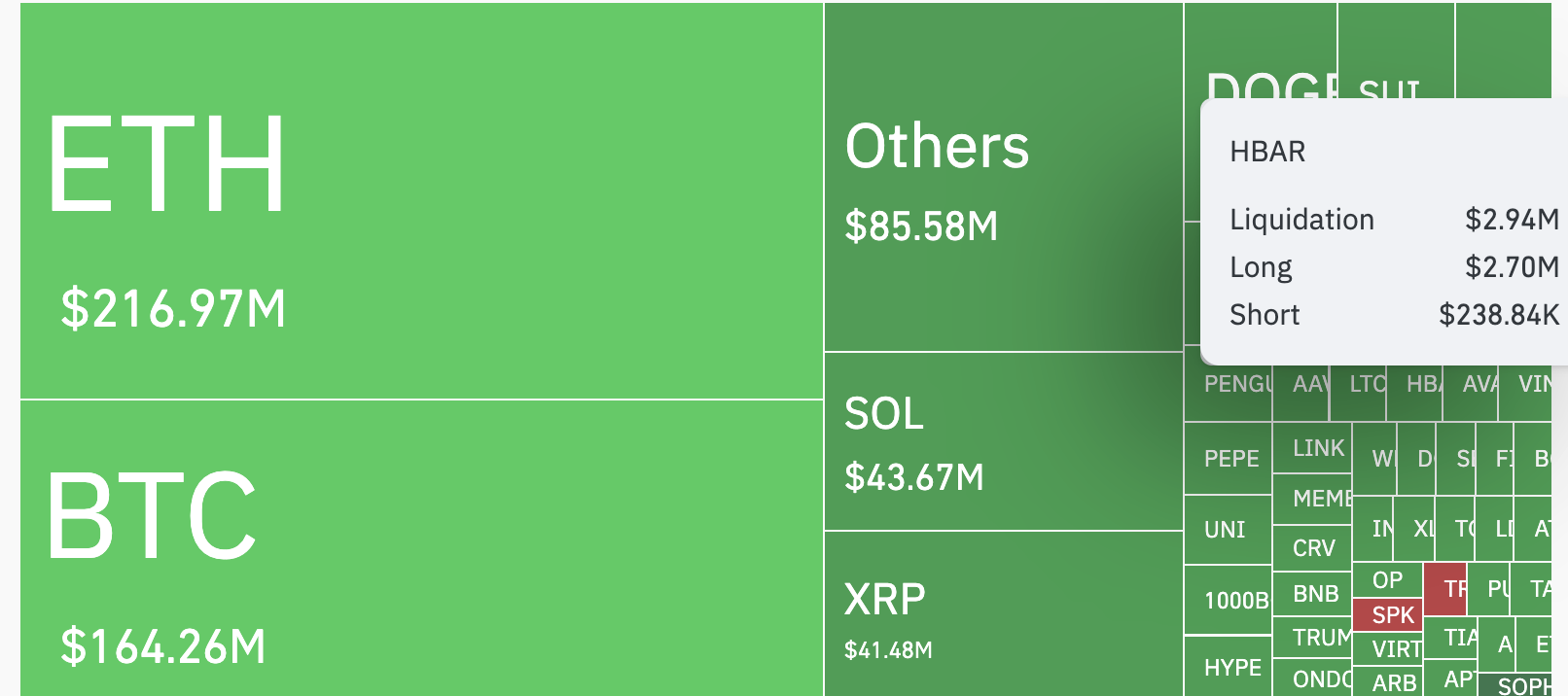

In the past 24 hours, HBAR’s price has plunged by 9%, deepening the losses for bullish traders. Data from Coinglass shows that long liquidations alone accounted for $2.70 million of the total $2.94 million wiped from the HBAR futures market during this period.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Crypto Liquidation Heatmap. Source:

Coinglass

Crypto Liquidation Heatmap. Source:

Coinglass

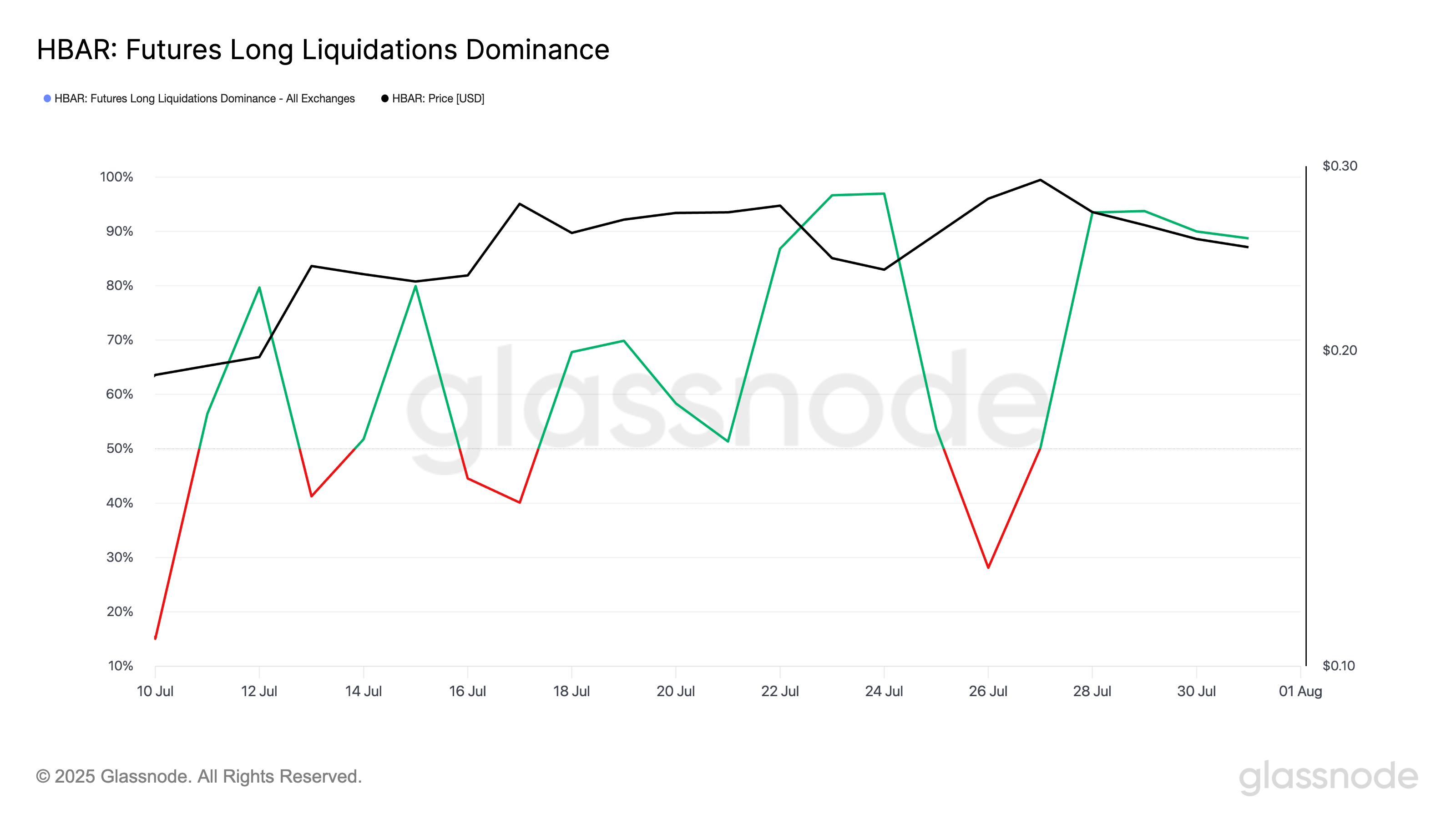

Long-position holders have faced a wave of liquidations as HBAR’s price continues to fall. According to Glassnode, the token’s Futures Long Liquidations Dominance surged past 88% on Thursday, marking another day of aggressive shakeouts for bullish traders this week.

HBAR Futures Long Liquidations Dominance. Source:

Glassnode

HBAR Futures Long Liquidations Dominance. Source:

Glassnode

This metric measures the proportion of total futures liquidations that come from long positions. When it spikes, it indicates that most liquidations are coming from traders who bet on rising prices due to a downward price trend.

In HBAR’s case, the metric confirms that bearish momentum has overwhelmed bullish sentiment. This has triggered a cascade of forced sell-offs that could further pressure the token’s price.

HBAR’s Smart Holders Hit the Exit

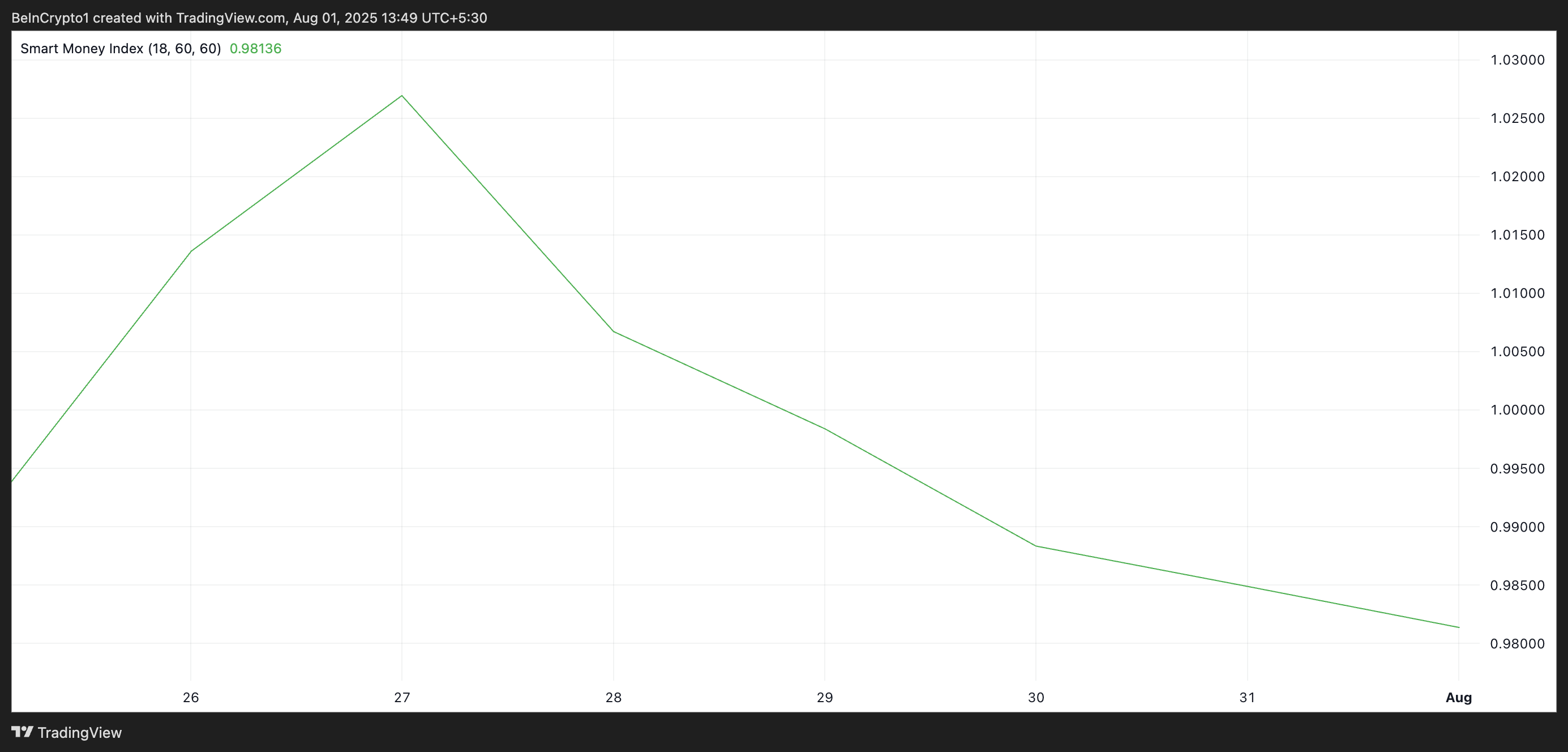

Selling activity has also rocketed among HBAR “smart holders.” Readings from the token’s Smart Money Index (SMI) indicator reveal a steady decline in demand among these investors since Sunday. At press time, it stands at 0.98.

HBAR SMI. Source:

TradingView

HBAR SMI. Source:

TradingView

Smart money refers to capital controlled by institutional investors or experienced traders who understand market trends and timing more deeply. The SMI tracks the behavior of these investors by analyzing intraday price movements.

It measures selling in the morning (when retail traders dominate) versus buying in the afternoon (when institutions are more active).

A rising SMI signals that smart money is accumulating an asset, often ahead of major price moves.

However, when this momentum indicator falls, experienced traders are pulling back from the market. This trend signals weakening confidence in HBAR’s short-term price stability as the market enters a new trading month.

HBAR Holds the Line at $0.24 — But Will the $0.22 Floor Collapse?

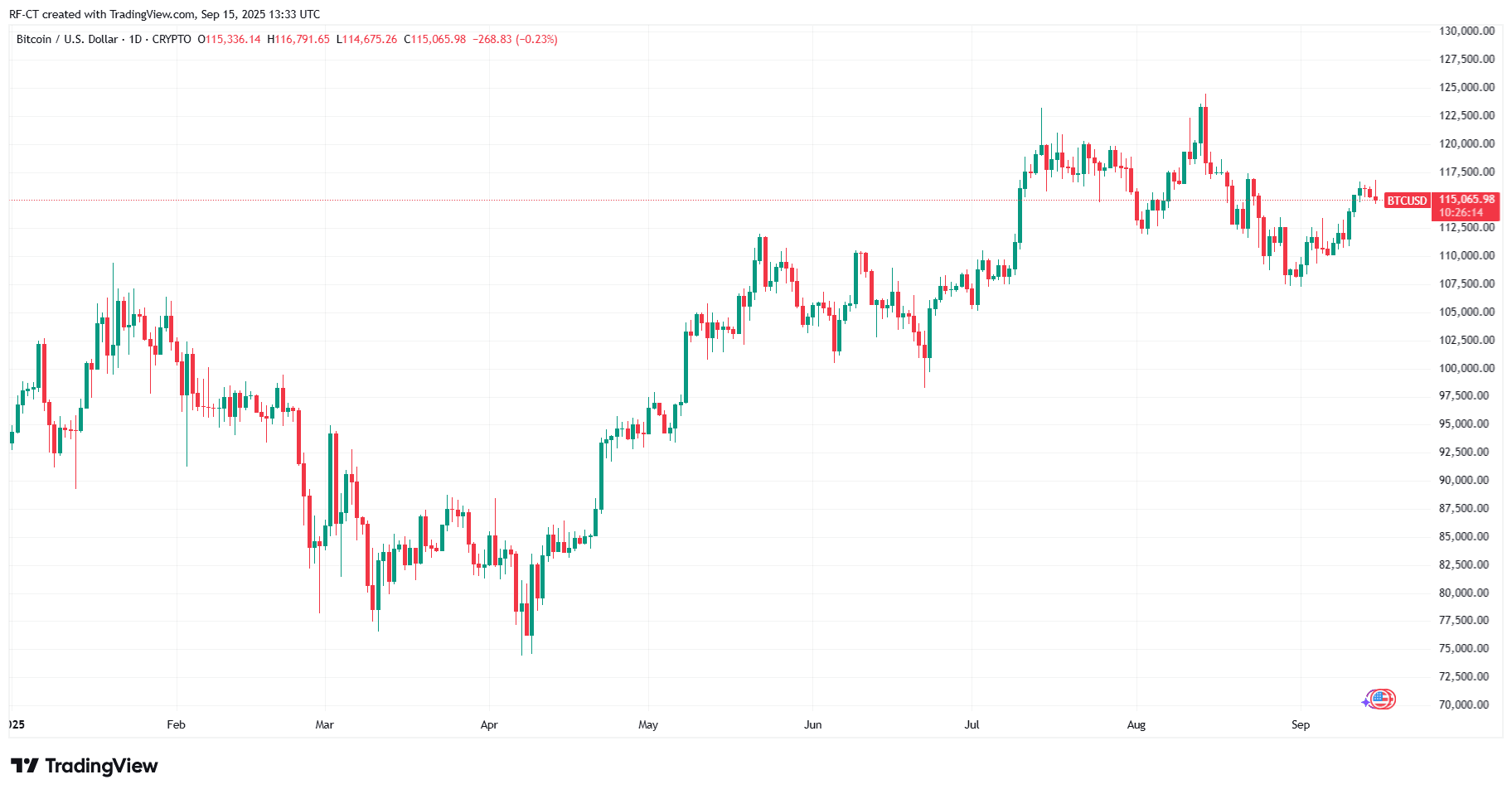

HBAR trades at $0.24 at press time, holding just above a key support level at $0.22. If sell-side pressure intensifies, a drop below this floor could be imminent, potentially driving the token’s price down to $0.18.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

Conversely, a resurgence in buying interest could trigger a bullish reversal. HBAR may attempt to break above the $0.26 resistance level in that scenario.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Sees 2.25 Billion USDC Minted In September

Quick Take Summary is AI generated, newsroom reviewed. Solana recorded $2.25 billion USDC Mint during September 2025 Institutions prefer Solana for speed, liquidity, and regulatory clarity GENIUS Act rules boost compliance trust for institutional stablecoin adoption Public companies increasingly use Solana treasuries for staking and yield Circle expands USDC Mint globally under MiCA and e-money frameworksReferences $2.25B $USDC Minted on Solana This Month

Forward Industries to tokenize company stock and operate fully on Solana blockchain

Get Your Bitcoin and Ethereum via PayPal: P2P Payments Have Just Entered the Cryptocurrency Space

PayPal has launched peer-to-peer payments for Bitcoin and Ethereum, allowing users to send and receive cryptocurrencies directly through its platform more easily than before.

Bitcoin eyes long liquidations as gold passes $3.7K for first time