Date: Sun, Aug 03, 2025 | 03:20 PM GMT

The cryptocurrency market is making a slight recovery from the latest sharp decline as the price of Ethereum (ETH) has now bounced to $3,460 from its 24h low of $3,357. Following this, notable altcoins have started to move upward — including Initia (INIT).

INIT has surged 13% in the past 24 hours, and its chart is now flashing a major bullish signal — the emergence of the “Power of 3” fractal pattern, which could hint at a potential upside move.

Source: Coinmarketcap

Source: Coinmarketcap

“Power of 3” Fractal Pattern in Play?

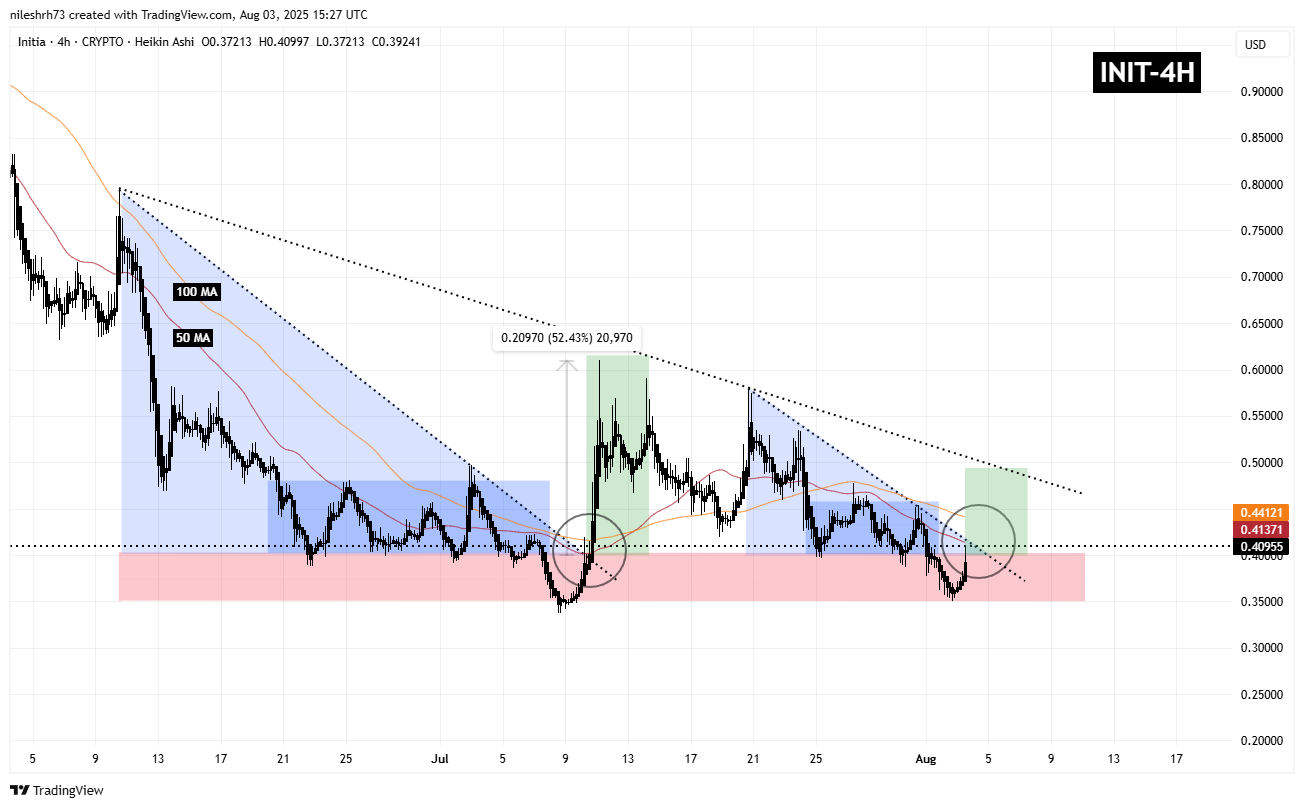

On the 4-hour timeframe, INIT seems to be replaying a textbook Power of 3 setup, a market structure composed of three distinct phases:

- Accumulation – price consolidates in a base region

- Manipulation – a fake breakdown or shakeout occurs

- Expansion – a sharp move in the direction of the trend

This exact sequence unfolded last month, when INIT dropped into the accumulation zone, shook out weak hands in the manipulation zone, and then rallied by over 52% after breaking out of a descending trendline and claiming its 50 and 100 moving averages.

Initia (INIT) Fractal Chart/Coinsprobe (Source: Tradingview)

Initia (INIT) Fractal Chart/Coinsprobe (Source: Tradingview)

Now, a similar pattern is emerging again.

INIT has bounced from the same key support zone which was the manipulation zone (red area) and is currently challenging the downtrend resistance while approaching its 50 and 100 MAs — all critical ingredients that sparked the previous surge.

What’s Next for INIT?

If INIT successfully breaks above the trendline and reclaims the 50 and 100 MA zones, it could confirm the Expansion phase of the PO3 fractal. This would potentially lead to a continuation of bullish momentum, targeting the next major resistance level around $0.49 — a move that represents over 21% upside from current levels.

However, a clear breakout is essential for confirmation. If INIT fails to break above its trendline or gets rejected from the MAs, the fractal setup could stall, delaying further gains.