Solana’s Anatoly Yakovenko Sparks Backlash with Anti-Community Remark

A controversial take from Solana’s co-founder on communities stirred outrage, clashing with data showing their vital role in the network’s growth.

Anatoly Yakovenko ignited a wave of backlash across crypto Twitter, opening a heated debate about the role of communities.

While the conversation was nowhere close to Web3, a single comment from the Solana executive attracted a long chain of criticism.

Base and Solana Execs Disagree on Communities

The controversy began when Yakovenko replied to a post by X Head of Product Nikita Bier, concerning a potential X (Twitter) revamp.

If you had to remove 1 feature or part of the X app, what would it be?

— Nikita Bier (@nikitabier) August 3, 2025

According to Solana co-founder Anatoly Yakovenko, communities are useless, a stance that triggered swift and vocal criticism from both developers and users.

While some interpreted his comment as referring to the X app’s Communities feature, others considered it a broader dismissal of community-driven growth in the crypto space.

Jesse Pollak, creator of the Base chain and a leading figure at Coinbase exchange, challenged this perception by articulating the relevance of communities.

Communities are everything.

— jesse.base.eth (@jessepollak) August 3, 2025

Pollak later elaborated that meme coin projects, particularly, rely on communities. According to the Base executive, as relevant as they are, communities also need facilitation to bring them together.

Other users echoed Pollak’s sentiment, pointing out the irony of Yakovenko’s statement given Solana’s current trajectory in the meme coin market.

“Why does Toly hate the only people propping up Solana’s price?” one user chimed.

The remark refers to the meme coin traders and gamblers who have dominated Solana’s on-chain activity in recent months.

“It’s crazy to bite the hand that built you,” they added.

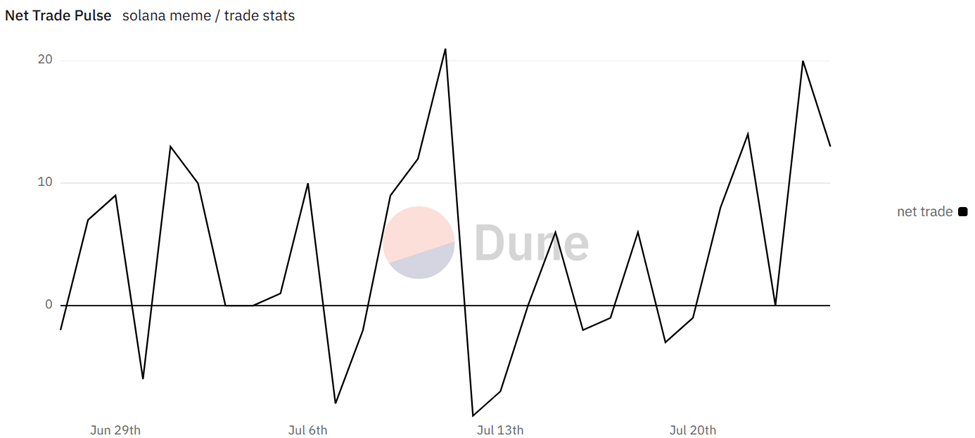

Indeed, data on Dune shows an active and speculative trading environment for Solana meme coins, characterized by short-term momentum shifts.

Solana Net Trade Pulse. Source:

Dune Analytics

Solana Net Trade Pulse. Source:

Dune Analytics

Meme Coins Prove the Power of Community on Solana

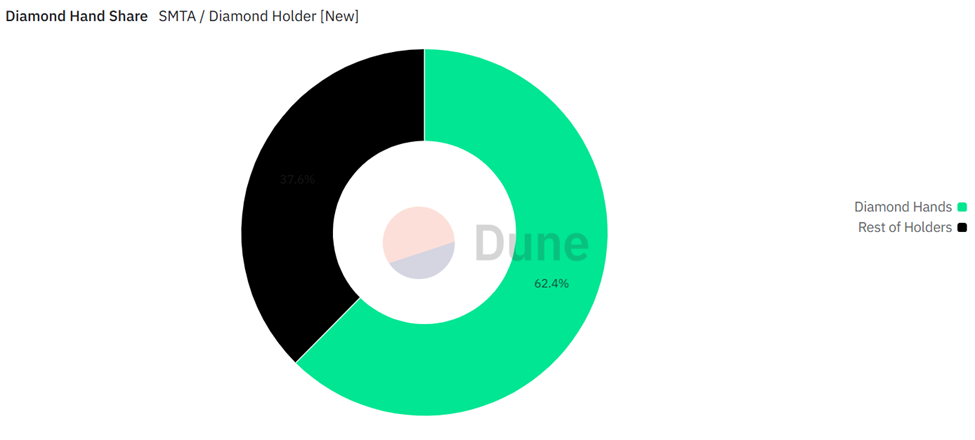

Similarly, the diamond hand share metrics show that 62.4% of SMTA (Solana Meme Token Analysis) token holders qualify as Diamond Hands, meaning they have held their tokens for a prolonged period without selling.

The remaining 37.6% are considered more transient or short-term holders. This is a strong sign of investor conviction, especially for relatively new or speculative assets on the Solana network.

Solana Meme Coins Diamond Hand Share. Source:

Dune Analytics

Solana Meme Coins Diamond Hand Share. Source:

Dune Analytics

It suggests that a significant majority of SMTA holders believe in the project’s long-term value and are not easily shaken by price volatility or short-term market fluctuations.

Key metrics show resilience despite repeated dips in the Solana meme coin narrative. This supports the argument that meme communities, and their trading behavior, play a significant role in Solana’s ecosystem.

The BONK community is the biggest on Solana And you doubted The Dog?

— BONK!!! (@bonk_inu) August 3, 2025

This directly contradicts Anatoly Yakovenko’s claim that communities are useless.

“Literally every coin on Solana now uses communities instead of Telegram chats, Anatoly,” one user quipped.

The timing of the remark is particularly sensitive. Solana has seen a surge in on-chain activity, with long-term holders quietly buying the dip.

Despite recent price drops, BeInCrypto reported Solana holders gobbling up $367 million SOL in a week.

Critics argue that diminishing the importance of grassroots structures such as communities alienates the chain’s most active user base and undermines Solana’s decentralized narrative.

The debate highlights a larger crypto theme: while tech and scalability matter, community engagement often drives adoption.

With chains competing for users, builders like Pollak see communities as essential infrastructure, not optional marketing fluff.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETH Price Experiences Volatility: In-Depth Analysis and Outlook

The Truth Behind Dogecoin's Plunge: Why Are Meme Coins the First to Fall in the Storm?

Bitcoin's "Breathing Crisis": Whales Flee, $100,000 Mark Hangs by a Thread