Nexus Mutual’s $250k payout cushions blow for Arcadia hack victims

Nexus Mutual has transferred $250,000 to reimburse users caught in Arcadia Finance’s $3.5 million exploit, marking one of Base blockchain’s first major insurance settlements. The payout arrives as Arcadia’s own recovery plan remains weeks from implementation.

- Nexus Mutual paid $250,000 to victims of Arcadia Finance’s $3.5 million hack, marking one of Base chain’s first major insurance settlements.

- The payout offers early restitution ahead of Arcadia’s own delayed recovery plan based on “Recovery Tokens.”

On August 4, crypto insurance alternative Nexus Mutual announced it had paid out $250,000 to users impacted by the July 15 Arcadia Finance exploit on Base, where attackers drained $3.5 million in stablecoins through a contract vulnerability.

The smart contract bug allowed funds to be siphoned directly from user accounts, with stolen assets swiftly laundered into wrapped Ether. Nexus Mutual began processing claims in late July after a standard cooldown period, ultimately honoring coverage for eligible users who had purchased protection through OpenCover, a Base-native distributor.

A turning point for DeFi risk mitigation?

The Arcadia Finance payout signals a deeper shift in the way decentralized finance is starting to confront its most systemic weakness: the lack of credible recourse when things go wrong. Nexus Mutual has now paid out over $18.2 million across 37 incidents since 2019, according to its public claims dashboard .

The Arcadia settlement joins a roster of landmark payouts including $5 million for the 2022 TribeDAO hack, $2.3 million for Euler Finance’s $197 million exploit, and nearly $5 million when FTX collapsed. These aren’t abstract numbers; they trace the evolution of crypto’s risk management infrastructure through its most chaotic years.

While smaller than other settlements, the Arcadia payout is symbolic. Its timing matters: this is one of the earliest high-profile insurance resolutions on Base, Coinbase’s Layer 2 chain, which has only recently started to see sustained DeFi activity. For affected users, the payout served as a crucial stopgap in the absence of protocol-native compensation, arriving before Arcadia itself was able to mobilize a full recovery plan.

Meanwhile, Arcadia Finance has charted a different course with its Recovery Token (RT) system, a complex mechanism where victims receive USDC-pegged tokens redeemable through staking, fee rebates, or secondary market sales.

Though innovative in its attempt to align incentives, the plan requires users to maintain long-term engagement with the protocol. Some may prefer Nexus Mutual’s straightforward ETH transfers, which impose no lockups or behavioral conditions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

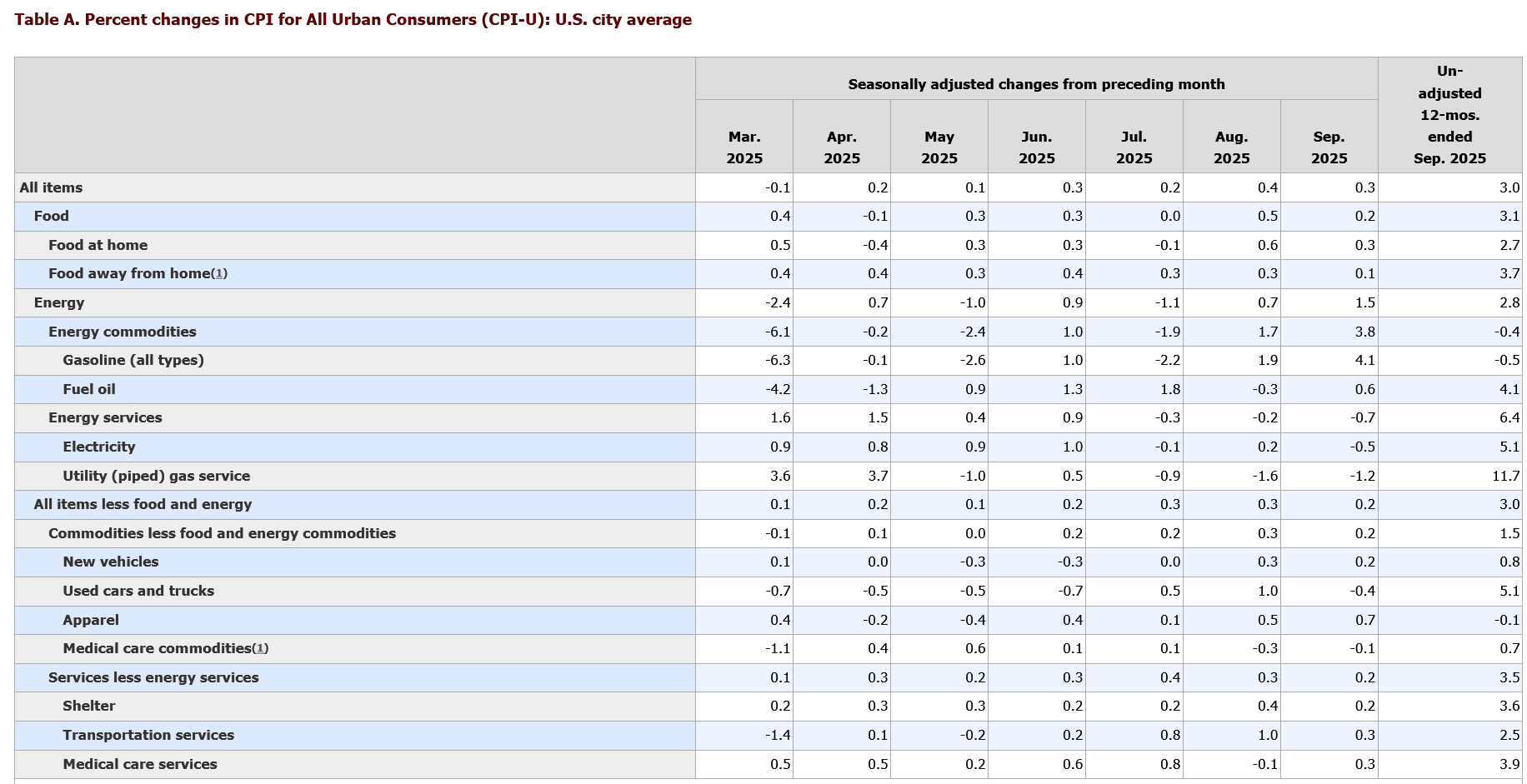

As inflation eases slightly, will XRP break its downward trend?

After several weeks of decline, XRP is finally showing signs of recovery as US inflation slightly cools.

XRP price eyes rally to $3.45 after Ripple CEO tells investors to ‘lock in’

Why is Prop AMM flourishing on Solana but still absent on EVM?

In-depth analysis of the technical barriers and EVM challenges faced by Prop AMM (Professional Automated Market Makers).

Zero Knowledge Proof Whitelist Coming Soon: Where Builders Find Purpose in the Next Blockchain Era