Will the US own nearly half of all Bitcoin by 2025? New Projection Sparks Debate

Claims that the U.S. and India will hold 45% of all Bitcoin by 2025 are exaggerated, given current holdings and market dynamics.

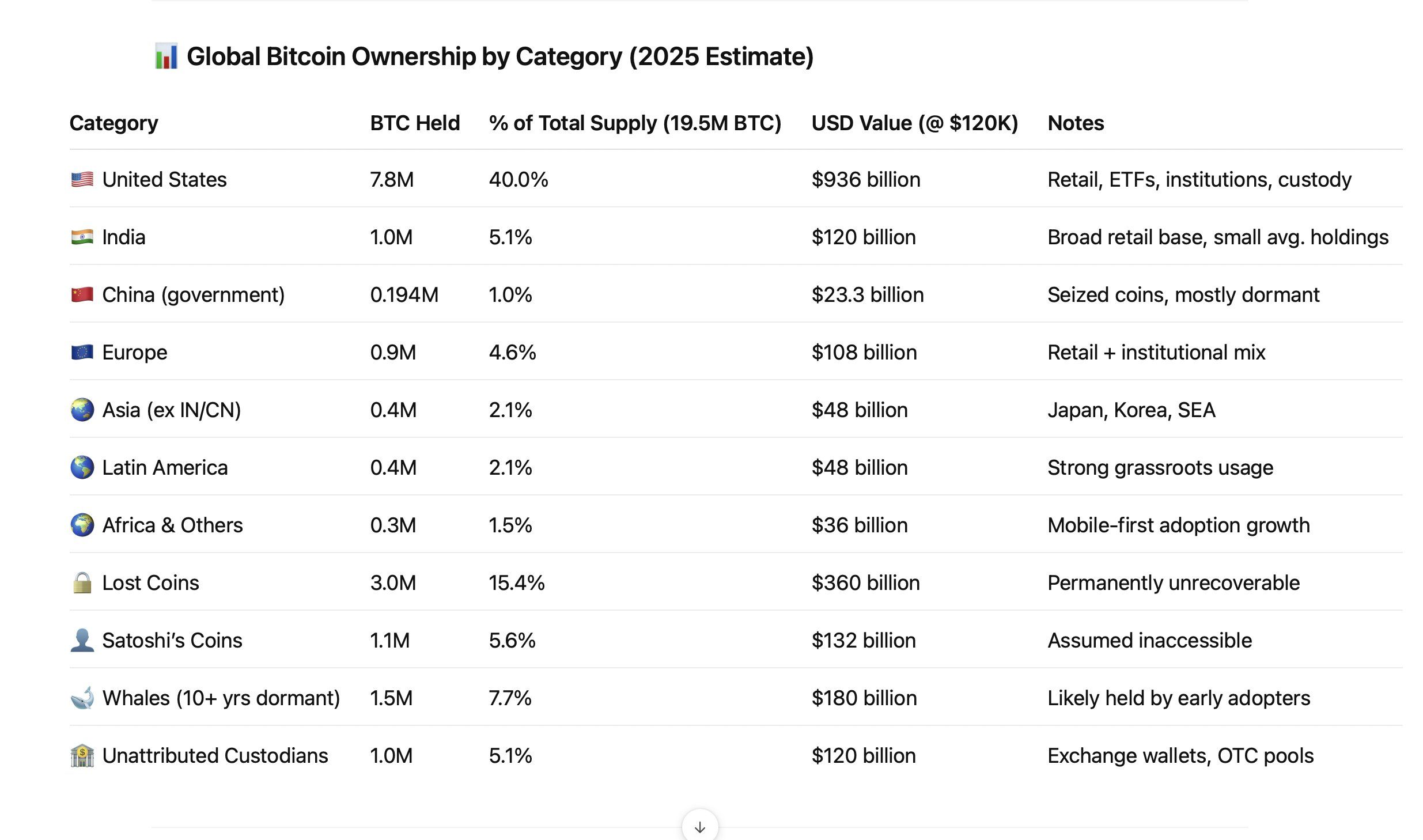

Information circulating on X suggests that by the end of 2025, the US could hold approximately 7.8 million Bitcoin, roughly 40% of the total BTC supply.

It also shows India will own around 1 million BTC, accounting for 5.1% of the global supply by 2025.

Bitcoin Ownership in 2025: Why the US 40% Claim Doesn’t Add Up

According to an image shared by investor Fred Krueger on X, the US is projected to hold nearly 8 million in Bitcoin by the end of 2025. It is not immediately clear what the source of the data is.

A figure like 7.8 million Bitcoin is notably large at this point. It seemingly includes BTC held by governments, publicly listed companies, ETFs, and retail investors.

However, is it truly feasible for the US to hold up to 40% of BTC’s total supply (after accounting for lost coins) by the end of 2025?

The US is estimated to own 40% of the total BTC supply by the end of 2025. Source:

Fred Krueger

The US is estimated to own 40% of the total BTC supply by the end of 2025. Source:

Fred Krueger

“The source data looks unrealistic, not sure how they cooked that up, but it’s not good data I’d say,” Blockstream CEO commented in response to Kreuger’s tweet.

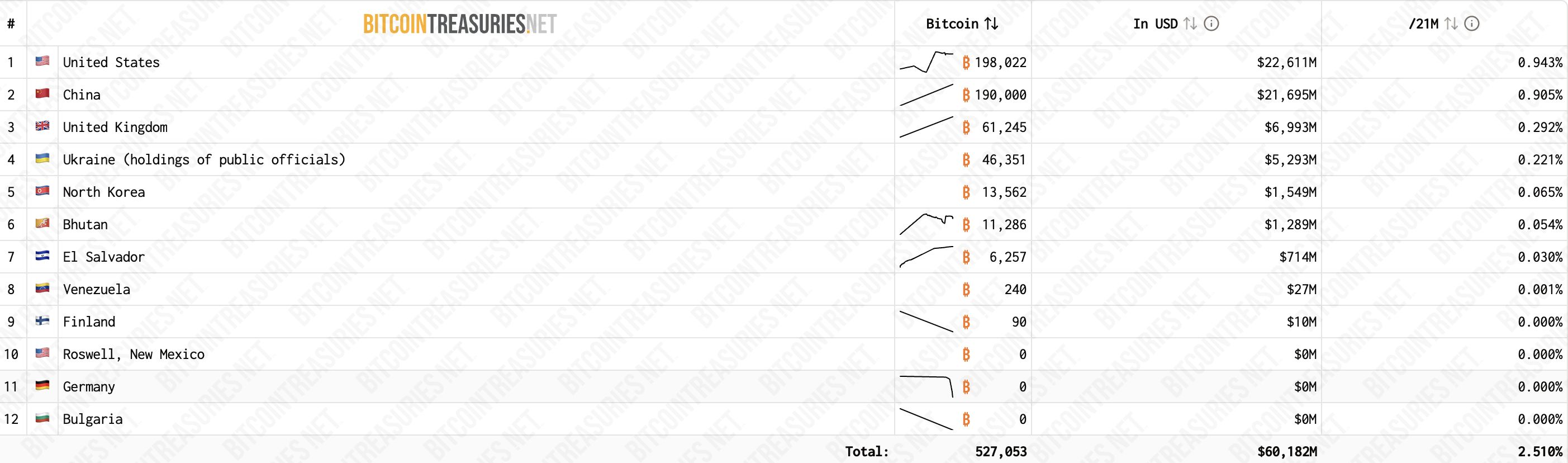

Moreover, according to the latest data from Bitcoin Treasuries, the US government currently holds about 198,022 BTC, representing less than 1% of the total supply.

Most of this comes from major seizures such as Silk Road and Bitfinex. The Trump administration had previously stated that seized Bitcoin would be moved into national reserves.

Bitcoin Holdings By Countries. Source:

Bitcoin Treasuries

Bitcoin Holdings By Countries. Source:

Bitcoin Treasuries

Forty-six of the top public companies with the largest Bitcoin holdings are based in the US. Notably, MicroStrategy and MARA Holdings top the list. Combined, these US public companies hold an estimated 876,517 BTC. Meanwhile, private companies in the US reportedly hold another 188,105 BTC.

ETFs Now Hold 1.3 Million BTC — Can They Push US Ownership to 40%?

Furthermore, according to Bitcoin Treasuries, US ETFs currently hold around 1,342,715 BTC. This brings the total BTC held by four major US entities—the government, public companies, private companies, and ETFs—to roughly 2,605,359 BTC.

BTC held by U.S.-based public companies. Source:

Bitcoin Treasuries

BTC held by U.S.-based public companies. Source:

Bitcoin Treasuries

Another key entity that may contribute significantly to US Bitcoin ownership is retail investors. Triple-A’s 2023 data shows that about 13% of the US population owns cryptocurrency, translating to approximately 46 million people.

Bitcoin remains the most popular asset, with over 73% of crypto users in the US holding BTC.

Given these numbers, the projection that the US will own 7.8 million BTC in 2025 appears overly optimistic. Even in the most aggressive growth scenarios, a single country rarely controls nearly half of Bitcoin’s supply, especially since BTC is already distributed globally.

As for India, the forecast of holding 1 million BTC by 2025 also seems unlikely. Indians have a long-standing tradition of storing wealth in gold, and this mindset is gradually shifting toward Bitcoin, a digital asset with scarcity and easier storage properties.

However, unlike gold, Bitcoin in India continues to face regulatory challenges. As such, owning 5% of the global BTC supply by 2025 appears improbable under the current circumstances.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

samczsun: The Key to Crypto Protocol Security Lies in Proactive Re-Auditing

Bug bounty programs are passive measures, while security protection requires proactive advancement.

Millennials with the most cryptocurrency holdings are reaching the peak of divorce, but the law is not yet prepared.

The biggest problem faced by most parties is that they have no idea their spouse holds cryptocurrency.

Using "zero fees" as a gimmick, is Lighter's actual cost 5–10 times higher?

What standard accounts receive from Lighter is not free trading, but rather slower transactions. This delay is turned into a source of profit by faster participants.

Prize pool of 60,000 USDT, “TRON ECO Holiday Odyssey” annual ecological exploration event is about to begin

TRON ECO is launching a major ecosystem collaboration event during Christmas and New Year, offering multiple luxurious benefits across the entire ecosystem experience!