Here Is XRP Price If It Powers Cross-Border Property Transactions

With the real estate sector recently seeing impressive volume growth, what could XRP price rise to if it powered cross-border property transactions?

Currently, XRP trades at $2.91, with a market value of $172.8 billion. It has jumped more than 38% this year despite a recent pullback and soared nearly 480% since November 2024.

Could XRP Penetrate the Real Estate Sector?

However, even with those impressive gains, many analysts still argue that XRP remains undervalued. To make this argument, they typically cite its growing role as a global payment bridge. Interestingly, one area where XRP could make a major impact is the real estate industry, especially in handling cross-border property deals.

Specifically, the Americas led with $372 billion, while EMEA reached $199 billion and the Asia-Pacific posted $131 billion. Notably, momentum picked up toward the end of the year, especially in the fourth quarter, when deal volume climbed to $232 billion.

Based on this data, ChatGPT built a model using the idea that XRP could act as both a bridge asset and a store of value. In this setup, all $703 billion in property deals would move through XRP.

XRP Price if It Powers Cross-Border Property Transactions

Investors, real estate companies, and financial institutions would hold XRP, either briefly or for longer periods, to make transactions faster and more efficient. Notably, such a setup would demand deep liquidity and give XRP a more stable role in settlement systems.

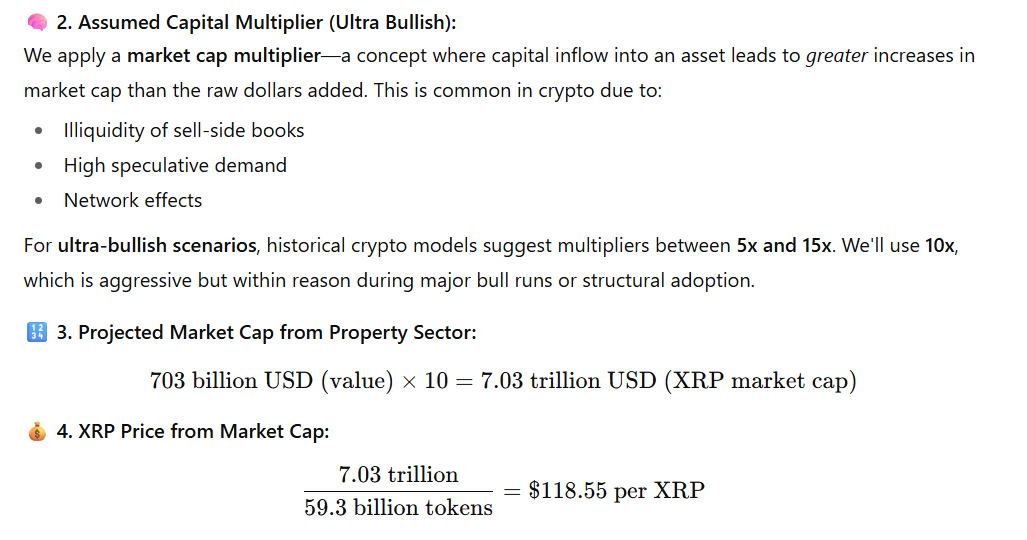

Afterward, ChatGPT then used a capital multiplier to project XRP’s market cap under this scenario. For context, in crypto markets, new capital entering an asset often pushes its total value up far more than the raw amount invested, especially when demand rises and liquidity stays limited.

Multipliers like this tend to range between 5x and 15x, but could surge to hundreds during strong bull markets, depending on liquidity. ChatGPT chose a 10x multiplier to model a highly optimistic outcome.

Using that approach, the chatbot multiplied the $703 billion in real estate transactions by ten, which gave a projected XRP market cap of $7.03 trillion. With XRP’s current circulating supply of 59.3 billion tokens, this results in a hypothetical XRP price of $118.55.

For a more conservative scenario, ChatGPT also ran the same model with a 5x multiplier. Notably, this alternative calculation produced a market cap of $3.515 trillion and a token price of $59.27. Interestingly, even in this more modest scenario, XRP’s price would jump more than 20 times its current value.

ChatGPT stressed that the prospect of XRP fully taking over global property transactions remains unlikely anytime soon. However, if XRP grabs even 5% to 10% of this market, its price could easily climb into the $6 to $12 range.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ether retail longs metric hits 94%, but optimism could be a classic bull trap

Bitcoin options markets highlight mounting fears as traders brace for more pain

$15 Billion Changes Hands: How Was the So-Called Decentralized BTC "Seized" by the US Government?

With the transfer of 127,271 BTC, the United States has become the world's largest sovereign holder of bitcoin.