Tom Lee forecasts that Bitcoin could reach $1 million over time, with a potential target of $250,000 by 2025, despite mixed market sentiments.

-

Tom Lee remains bullish on Bitcoin, predicting a price of $250,000 by 2025.

-

Market sentiment has shifted to neutral, reflecting caution among analysts.

-

Bitcoin’s recent price volatility has led to a drop in the Crypto Fear & Greed Index.

Tom Lee predicts Bitcoin could reach $1 million over time, with a potential $250,000 target for 2025, amidst mixed market sentiments.

| Tom Lee | $250,000 | 2025 |

| Bernstein | $200,000 | 2025 |

| 10x Research | $160,000 | 2025 |

What is Tom Lee’s Bitcoin Price Prediction?

Tom Lee, a managing partner at Fundstrat, believes that Bitcoin could reach $1 million over time, with a more immediate target of $250,000 for 2025. This optimistic outlook comes despite a backdrop of cautious sentiment among other analysts.

Why Are Other Analysts More Cautious?

While Tom Lee remains bullish, other analysts like Arthur Hayes and Joe Burnett have adopted a more cautious stance. Bernstein and Standard Chartered have set their year-end Bitcoin targets at $200,000, while 10x Research’s Markus Thielen has projected a more modest target of $160,000.

Source: Natalie Brunell

Source: Natalie Brunell

Lee suggests that the increasing institutional interest in Bitcoin may indicate that the traditional four-year cycle could be ending. This sentiment is echoed by several industry executives.

How Has Market Sentiment Shifted Recently?

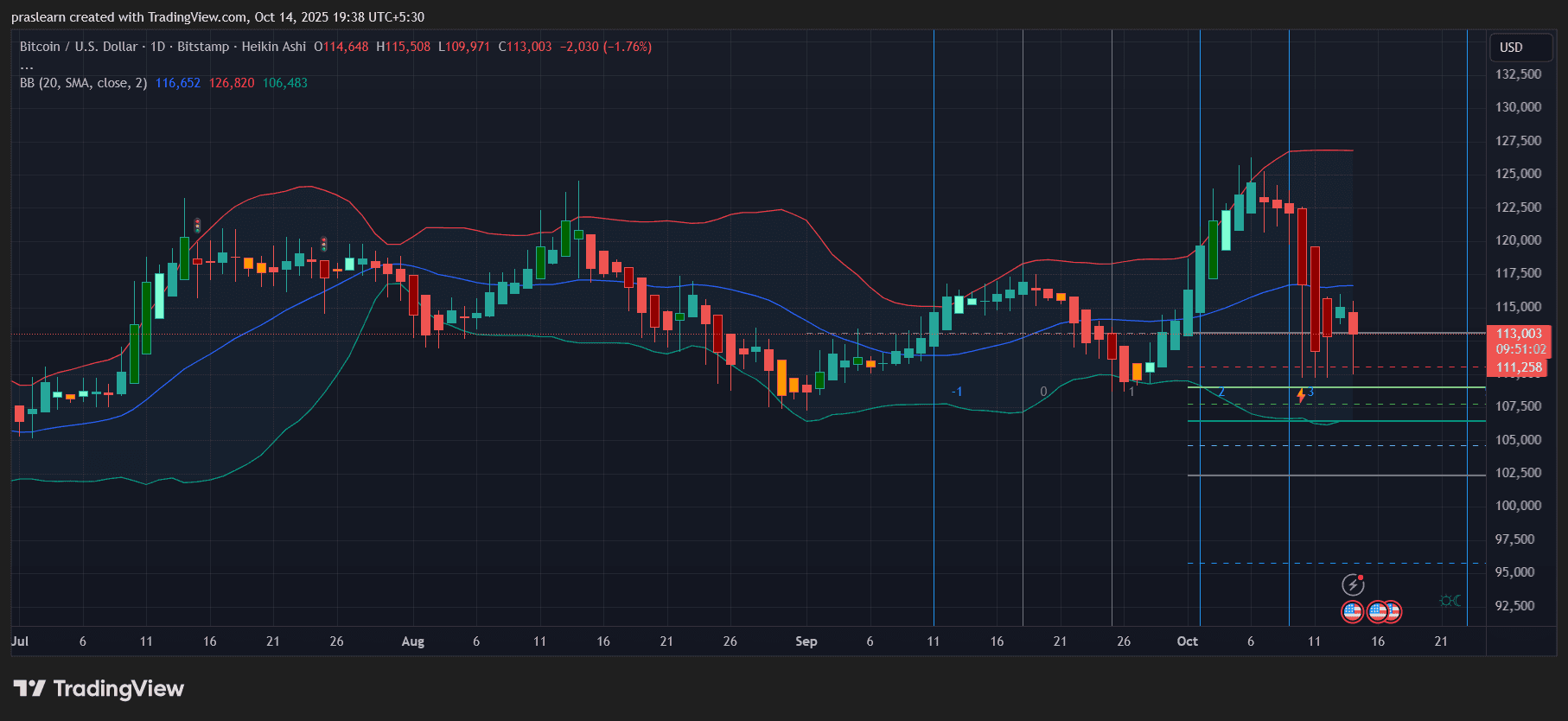

Lee’s bullish target comes amid a volatile week for Bitcoin. After reaching an all-time high of $123,100 on July 14, BTC has since pulled back to around $113,000. The Crypto Fear & Greed Index has also shifted from a “Greed” score of 60 to a “Neutral” score of 54, indicating a more cautious market sentiment.

Lee emphasizes that skepticism can be beneficial in financial markets, allowing for price discovery. He believes that the current skepticism may lead to positive surprises in the market.

Key Takeaways

- Tom Lee predicts Bitcoin could reach $1 million over time.: His immediate target for 2025 is $250,000.

- Market sentiment is shifting to neutral.: The Crypto Fear & Greed Index reflects this change.

- Other analysts are more cautious.: Price targets vary significantly among experts.

Conclusion

In summary, while Tom Lee maintains an optimistic outlook for Bitcoin’s future, other analysts express caution. The mixed sentiments in the market highlight the uncertainty surrounding Bitcoin’s price trajectory as we approach 2025.

Frequently Asked Questions

What are the current Bitcoin price targets from analysts?

Current Bitcoin price targets vary, with Tom Lee predicting $250,000 for 2025, while Bernstein and Standard Chartered set their targets at $200,000.

Why is market sentiment important for Bitcoin?

Market sentiment influences investor behavior and can lead to price fluctuations. A shift from greed to neutrality often indicates caution among traders.