SharpLink Gaming secures $200M from global institutional investors to expand Ether holdings

Key Takeaways

- SharpLink Gaming secured $200 million to expand its Ether holdings.

- The company's ETH treasury is expected to exceed $2 billion after the funding deployment.

Share this article

SharpLink Gaming secured $200 million in funding from four global institutional investors through a registered direct offering, the company announced today.

“SharpLink is proud to be joined by globally-recognized institutional investors, augmenting our strong existing investor base and further validating our mission to be the world’s leading ETH treasury,” said Joseph Chalom, SharpLink’s Co-Chief Executive Officer, in a statement.

A.G.P./Alliance Global Partners is serving as the lead placement agent, with Société Générale as a co-placement agent. Cantor is acting as a financial advisor to the company.

The offering, made under an effective shelf registration statement on Form S-3ASR, is expected to close around August 8, 2025, subject to customary closing conditions.

SharpLink will allocate the net proceeds to its Ethereum (ETH) treasury. The Nasdaq-listed company recently acquired 83,561 ETH for approximately $304 million, raising its total holdings to 521,939 ETH, valued at over $1.9 billion, according to a regulatory disclosure .

SharpLink is on track to surpass $2 billion in ETH holdings following the raise, reinforcing its rank as the second-largest corporate holder after BitMine.

Share this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Weekly Watch: Has the Market Code Emerged? Dynamic Take-Profit Strategy Suggestions Included

Monad airdrop query goes live, almost all testnet users “get rekt”?

This article analyzes the results of the Monad airdrop allocation and the community's reactions, pointing out that a large number of early testnet interaction users experienced a "reverse farming" situation, while most of the airdrop shares were distributed to broadly active on-chain users and specific community members. This has led to concerns about transparency and dissatisfaction within the community. The article concludes by suggesting that "reverse farmed" airdrop hunters shift their focus to exchange activities for future airdrop opportunities.

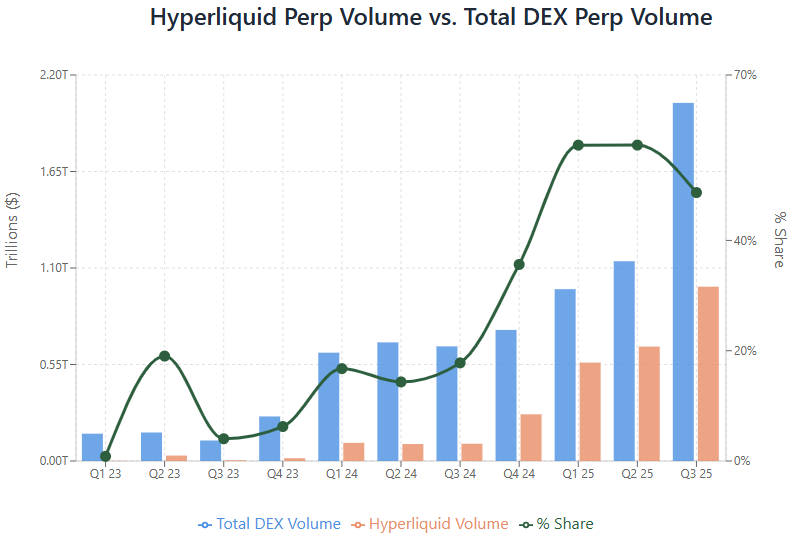

Arete Capital: Hyperliquid 2026 Investment Thesis, Building a Comprehensive On-chain Financial Landscape

The grand vision of unified development across the entire financial sector on Hyperliquid has never been so clear.

S&P Index Adjusted as Expected: Key Observations on Timing and Scope of the Adjustment!