Bitcoin Miners Bounce Back: MARA, Cipher, and Cango Boost Production in July

July 2025 marked a strong rebound for Bitcoin miners, with key firms scaling operations and boosting BTC holdings to meet soaring institutional demand in an increasingly competitive environment.

Several Bitcoin mining companies recorded a clear performance recovery in July with increased mining output.

This recovery reflects the flexible adaptability of mining infrastructure and the effectiveness of energy management strategies.

Bitcoin Miners Recover Strongly

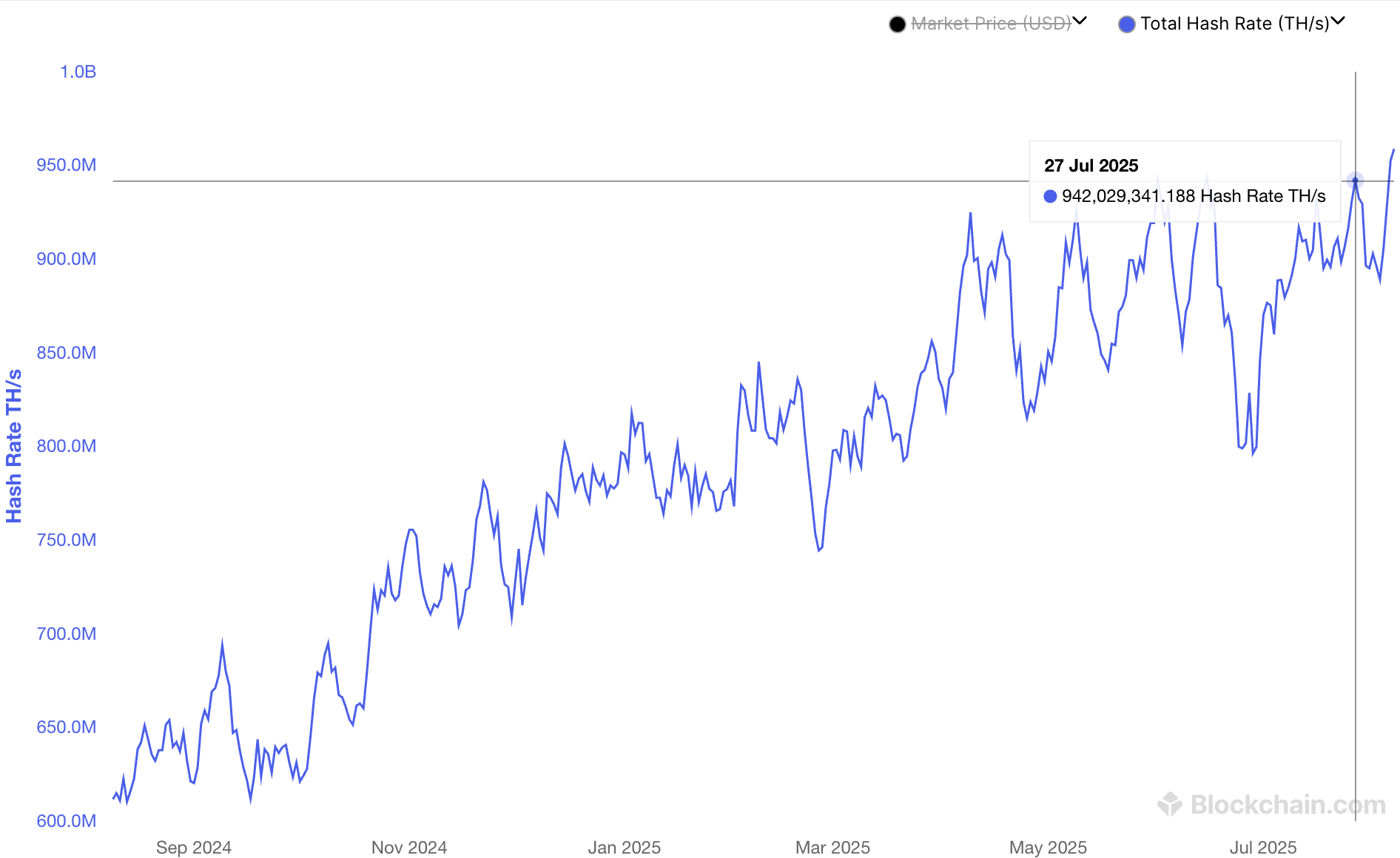

Data from Blockchain.com indicates that the total network hashrate rebounded significantly in July, nearing its all-time high. This demonstrates that mining companies are returning to expansion mode after facing various challenges in the previous month.

However, the resurgence in hashrate also means that network difficulty is rising. This increases competitive pressure on companies that cannot optimize energy and hardware efficiency.

Network hashrate. Source:

Blockchain.com

Network hashrate. Source:

Blockchain.com

Bitcoin mining difficulty hit a record 127.6 trillion in August 2025, yet miner revenues surged 105% year-over-year, defying typical trends. Amid this context, several Bitcoin mining companies delivered impressive results in July.

Cipher Mining produced 214 BTC, bringing its total Bitcoin holdings to 1,219 BTC. In its Q2 2025 report, the company announced revenue of $44 million and adjusted earnings of approximately $30 million. This growth was driven by the launch of the initial phase of its Black Pearl data center, which brought the total operational mining capacity to 20.4 EH/s.

CleanSpark mined 671 BTC in July. The company has surpassed 1 GW in contracted power capacity and maintains over 12,700 BTC in treasury.

Cango surprised the market with a 45% increase in monthly output, reaching 650.5 BTC. Its deployed hashrate has hit the 50 EH/s mark, and its Bitcoin holdings exceeded 4,500 BTC.

Canaan Technology produced 89 BTC from mining in July, with Bitcoin holdings reaching 1,511 BTC at the end of the month.

MARA recorded a mining output of 703 Bitcoin in July, down slightly by 1% compared to June, yet it remains one of the highest BTC-producing companies in the industry. More notably, MARA is holding over 50,000 BTC.

Despite the minor fluctuation in output, its long-term accumulation strategy continues to be a key strength. This strength is particularly evident as the Bitcoin supply becomes increasingly scarce.

Supply and Demand Gap

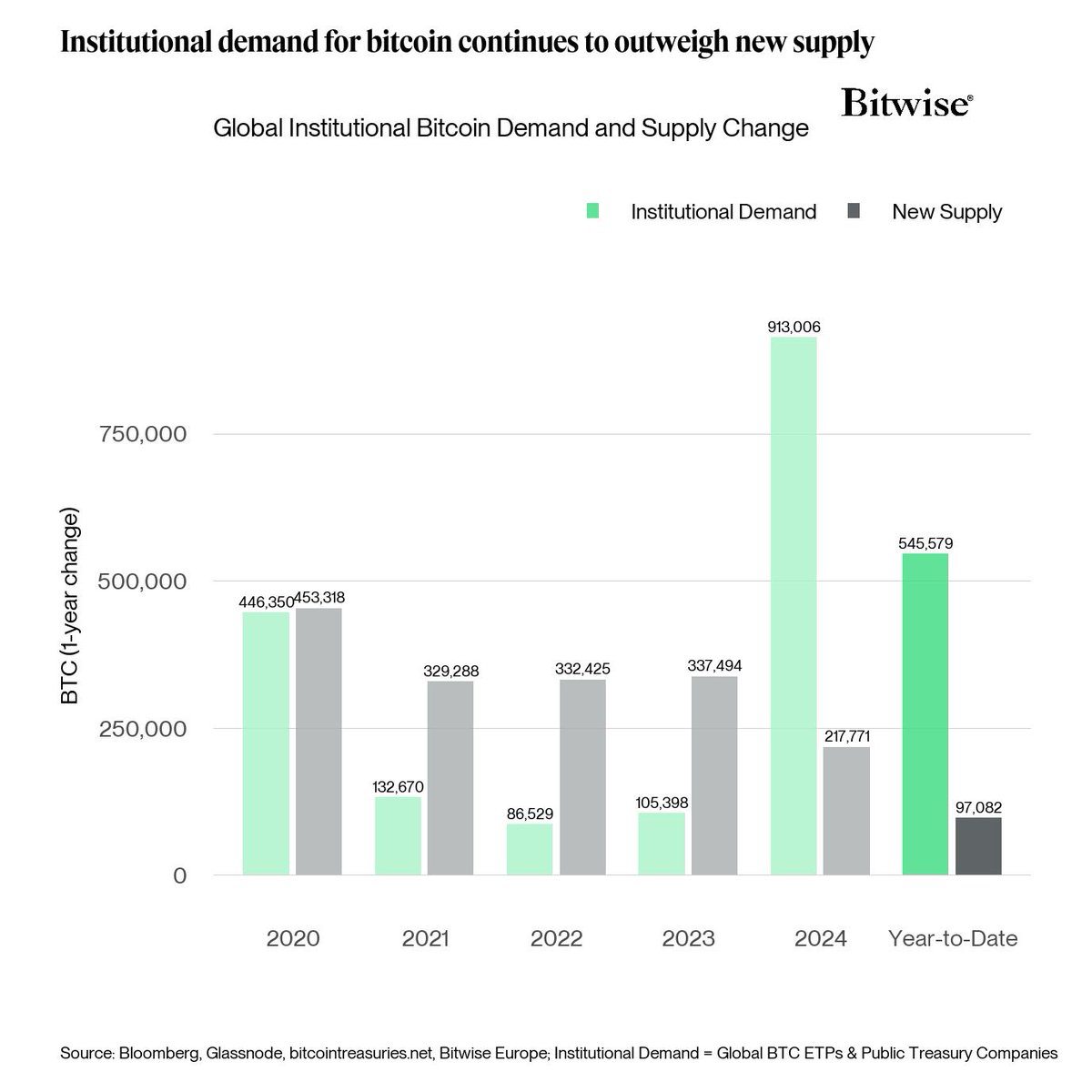

Although some Bitcoin mining companies reported increased output in July, the overall number remains relatively low compared to market demand.

Bitcoin mining output vs. market demand. Source:

Bitwise/Bitcoin Magazine

Bitcoin mining output vs. market demand. Source:

Bitwise/Bitcoin Magazine

According to data from Bitwise, institutions purchased over 545,000 BTC in 2025, while the total mined supply during the same period was only around 97,000 BTC.

If this trend continues, the limited supply from mining will further elevate the strategic importance of companies with substantial Bitcoin holdings in their treasuries.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Brevis receives collective praise from the Ethereum community—Is ZK finally becoming practical?

Brevis has achieved proof for 99.6% of Ethereum blocks within 12 seconds, with an average of only 6.9 seconds, using just 64 RTX 5090 GPUs.

From SDK to "Zero-Code" DEX Building: Orderly's Three-Year Masterpiece

Orderly ONE proves that sticking to one thing and doing it to the extreme is the right approach.

The Ethereum community collectively gives a thumbs up: Has ZK technology finally moved from the lab to production-grade tools?

Brevis has achieved proof for 99.6% of Ethereum blocks within 12 seconds, with an average time of only 6.9 seconds, using just 64 RTX 5090 GPUs.

When the market complains about CZ, people begin to miss SBF

SBF interview: The bankruptcy lawyers won, the creditors received full repayment, and the one who could have made them even richer is now waiting for the day when the world recognizes the truth.