Ethereum Treasury Companies Are a Better Buy Than US Spot Ether ETFs, Standard Chartered Says

Why Ethereum Treasury Holdings Beat Spot ETFs, According to Standard Chartered

Geoffrey Kendrick, head of digital assets research at London-based Standard Chartered Bank, delivered a nugget of alpha that many may have missed last week, ether treasury companies are probably a better buy than spot ether ETFs. The reason, which may be obvious to some, is that spot ETH funds don’t currently offer staking rewards, but treasury companies do.

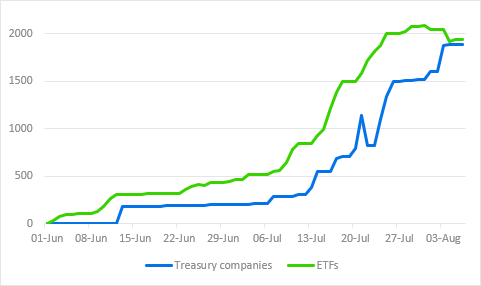

Kendrick and his team published a research note last Tuesday, showing how ether treasury companies such as Sharplink , have purchased the cryptocurrency at double the rate of spot ETFs. In a follow-up note yesterday, Kendrick said that since June, both treasury firms and ETFs each bought roughly 1.6% of all ether in circulation.

( ETH holding companies and ETFs are neck-and-neck when it comes to amount of ETHbought since June / Standard Chartered Research)

And now, given the already rapid pace of acquisition shown by treasury entities, the additional benefit of compounded staking rewards, and the fact that holding companies face fewer regulatory hurdles than ether ETFs, Kendrick and team see ETH treasury firms as having more growth potential than their fund counterparts or even their bitcoin treasury cousins.

“We think ETH treasury companies have even more growth potential than BTC ones from a regulatory arbitrage perspective,” Kendrick and team explain. “We think they may eventually end up owning 10% of all ETH , a 10x increase from current holdings.”

The team also expects ether treasury companies to help buoy the cryptocurrency past the $4,000 threshold. Ether, which floundered in the first quarter of 2025, reached its all-time high of $4,891.70 nearly four years ago in November 2021. The digital asset was trading at $3,816.40 at the time of reporting, up 3.81% over 24 hours, according to Coinmarketcap.

“If the flows can continue, ETH may be able to break above the key USD 4,000 level (our current end-2025 forecast),” Kendrick and team said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the moat of public blockchains only 3 points? Alliance DAO founder's remarks spark heated debate in the crypto community

Instead of worrying about "moats," perhaps we should focus more on how cryptocurrencies can meet the real needs of more market users faster, at lower cost, and with greater convenience.

Digital Finance Game: Unveiling the US Cryptocurrency Strategy

Glassnode: Bitcoin weakly fluctuates, is major volatility coming?

If signs of seller exhaustion begin to appear, it is still possible in the short term for bitcoin to move towards the $95,000 level and the short-term holder cost basis.

Axe Compute (NASDAQ: AGPU) completes corporate restructuring (formerly POAI), enterprise-level decentralized GPU computing power Aethir officially enters the mainstream market

Predictive Oncology officially announced today that it has changed its name to Axe Compute and will trade on Nasdaq under the ticker symbol AGPU. This rebranding marks Axe Compute's transition into an enterprise-level operator, officially commercializing Aethir's decentralized GPU network to provide robust, enterprise-grade computing power services for AI companies worldwide.