How Crypto Whales are Reacting to Ethereum’s Rally and All-Time High Optimism

Ethereum’s rally to $4,331 has sparked a tug-of-war among major holders, with some doubling down and others cashing out big gains.

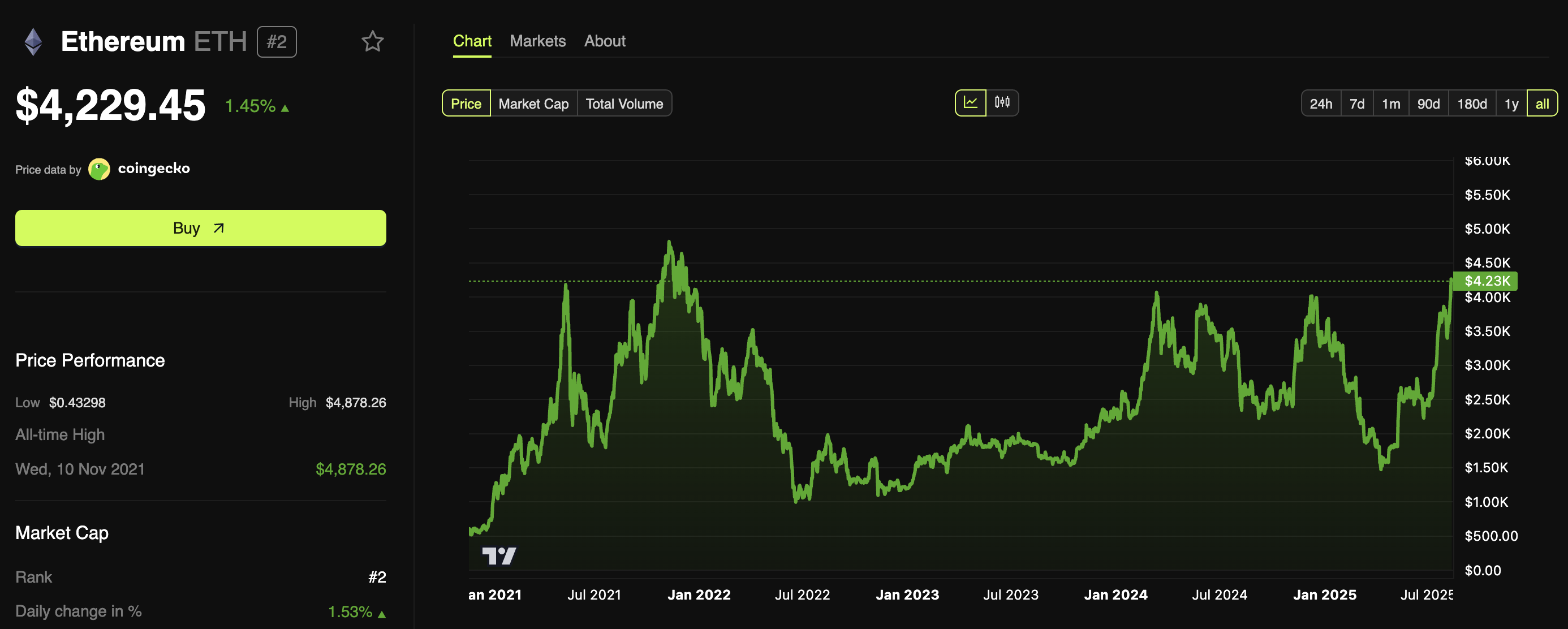

Ethereum (ETH) has surged to its highest level in nearly four years, sitting just 13.5% below its all-time high.

The renewed momentum has sparked mixed activity among crypto whales, with some accumulating in anticipation of further gains while others lock in profits as the market edges toward record territory.

Crypto Whales Flip Bullish as Ethereum Closes in on Record Price

Yesterday, BeInCrypto reported that ETH broke past $4,000 after 8 months. Since this milestone, the uptrend has continued to accelerate.

The second-largest cryptocurrency reached $4,331 during early Asian trading hours today, a level last seen in December 2021. At press time, the price had adjusted to $4,229.45, representing an appreciation of 1.45% over the past day.

Ethereum Price Performance. Source:

BeInCrypto Markets

Ethereum Price Performance. Source:

BeInCrypto Markets

With the price only $648 shy of the November 2021 record peak of $4,878, Ethereum whales are adjusting their positions. On-chain data indicates a mixed response among whales.

In an X (formerly Twitter) post, Lookonchain highlighted that some big players are moving large amounts of capital into Ethereum.

A whale with wallet address 0xF436 withdrew 17,655 ETH worth $72.7 million from exchanges. The blockchain analytics firm added that the whale might be acting on behalf of SharpLink Gaming.

Another whale, wallet 0x3684, spent 34 million Tether (USDT) to buy 8,109 ETH at $4,193 each. What’s noteworthy is that Ethereum’s latest rally has drawn back players who had previously sold their holdings, prompting them to switch sides.

Lookonchain noted that in early August, Arthur Hayes, Maelstrom’s Chief Investment Officer (CIO), sold 2,373 ETH worth $8.32 million. At the time, ETH was priced around $3,507.

Yesterday, he transferred 10.5 million USDC (USDC) to repurchase ETH, this time at a higher price.

“Had to buy it all back, do you forgive me @fundstrat? I pinky swear, I’ll never take profit again,” Hayes said.

Hayes isn’t alone. An unidentified whale sold 38,582 ETH during the price dip to $3,548, only to buy back at $4,010.

“That’s a loss of over $17 million just from selling low and buying higher. Market swings can trigger fear, but history shows that strong hands often win in Crypto,” a crypto market watcher wrote.

This whale panic sold $19,810,000 $ETH after the drop.Today, he bought back $12,580,000 Ethereum after the bounce.

— Ted

Key ETH Whales Trim Holdings Despite Positive Momentum

Nonetheless, the whale’s behavior has not been uniformly optimistic. According to Lookonchain, Erik Voorhees, an early Bitcoin advocate and founder of ShapeShift, sold 6,581 ETH worth $27.38 million at a price of $4,161.

Despite the recent transaction, he still retains 556.68 ETH, worth approximately $2.3 million.

“We were founded before Ethereum existed. Still bullish ETH,” ShapeShift posted.

Another notable move came from Ethereum co-founder Jeffrey Wilcke. He recently deposited 9,840 ETH (about $9.22 million) into Kraken.

Just three months ago, Wilcke transferred 105,737 ETH to eight newly created wallets. He now holds 95,897 ETH, valued at around $401 million.

In a separate case, OnChain Lens observed that a long-dormant whale moved funds after five years of inactivity. The crypto whale deposited 5,000 ETH worth $21.14 million into Binance. The move netted a profit of roughly $45.38 million.

“The whale initially received 55,001 ETH worth $6.73 million from BitZ, 7 years ago. The whale still holds 5,001 ETH worth $21.07 million,” OnChain Lens added.

The contrasting moves, from large-scale accumulation to substantial profit-taking, reveal a split in sentiment among major ETH holders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gain Insight into Cryptocurrency’s Promising Future for 2026

In Brief The next major crypto bull cycle will start in early 2026. Institutional investors and regulation drive long-term market confidence. Short-term shifts show investors favoring stablecoins amid volatility.

Stunning $204 Million USDT Transfer Ignites Market Speculation