PUMP Underperforms Despite Pump.fun’s Buyback and Liquidity Program

Pump.fun’s bold Glass Full Foundation and $12M buyback aim to strengthen meme coin cults, yet PUMP struggles to impress investors.

PUMP, the native token of meme coin launchpad Pump.fun, has slipped another 6% in the past 24 hours, effectively underperforming relative to other meme coins.

With Solana meme coins enjoying periodic hype cycles, sustained attention and capital injection could give Pump.fun an edge.

Pump.fun To Back Organic and Active Communities

Pump.fun introduced the Glass Full Foundation (GFF), a liquidity support program designed to inject significant capital into meme coin projects within its orbit.

According to the team, the move is part of a broader mission to expand the Solana ecosystem and nurture its most diehard cults.

With GFF presenting as a vehicle to accelerate the platform’s most organic, active, and promising communities, the launchpad will allocate funds directly to ecosystem tokens. This means providing liquidity to ensure healthier market activity and greater investor confidence.

“The Foundation has already begun with several projects receiving initial support and will continue deploying capital,” Pump.fun said in its post on X (formerly Twitter).

Liquidity remains critical to the survival and growth of smaller-cap meme coins. GFF aims to reduce volatility for such tokens by directly injecting funds into ecosystem tokens.

The move could also reduce narrow spreads and give projects more runway to grow their communities.

While Glass Full Foundation represents a bold commitment to nurturing the Pump.fun ecosystem, PUMP token registered a muted market response.

PUMP price has increased by a modest 0.8% in the last 24 hours and was trading for $0.003364 as of this writing. CoinGecko data shows the meme coin is underperforming relative to its peers in the sector.

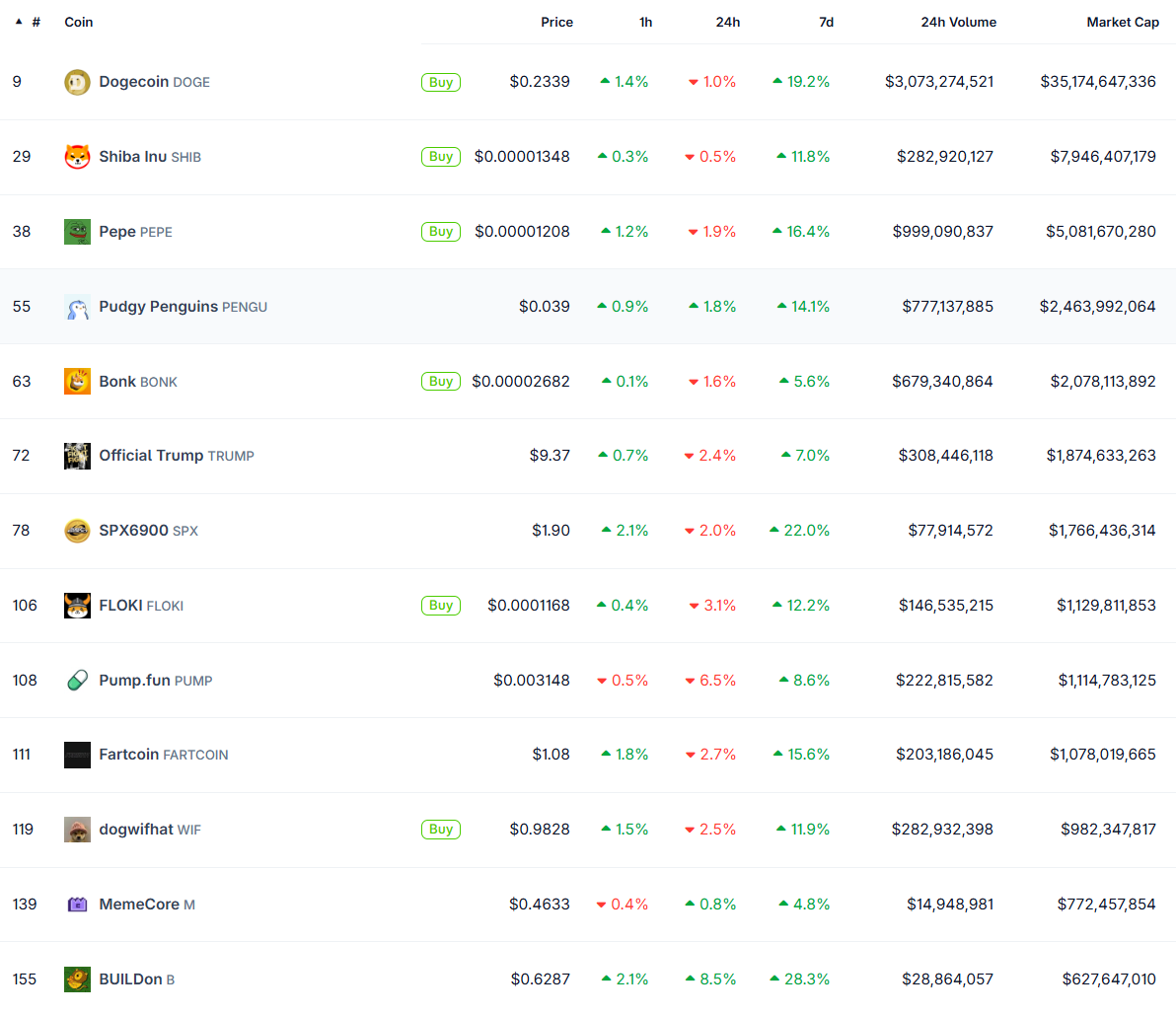

Top Meme Coins. Source:

CoinGecko

Top Meme Coins. Source:

CoinGecko

The tepid reaction highlights investor caution in a volatile meme coin sector. It follows days of anticipation in the Pump.fun community after Alon Cohen, the launchpad’s founder, promised a big announcement.

huge announcement coming for organic community coins in the pump fun ecosystem this week.

— alon (@a1lon9) August 4, 2025

Following the announcement, whale interactions with PUMP fueled a 15% surge in the token’s price.

Pump.fun Fires $12 Million Token Buyback Cannon

Many investors expected the reveal to trigger another leg up in the token’s price, given the initiative’s aim to support liquidity and buying power.

While the initiative may have long-term benefits, short-term traders seek a more direct price catalyst, such as a major exchange listing, token burn, or airdrops.

“Is this an airdrop?” wrote Abhi, a popular user on X.

Pump.fun gives them one better by resorting to a token buyback, a bullish catalyst that often bolsters demand by reducing supply.

Arkham Intelligence says Pump.fun is buying over $5 million worth of PUMP. According to the blockchain analytics firm, this marks a subsequent purchase after a previous one of almost $7 million, with partial holdings stored on Squads Vault.

PUMP IS BUYING PUMPPumpFun just sent another $5.6M SOL to a new address where they are buying back PUMP.So far they have bought back $6.68M PUMP on this address, and sent $5.72M of that to a Squads Vault.Address: 88uq8JNL6ANwmow1og7VQD4hte73Jpw8qsUP77BtF6iE pic.twitter.com/i2fS7YJddt

— Arkham (@arkham) August 8, 2025

“That is not just buying pressure, it is a full-on feedback loop, Pump buying Pump fuels the fire,” one user remarked.

Some users see these initiatives as the network’s push to secure its market share in the meme coin sector against players like BONK.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Amid Market Turmoil, Strategy Inc. Bolsters Bitcoin Holdings by 220 BTC

Defying Market Turbulence: World's Largest Corporate Bitcoin Holder Buys More Amid Unprecedented Volatility

$45M Airdrop Launched by BNB Chain to Aid Memecoin Traders Post-Market Crash

"Reload Airdrop" Initiative Aims to Compensate 160,000 Memecoin Traders Hit by Market Volatility and Liquidations

Bitcoin Whales in Choppy Waters: Analyst Forecasts Spike in Market Volatility

High Market Turbulence Predicted as New Bitcoin Whales Navigate Financial Depths

Metaplanet’s Bitcoin Strategy Fails to Yield Expected Returns: Study Reveals

Enterprise Value Plummets as Shares Nosedive by 70% Since June Despite Bitcoin Reserves