El Salvador Authorizes Bitcoin Investment Banks Under New Regulatory Framework

El Salvador's Legislative Assembly has approved sweeping Investment Banking Law that allows private investment banks to hold Bitcoin and other digital assets on their balance sheets. According to Cointelegraph, the law was passed on Thursday and classifies investment banks under different regulations than commercial banks.

Investment banks operating under this framework must maintain minimum share capital of $50 million and serve only sophisticated investors. Juan Carlos Reyes, president of El Salvador's Commission of Digital Assets, told Cointelegraph that these institutions can offer crypto services to sophisticated investors, equivalent to accredited investors in the United States. Banks can request authorization to become Digital Asset Service Providers and operate entirely as Bitcoin banks.

The legislation requires sophisticated investors to have extensive market experience and minimum $250,000 in liquid assets. According to CryptoBriefing, these assets can include Bitcoin, treasury bonds, tokenized products, gold, or cash. Investment banks can conduct bond issuance, loan granting, foreign currency transactions, and complementary services under the new framework.

Why This Development Matters for Bitcoin Adoption

El Salvador's Investment Banking Law represents the world's first regulatory framework specifically designed for Bitcoin-focused financial institutions. The legislation positions the Central American nation as an emerging hub for digital finance and addresses growing institutional demand for cryptocurrency services.

Legislative Assembly member Dania González stated that investment banking helps governments, companies, and institutions raise capital for major projects. The law aims to attract international private capital, financial groups, and high-net-worth individuals to use El Salvador as a regional operations base. This regulatory development comes as global interest in government Bitcoin reserves grows rapidly. We recently reported that 15 US states are moving forward with plans for Bitcoin reserves, with Oklahoma, New Hampshire, and Pennsylvania proposing to allocate up to 10% of public funds for Bitcoin purchases.

The sophisticated investor requirement protects average citizens from cryptocurrency volatility while enabling institutional access to digital assets. Banks must demonstrate adequate risk management capabilities and maintain separation from commercial banking operations. This approach balances innovation with consumer protection by limiting high-risk exposure to qualified participants who understand digital asset markets.

Broader Industry Implications for Global Financial Systems

El Salvador's Bitcoin banking initiative could reshape international approaches to cryptocurrency regulation and institutional adoption. The framework creates precedent for sovereign digital asset integration and may influence other nations developing similar legislation.

Recent regulatory shifts in the United States support institutional cryptocurrency adoption. According to Grant Thornton, the Trump administration's support for digital assets has reduced enforcement actions and driven institutional interest. The FDIC clarified in March 2025 that US banks can engage in permissible crypto activities without prior approval, removing previous notification requirements.

Traditional financial institutions face competitive pressure as Bitcoin gains institutional acceptance. Investment banks in other jurisdictions may seek similar regulatory clarity to serve growing cryptocurrency demand from sophisticated investors. The $50 million capital requirement demonstrates El Salvador's commitment to financial stability while enabling innovation.

Critics argue that Bitcoin adoption primarily benefits institutions rather than average citizens. However, supporters view this legislation as necessary infrastructure development for broader digital asset integration. The law's focus on sophisticated investors reflects international regulatory trends that prioritize institutional adoption before retail market expansion.

El Salvador's approach may influence regional financial policy as neighboring countries observe outcomes from this experimental framework. Success could accelerate similar legislation across Latin America, while challenges might prompt more cautious regulatory approaches in other markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Weekly Watch: Has the Market Code Emerged? Dynamic Take-Profit Strategy Suggestions Included

Monad airdrop query goes live, almost all testnet users “get rekt”?

This article analyzes the results of the Monad airdrop allocation and the community's reactions, pointing out that a large number of early testnet interaction users experienced a "reverse farming" situation, while most of the airdrop shares were distributed to broadly active on-chain users and specific community members. This has led to concerns about transparency and dissatisfaction within the community. The article concludes by suggesting that "reverse farmed" airdrop hunters shift their focus to exchange activities for future airdrop opportunities.

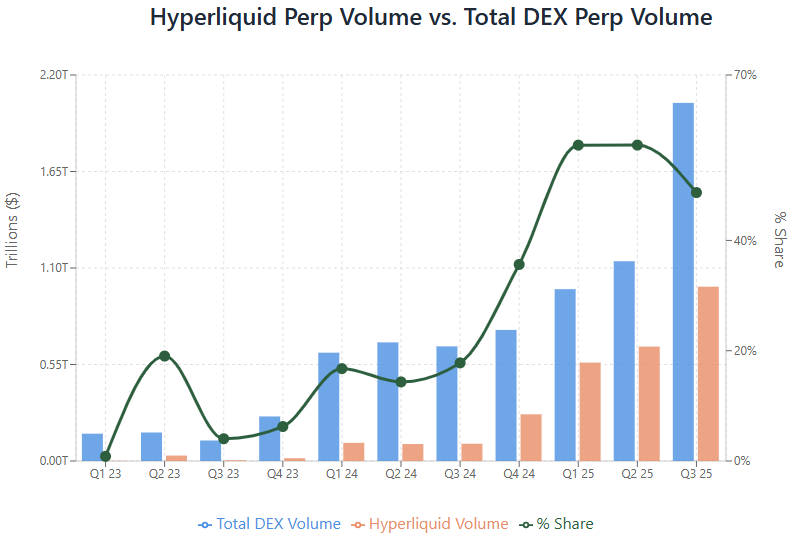

Arete Capital: Hyperliquid 2026 Investment Thesis, Building a Comprehensive On-chain Financial Landscape

The grand vision of unified development across the entire financial sector on Hyperliquid has never been so clear.

S&P Index Adjusted as Expected: Key Observations on Timing and Scope of the Adjustment!