PI Network Eyes Major Upswing as New Demand Emerges

The PI Network token has surged past a critical resistance level, fueled by rising trading volume and positive market sentiment. Trading above its 20-day EMA, PI shows signs of a sustained uptrend with potential to reach $0.52 if buying momentum persists.

On Saturday, the PI Network token closed above the upper boundary of its horizontal channel, signaling a potential bullish breakout.

Over the past 24 hours, improving market sentiment has fueled the altcoin’s rally. It has climbed 2% and looks poised to extend its gains further.

PI Breakout Sparks Optimism for Sustained Price Rally

Readings from the PI/USD one-day chart show that yesterday, PI’s price broke above the upper line of the horizontal channel. This channel had prevented any significant upward movement between August 2 and August 8.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

PI Horizontal Channel. Source:

TradingView

PI Horizontal Channel. Source:

TradingView

This breakout propelled PI to 16% gains during yesterday’s trading session. When an asset breaks above a key resistance line like this, it suggests renewed bullish sentiment and the possibility of a sustained rally.

For PI, this breakout could mark the start of a stronger upward trend as traders gain confidence and momentum builds.

Strong Buying Interest Pushes PI Higher

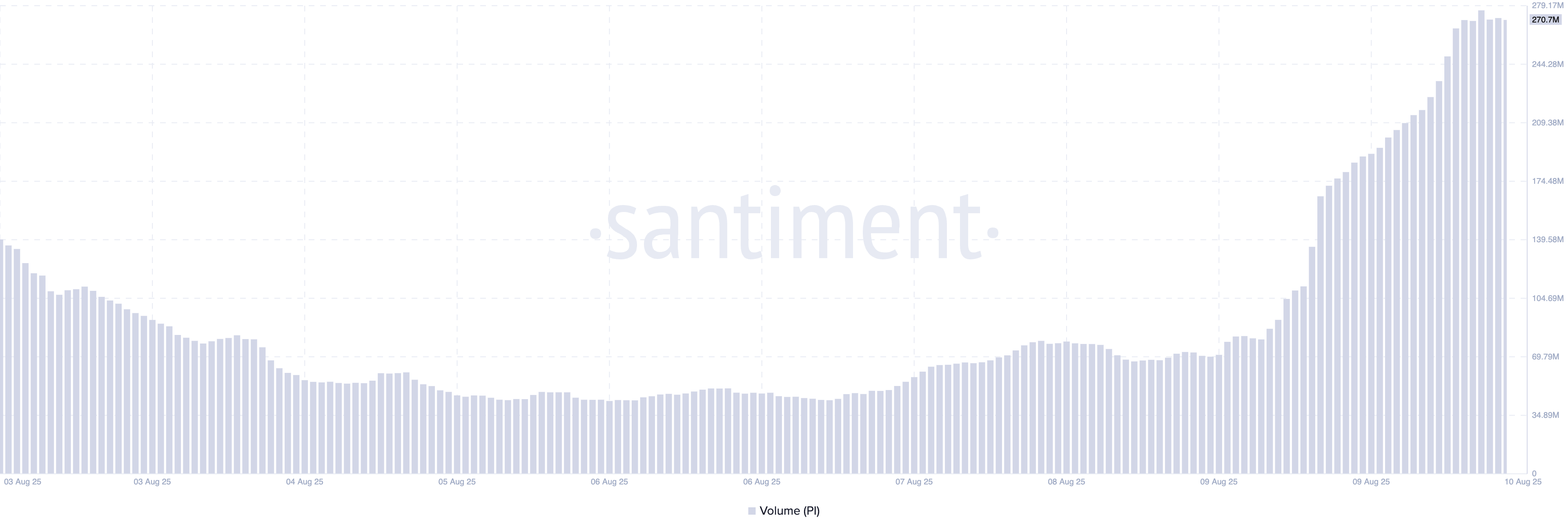

Today, PI has maintained its rally, climbing by 2%. A surge in trading volume accompanies this price increase. Over the past 24 hours, it has jumped nearly 150% to reach $270 million by press time.

PI Trading Volume. Source:

Santiment

PI Trading Volume. Source:

Santiment

Rising price combined with increased trading volume like this confirms the strength of a trend. It indicates that more participants are actively buying, supporting the price movement and reducing the likelihood of a false breakout.

For PI, the volume surge strengthens the positive momentum and suggests that the rally may continue in the near term.

Additionally, PI’s rally over the past two sessions has pushed its price above the 20-day exponential moving average (EMA), confirming growing demand. At press time, this key moving average forms dynamic support under the token’s price at $0.4038.

PI 20-Day EMA. Source:

TradingView

PI 20-Day EMA. Source:

TradingView

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving weight to recent prices. When an asset’s price trades above its 20-day EMA, short-term bullish momentum is growing as buying interest surges.

This confirms the asset is in an upward trend and may continue to gain strength.

PI Rally Gains Traction, Eyes $0.52

If buying momentum continues, PI could extend its rally and attempt a break above the key resistance level at $0.4451. A successful breakout above this barrier may propel the price toward $0.5281.

PI Price Analysis. Source:

TradingView

PI Price Analysis. Source:

TradingView

Conversely, if traders begin taking profits, PI’s price could retrace to support near $0.3773.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Real Recovery Phase: How Should the Market Rebuild After Leverage Liquidation?

From "President's Son" to "Teenage Tycoon": Barron Trump's First Pot of Gold

Trump holds $870 million in Bitcoin! Will the tariff war cause the market to crash?