XLM’s Bullish Setup Holds—But Stellar Gains Could Stall for Now

Stellar price remains inside a bullish setup after its recent breakout, but record exchange balances and fading momentum hint that gains could take longer to arrive.

Stellar (XLM) has been quietly moving higher, up 10% in the past week and 3% in the last 24 hours, but the pace is far from explosive. This is despite the token breaking out of a bullish pattern on the daily chart earlier this month.

If the structure remains bullish, why hasn’t price surged? The answer lies in a tug-of-war between supply and demand that’s playing out on-chain and on the charts.

Supply Side Pressure: Exchange Balances at Record Levels

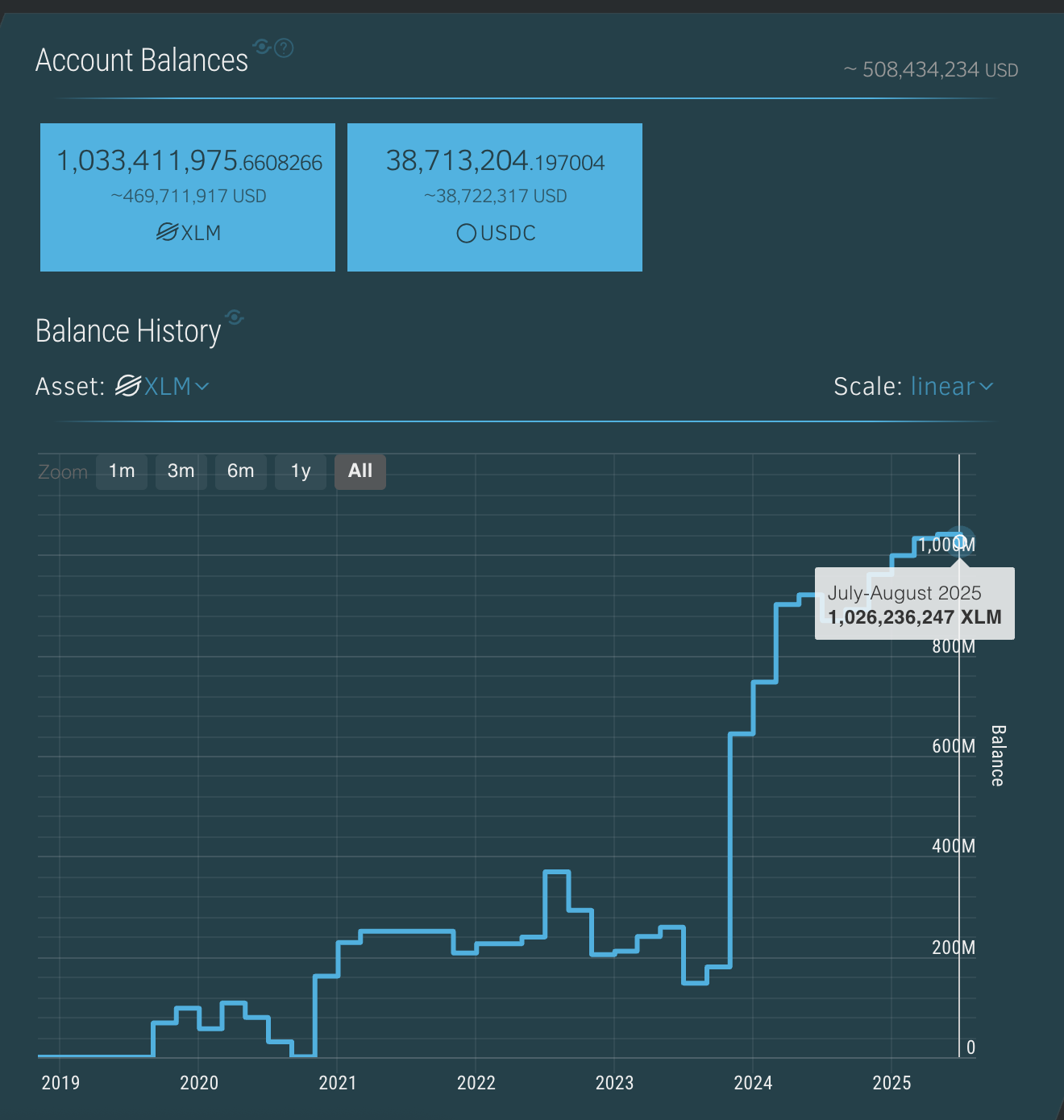

The first clue comes from XLM’s exchange balances. Over the past year, these have climbed to a record 1.03 billion XLM (almost $469.7 million), with the July–August reading of 1.02 billion XLM marking one of the highest points in history.

Stellar exchange balances keep rising:

Stellar Expert

Stellar exchange balances keep rising:

Stellar Expert

In practice, high balances mean more tokens are sitting on exchanges, readily available for traders to sell.

This creates a ceiling effect: every push higher risks meeting a wave of sell orders. That supply overhang may explain why, even after a bullish breakout, the Stellar price hasn’t yet followed through with the kind of rally seen in other altcoins.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Demand Side Pushback: Money Flow Index Curling Up

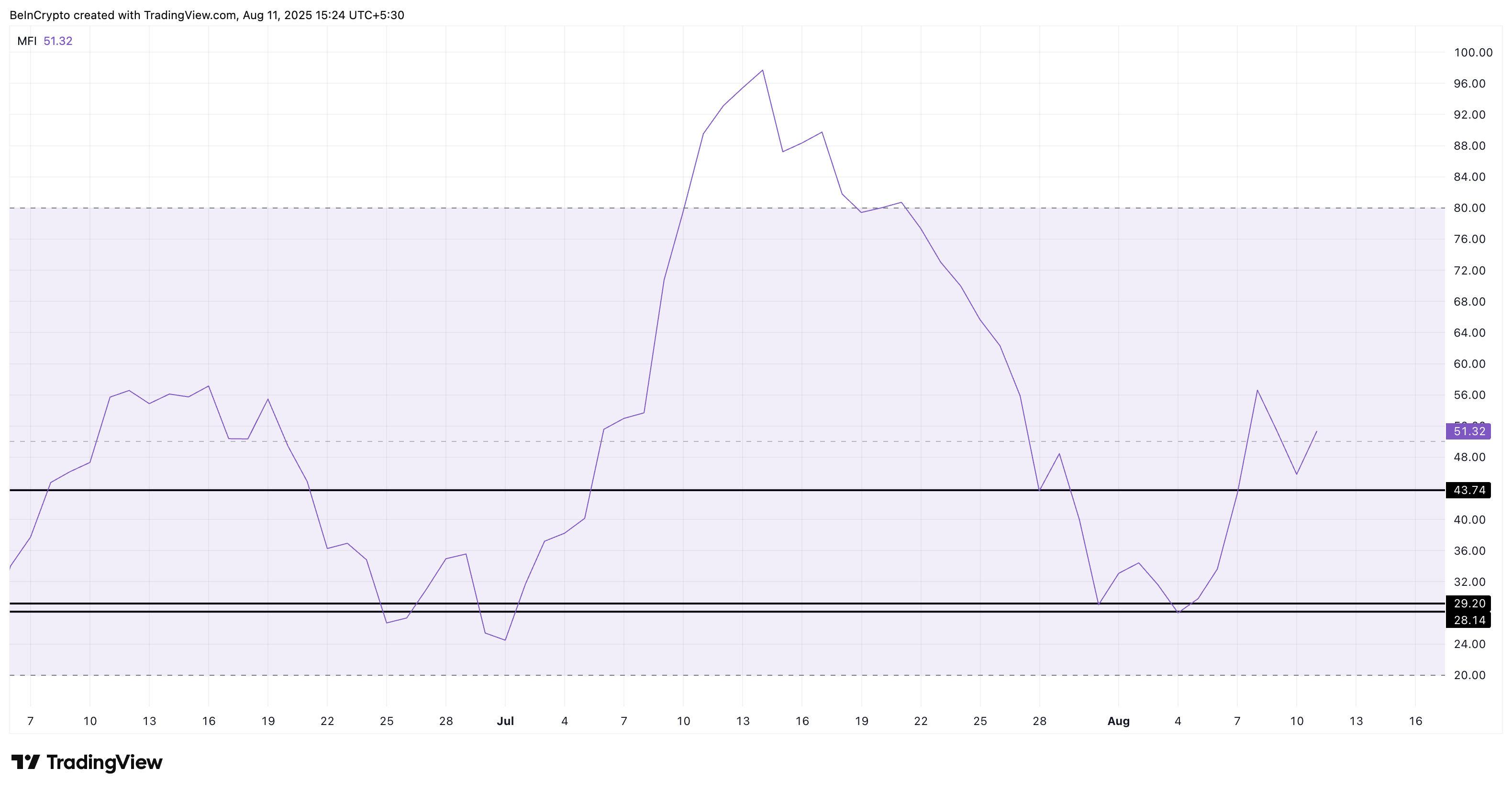

Against this heavy supply backdrop, buying pressure hasn’t vanished. The daily Money Flow Index (MFI), which blends price action with volume to track real capital flows, is holding above 50 at 51.32, and has recently curled higher after avoiding a retest of July’s lows near 29.

XLM price and the surging Money Flow Index:

TradingView

XLM price and the surging Money Flow Index:

TradingView

This suggests that while sellers are parked and ready, there’s still meaningful inflow into XLM. Buyers are active enough to keep prices from breaking down, but not yet strong enough to overpower the record supply. This balance of forces is keeping the market in a holding pattern.

Zooming In: 4-Hour Stellar Price Chart Shows a Bullish Structure With Fading Momentum

To see if this buyer-seller deadlock is close to breaking, we turn to the 4-hour chart. Here, the XLM price is holding inside an ascending triangle; a bullish continuation setup, with key support at $0.44 and resistance levels at $0.46 and $0.47.

Stellar price analysis:

TradingView

Stellar price analysis:

TradingView

Yet momentum is showing cracks. The RSI on this timeframe has printed a lower high even as the price hit a higher high, hinting at short-term exhaustion. Combined with the high exchange balances, this slowdown explains why Stellar is still range-bound despite a bullish structure.

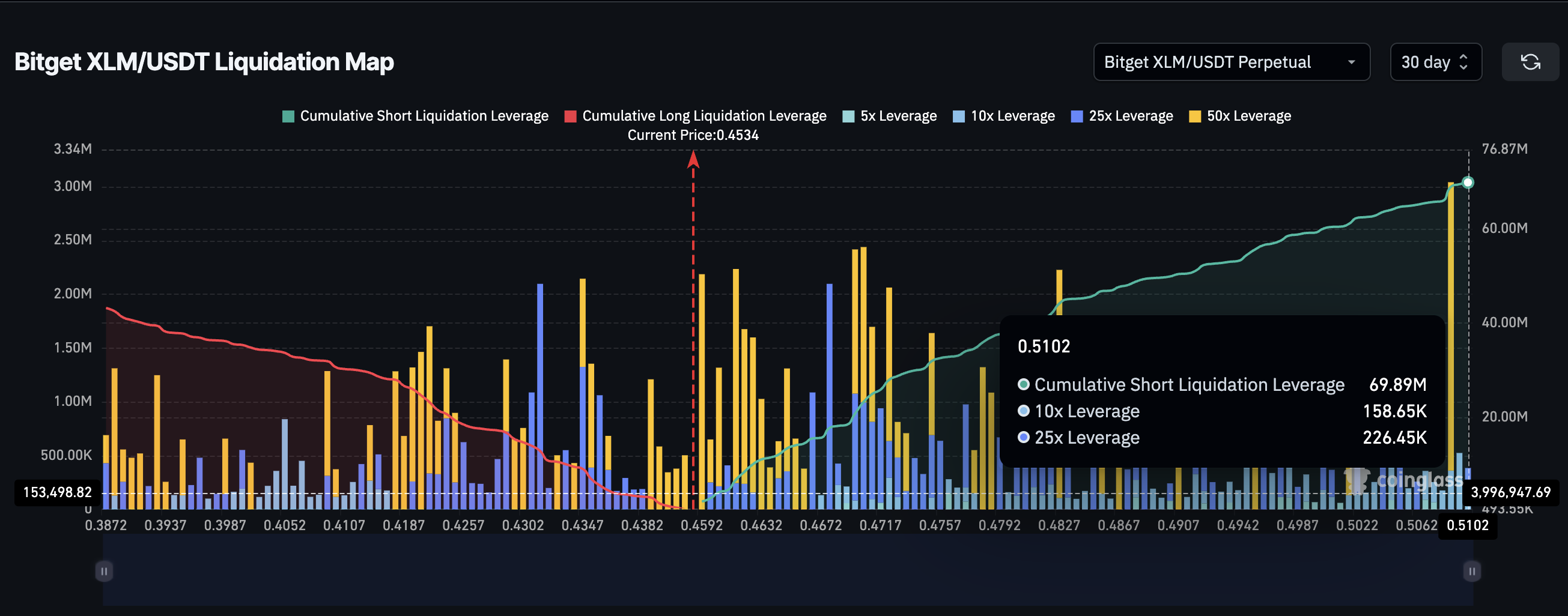

A break above $0.47 could propel the Stellar (XLM) price to new highs, as that would also mean a clean pattern breakout. That level also aligns with the short-liquidation cluster.

If the price manages to reach $0.47, shorts getting liquidated would be able to push the XLM prices higher, more like a cascading rally.

XLM needs a liquidation trigger

: Coinglass

XLM needs a liquidation trigger

: Coinglass

But then, according to the chart, if the price corrects and dips below $0.43, the bullish structure would be at risk—even from the long-side positions that get liquidated at $0.43 and lower.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.

From Yen Interest Rate Hike to Mining Farm Shutdown, Why Is Bitcoin Still Falling

The market is down again, but this may not be a good buying opportunity this time.