ETH tops $4.6K for first time since 2021, eyes ATH

Key Takeaways

- Ethereum hit $4,600 for the first time since November 2021, approaching its $4,800 all-time high.

- Treasury and ETF inflows totaling billions are fueling the rally alongside a $120M short squeeze.

Share this article

Ether, the second-largest crypto asset by market cap, is now less than 5% away from its all-time high of $4,800 set in November 2021. It traded above $4,600 on Tuesday afternoon, its highest level in nearly four years, as traders anticipate a potential breakout and the start of an alt season. Bitcoin dominance has fallen below 60% as ETH gains ground.

The rally triggered more than $120 million in short liquidations in the past hour, according to CoinGlass data . Market momentum has been fueled by a growing wave of Ethereum treasury companies that collectively hold more than $9 billion worth of ETH.

BitMine, the largest of these holders with 1.15 million ETH valued at roughly $5 billion, disclosed plans earlier today to expand its at-the-market equity program to $24.5 billion to fund additional purchases.

ETF demand is also adding fuel to the surge. Spot Ethereum funds have increased their combined market cap by about $5 billion over the past month, bringing total net inflows since their July 2024 launch to $9.4 billion. On Monday, the products posted their first day with more than $1 billion in net inflows, according to Farside Investors data .

Share this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trust Wallet Token (TWT) To Rise Further? Key Harmonic Pattern Hints Potential Upside Move

SPX6900 (SPX) Testing Crucial Support – Can It Defend from a Breakdown?

Is Bitcoin’s $100K Floor at Risk as the Fed Struggles to Find Its “Neutral” Rate?

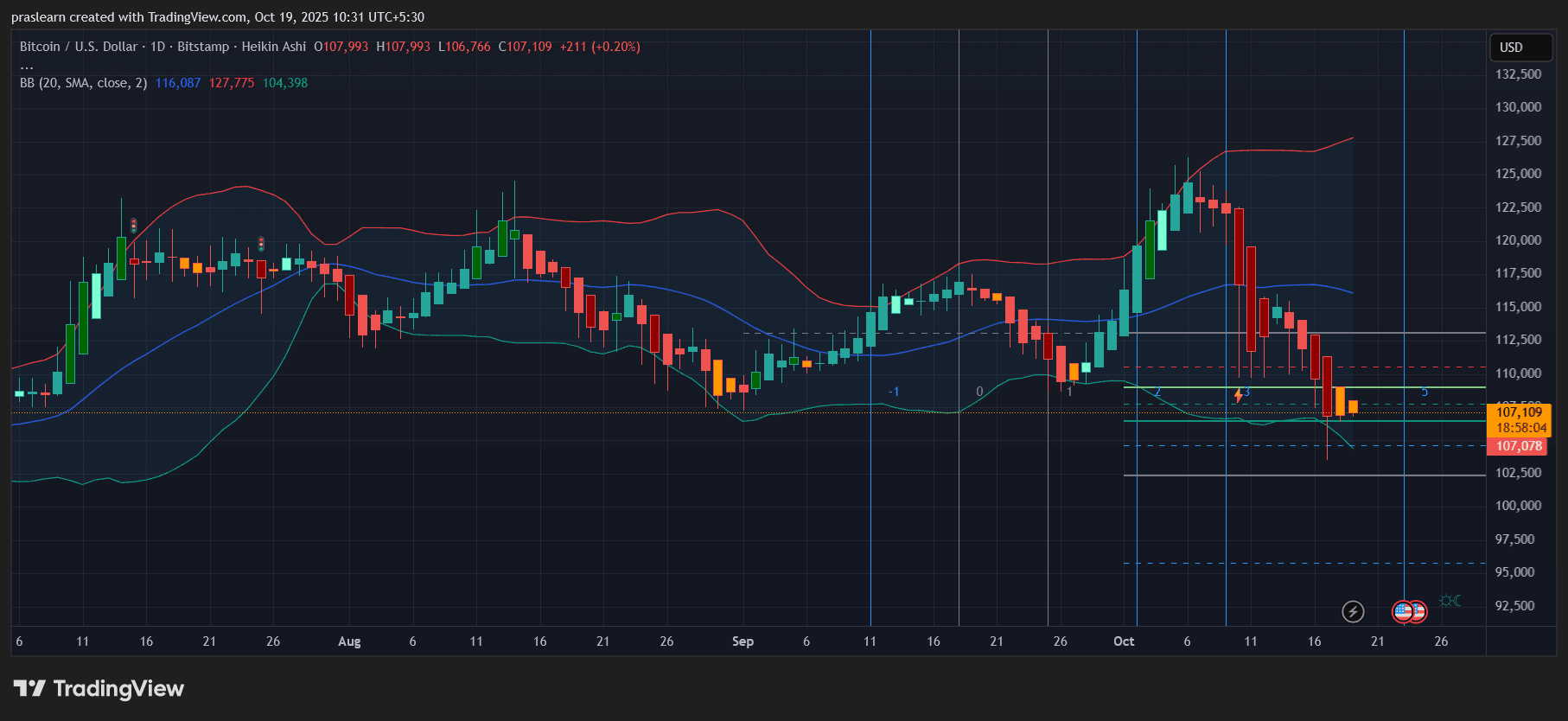

Bitcoin Consolidates Near $107K: Analysts Have THIS Bitcoin Prediction...