Ripple Price Prediction as XRP ETF Approval in 2025 Could Bring $5 Billion Outpacing Ethereum

The cryptocurrency market may soon see one of its biggest shakeups yet, with experts predicting that an XRP exchange-traded fund (ETF) could attract massive institutional investment this year. According to Steven McClurg, CEO of Canary Capital, the launch of an XRP ETF could pull in $5 billion in inflows in just the first month, far higher than previous expectations.

Why Analysts See an ETF as a Game-Changer

In an interview with Paul Barron Network, McClurg said that an ETF would open the door for large-scale institutional investment in XRP, similar to what happened when Bitcoin and Ethereum ETFs hit the market. He pointed out that earlier estimates for XRP ETF inflows were between $4 billion and $8 billion over an entire year. If his $5 billion first-month prediction holds true, it would mark a major leap for the asset and possibly even outpace Ethereum ETF launches.

Institutional investors such as banks, hedge funds, and asset managers often prefer ETFs because they make it easier to gain exposure to a cryptocurrency without having to directly hold or manage it. This could lead to stronger and more stable buying pressure on XRP.

Lessons From Past ETF Launches

Drawing from his past experience at Valkyrie, where he helped launch the first NASDAQ-traded Bitcoin futures ETF in October 2021, McClurg observed that ETFs often start strong, even if they face market downturns afterward.

The Bitcoin ETF he launched saw $100 million in trading volume on day one but then had to weather an 18-month bear market. Despite the challenges, McClurg added that surviving a bear market can strengthen a fund’s reputation, making it more attractive during the next bull run.

He gave another example from 2023, when a Bitcoin mining ETF he worked on became the best-performing ETF in the US, gaining over 300 percent after the market recovered.

Bull Market Now, Bear Market Later?

While McClurg is bullish about XRP’s ETF potential, he also warned that the current bull run might not last forever. He predicts that the first two interest rate cuts from the US Federal Reserve, expected as early as September, could push markets higher for the rest of the year.

However, he sees a global economic slowdown on the horizon, with many developed countries already in recession. If conditions worsen, a bear market could arrive sooner than expected.

What This Means for XRP’s Price

If the XRP ETF launches this year and hits McClurg’s $5 billion inflow target, it could trigger a price rally. Increased demand from institutional investors would likely boost liquidity and market confidence. However, as past ETF launches have shown, sustaining those gains will depend on broader market conditions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Weekly Watch: Has the Market Code Emerged? Dynamic Take-Profit Strategy Suggestions Included

Monad airdrop query goes live, almost all testnet users “get rekt”?

This article analyzes the results of the Monad airdrop allocation and the community's reactions, pointing out that a large number of early testnet interaction users experienced a "reverse farming" situation, while most of the airdrop shares were distributed to broadly active on-chain users and specific community members. This has led to concerns about transparency and dissatisfaction within the community. The article concludes by suggesting that "reverse farmed" airdrop hunters shift their focus to exchange activities for future airdrop opportunities.

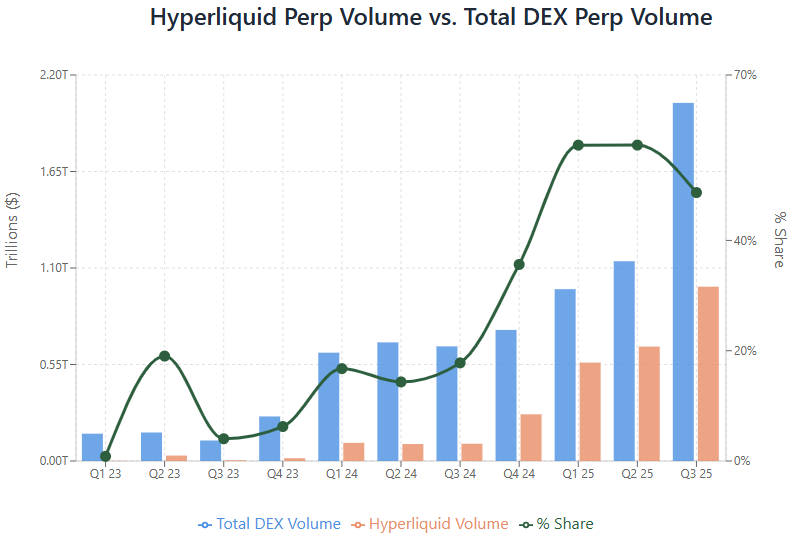

Arete Capital: Hyperliquid 2026 Investment Thesis, Building a Comprehensive On-chain Financial Landscape

The grand vision of unified development across the entire financial sector on Hyperliquid has never been so clear.

S&P Index Adjusted as Expected: Key Observations on Timing and Scope of the Adjustment!