Pantera Capital has invested $300 million into crypto treasury companies, predicting they will yield better returns than crypto ETFs due to their unique strategies for asset growth.

-

Pantera believes digital asset treasuries (DATs) can enhance net asset value per share.

-

Investments include firms holding Bitcoin, Ether, and Solana, among others.

-

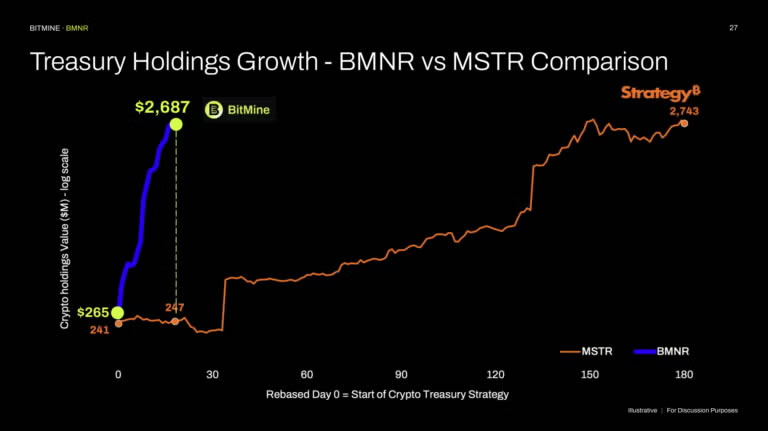

BitMine, a model example, holds nearly 1.2 million ETH valued at around $5.3 billion.

Discover how Pantera Capital’s $300 million investment in crypto treasury firms could outperform ETFs, offering unique growth strategies.

What are Crypto Treasuries?

Crypto treasuries, or digital asset treasuries (DATs), are companies that manage and grow their cryptocurrency holdings. Pantera Capital asserts that these treasuries can generate higher returns compared to traditional investments like ETFs by leveraging unique strategies to enhance net asset value.

How Do Crypto Treasuries Generate Returns?

Crypto treasuries employ various strategies to grow their digital asset holdings. For instance, they can issue stock at a premium to net asset value (NAV), utilize convertible bonds to capitalize on market volatility, and earn staking rewards. This multifaceted approach can lead to significant asset accumulation over time.

Frequently Asked Questions

What is Pantera Capital’s investment strategy?

Pantera Capital focuses on investing in crypto treasury firms, believing they can outperform traditional ETFs by generating higher yields through strategic asset management.

Why are crypto treasury companies gaining popularity?

Crypto treasury companies are attracting attention due to their potential for high returns, innovative asset management strategies, and growing institutional interest.

Key Takeaways

- Investment Potential: Pantera’s $300 million investment highlights the growing confidence in crypto treasuries.

- BitMine’s Success: BitMine has rapidly become a leading Ether treasury, showcasing effective asset management.

- Market Risks: Despite their potential, crypto treasury firms face significant risks that could impact their success.

Conclusion

Pantera Capital’s investment in crypto treasury companies underscores a shift towards innovative asset management in the cryptocurrency space. While the potential for high returns is evident, the associated risks require careful consideration. As the market evolves, these firms may redefine investment strategies in the digital asset landscape.

BitMine’s aggressive accumulation has outpaced Strategy’s. Source: Pantera

BitMine’s aggressive accumulation has outpaced Strategy’s. Source: Pantera