PI Price Hits Brick Wall at $0.40 as Bears Gain Ground — What’s Next?

PI token struggles at $0.40 resistance as volume drops, signaling possible pullback or reversal toward $0.32.

PI Network’s PI token has surged 15% over the past week, thanks to renewed optimism in the broader crypto market.

However, the rally is approaching a make-or-break moment as the token faces intense selling pressure at the $0.40 level. This price point once acted as strong support but has now flipped into resistance.

PI Price Stuck Under $0.40 as Bears Keep Tight Grip

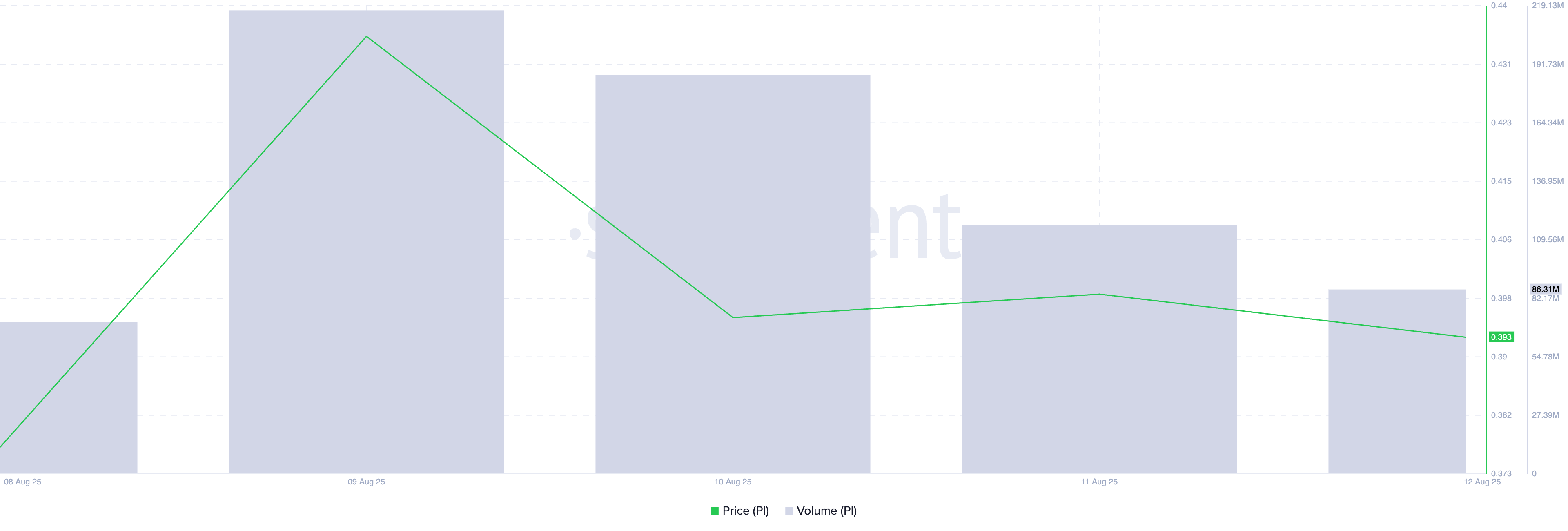

Readings from the PI/USD one-day chart reveal that, over the past week, PI has made two unsuccessful attempts to break above the $0.40 barrier.

On each occasion, the token briefly breached this threshold, only to be met with a wave of sell-side pressure that dragged prices below the mark before the daily close. This pattern reflects the strength of the resistance and the firm grip sellers still hold at this level.

While PI’s price is up 2% today in line with broader market growth, the 26% drop in trading volume paints a more cautious picture. This falling volume has created a negative divergence with the token’s price, hinting at the possibility of a pullback in the near term.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

PI Price and Trading Volume. Source:

Santiment

PI Price and Trading Volume. Source:

Santiment

When an asset’s price rises while trading volume falls, it often signals weakening buying strength. This divergence suggests the PI’s rally may lack conviction and be at risk of a reversal once the daily demand starts to wane.

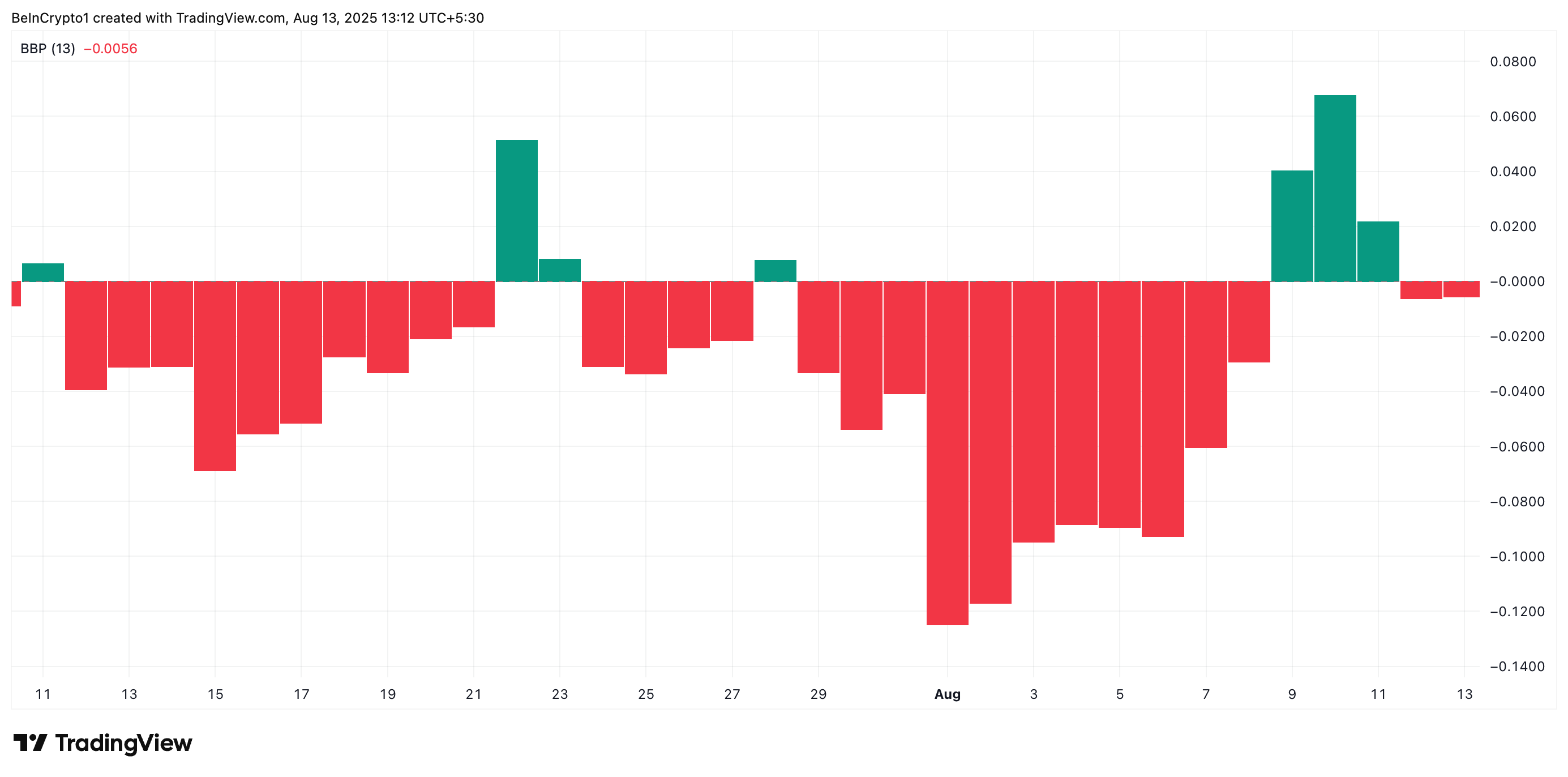

Moreover, PI’s Elder-Ray Index, observed on a daily chart, paints a similar bearish picture. Over the past two trading sessions, this indicator has posted negative values. At press time, this sits at -0.0056, indicating that the bears remain in deep control of PI spot markets.

PI Elder-Ray Index. Source:

TradingView

PI Elder-Ray Index. Source:

TradingView

The Elder-Ray Index measures the balance of buying and selling pressure by comparing price movements to a short-term moving average. When negative, selling pressure outweighs buying power, confirming bearish market control.

$0.32 Crash or $0.46 Rally?

PI’s failure to secure a decisive close above $0.40 soon could trigger a revisit to its all-time low of $0.32.

PI Price Analysis. Source:

TradingView

PI Price Analysis. Source:

TradingView

A successful breakout, however, could unlock the door for a sustained recovery, potentially pushing PI’s price toward $0.46 in the sessions ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The CEO of the world's largest asset management firm: The scale of "crypto wallets" has exceeded $4 trillion, and "asset tokenization" is the next "financial revolution"

BlackRock has revealed its goal to bring traditional investment products such as stocks and bonds into digital wallets, targeting this ecosystem worth over $4 trillion.

Brevis releases Pico Prism, enabling real-time Ethereum proofs on consumer-grade hardware

Pico Prism (zkVM) has improved its performance efficiency by 3.4 times on the RTX 5090 GPU.

Is sandwich attack illegal too? MIT prodigy brothers who profited $25 million to stand trial

The victim is an MEV bot.