2 Billion DOGE Accumulation Triggers Golden Cross For Dogecoin Price

Dogecoin price surges as 2 billion DOGE accumulate, triggering a Golden Cross; further gains may push DOGE toward $0.273.

Dogecoin (DOGE) has experienced a noticeable price increase this month, breaking above previous resistance levels.

The recent surge is fueled not just by favorable market conditions but also by the actions of major DOGE holders. As Dogecoin continues to gain momentum, it could see further upside if the trend persists.

Dogecoin Whales Change The Winds

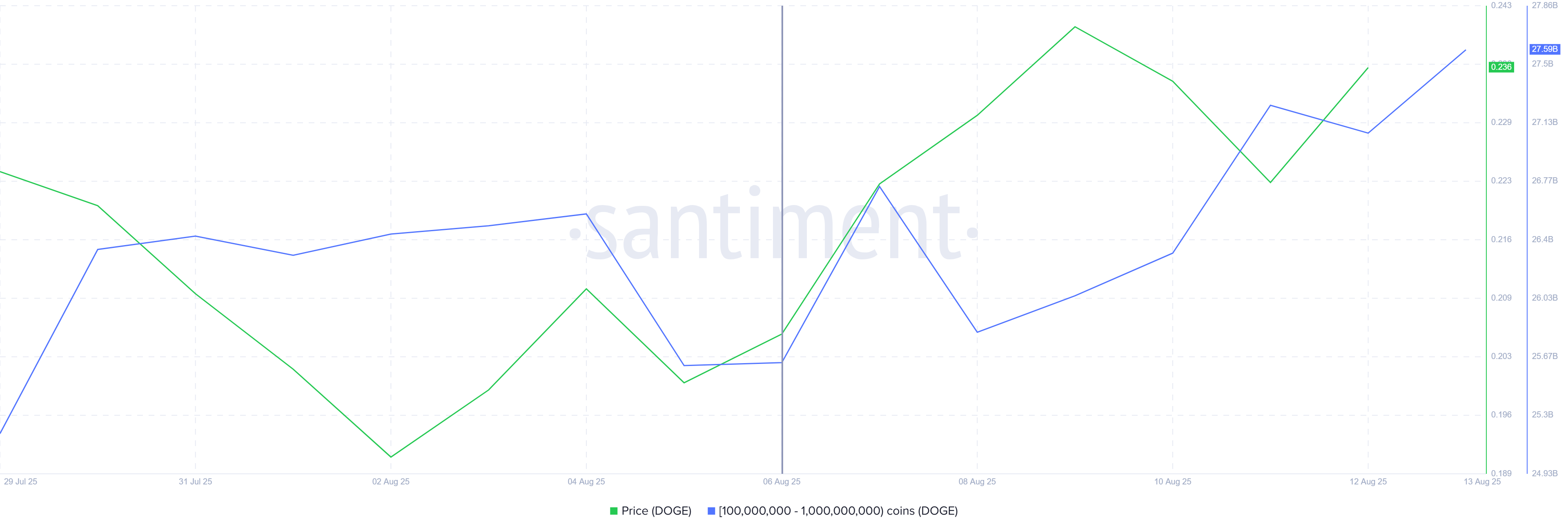

Dogecoin whales have been a significant driver of the recent price movement, showing bullish sentiment since the start of the month. In the past week, addresses holding between 100 million and 1 billion DOGE have accumulated more than 2 billion DOGE, worth approximately $500 million.

This accumulation by large holders indicates strong confidence in Dogecoin’s future potential. The support from these whales has been essential in pushing the meme coin higher, providing a solid foundation for further price gains.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Dogecoin Whale Holdings. Source:

Dogecoin Whale Holdings. Source:

The overall momentum for Dogecoin is shifting from bearish to bullish, thanks to key technical indicators. The 50-day and 200-day exponential moving averages (EMAs) recently formed a Golden Cross, signaling a significant shift in market sentiment. The Golden Cross ended the five-month-long bearish period marked by the Death Cross, suggesting that the path ahead for Dogecoin may be more favorable.

This crossover is a critical indicator that suggests the altcoin is poised for further growth, as the long-term outlook improves. If Dogecoin maintains its momentum and continues to experience strong support, the price could continue its upward trajectory in the coming weeks.

DOGE Golden Cross. Source:

DOGE Golden Cross. Source:

DOGE Price Continues to Rise

At the time of writing, Dogecoin is trading at $0.246, having recently broken through the $0.241 resistance level. To sustain its upward movement, Dogecoin needs to convert this level into solid support. If it manages to hold above $0.241, it will likely continue rising, with $0.273 acting as the next major resistance.

The accumulation of DOGE by whales is expected to drive the price towards the $0.273 resistance level. If the Golden Cross continues to signal bullish momentum, Dogecoin’s price could surpass this resistance and continue rising.

DOGE Price Analysis. Source:

DOGE Price Analysis. Source:

However, if the bullish momentum fails to strengthen, Dogecoin may experience consolidation between the $0.241 and $0.218 levels. This scenario would indicate a weakening of market confidence, causing a temporary price pullback. Should this occur, the bullish outlook would be invalidated, and further losses may follow.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Sreeram Kannan: Building the Trust Layer for Ethereum

Despite the controversies, EigenLayer remains at the core of Ethereum's evolution.

Bitcoin’s Stability Tested as Powell’s NABE Address Potentially Shakes Market: Will It Hold $108K-$110K?

Anticipated Market Fluctuations Amid Rate Cut Speculations and Bitcoin's Struggle to Maintain Key Support Levels

SEC-Registered YLDS Token Launched by Figure on Sui Blockchain for Enhanced Yield Access

Introducing a New Security Token Offering SOFR Minus 35 Basis Points Yield, Backed by Treasury Securities and Facilitating Direct Fiat Transactions

ODDO BHF, French Bank, Unveils New Stablecoin Backed by Euro

ODDO BHF Dives into Cryptocurrency with the Introduction of EUROD, a Stablecoin Pegged to the Euro