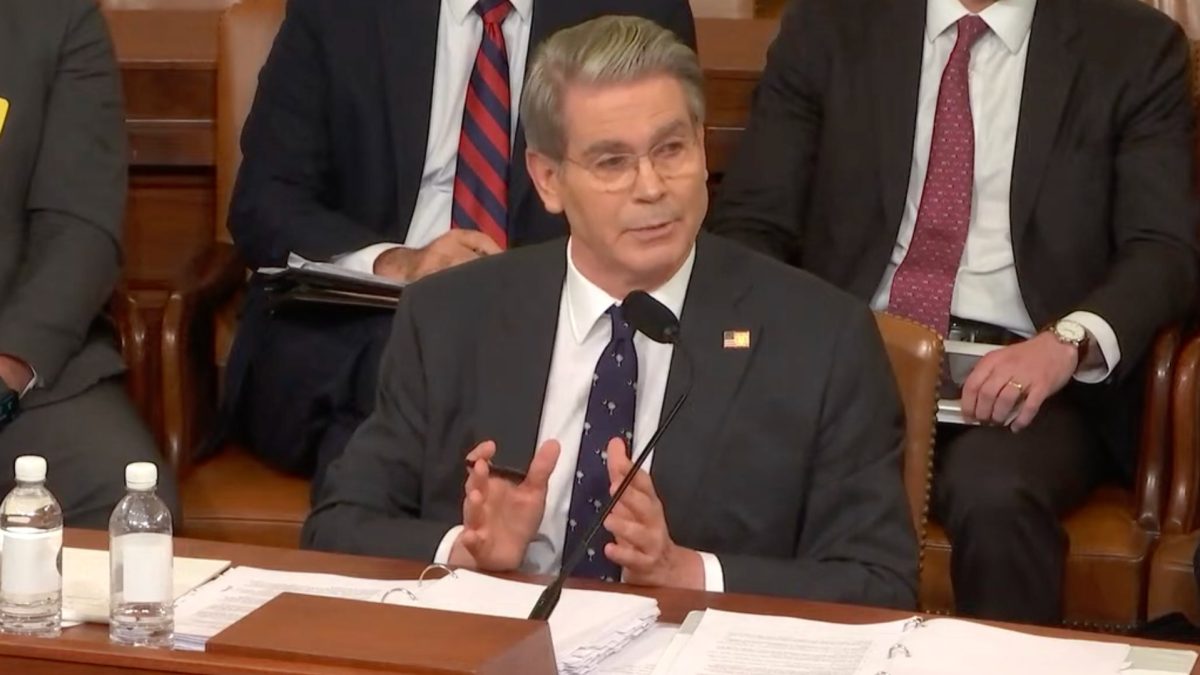

US Treasury Secretary Bessent says government won't buy bitcoin for strategic reserve but will retain seized assets as crypto markets see red

Quick Take Treasury Secretary Scott Bessent said in a television interview that the U.S. would not be buying bitcoin for its strategic reserve. However, he reiterated that the government would continue to use confiscated assets to build it up and would not sell bitcoin currently in the reserve, valuing it at $15 to $20 billion.

In a short segment of an interview with Fox Business on Thursday morning, U.S. Treasury Secretary Scott Bessent said the government would not be buying additional bitcoin for President Trump's strategic reserve, valuing the country's current holdings at $15 to $20 billion.

Describing the Strategic Bitcoin Reserve as the U.S. "starting to get into the 21st Century," Bessent did reiterate that current seized assets would continue to be held, with no bitcoin sold, and that future confiscations could add to the government's holdings over time.

"We're not going to be buying that, but are going to use confiscated assets and continue to build that up. We're going to stop selling that," he told host Maria Bartiromo. "You know, I believe that the bitcoin reserve at today's prices is somewhere between $15 and $20 billion."

Responding to a question on whether the U.S. would revalue its 261.5 million ounces of gold holdings, officially valued at around $11 billion based on a $42.22 per ounce price set back in 1973 but now worth around $750 billion at market prices, Bessent said he doubts it would be revalued, but it would also be kept as a store of value.

How we got here

Trump's first crypto-related executive order came within a few days of his inauguration on Jan. 20, creating a "President's Working Group on Digital Asset Markets" chaired by White House crypto czar David Sacks — tasked with developing a federal regulatory framework for digital assets and working to evaluate the creation of a "strategic national digital assets stockpile."

However, Trump accelerated this work on March 6, signing another executive order to create a U.S. Strategic Bitcoin Reserve, established from the approximately 198,022 BTC already owned by the federal government per Arkham data that was forfeited as part of criminal or civil proceedings, minus those that still need to be returned to victims of crime.

Additionally, Trump directed Bessent and Commerce Secretary Howard Lutnick to develop budget-neutral strategies for acquiring additional bitcoin, provided they have no incremental costs to American taxpayers.

The executive order also established a U.S. Digital Asset Stockpile, consisting of digital assets other than bitcoin forfeited in criminal or civil proceedings. However, the government already confirmed it would not acquire additional assets for the stockpile beyond those obtained through forfeiture proceedings.

The White House working group was given a 180-day deadline to submit a comprehensive report on its crypto roadmap, which subsequently arrived at the end of July, though with little further detail on the proposed bitcoin reserve.

Federal agencies were scheduled to submit reports by April 5 outlining their authority to transfer digital assets to the reserve. Details on budget-neutral acquisition strategies were then expected 60 days after the executive order, around May 5, when Bessent was due to deliver an evaluation of the legal and investment considerations for the reserve.

However, those deadlines came and went without any public announcements of their findings. Unless Bessent misspoke and meant to only refer to the crypto stockpile, he appears to have confirmed the government will not be buying bitcoin for that separate reserve, too. The Treasury Department could not be immediately reached for comment by The Block.

Crypto markets turn red following Bessent's comments and hot PPI data

Following Bessent's interview and hotter-than-expected PPI inflation data on Thursday, the crypto market saw red, with bitcoin swiftly dropping more than 4% from above $121,000 to below $118,000 at one point. Bitcoin is currently trading for $118,327, according to The Block's BTC price page.

Ether fell over 5% to below $4,500 in the same period, while the GMCI 30 index of the leading cryptocurrencies dropped 4% in about an hour.

BTC/USD price chart. Image: The Block/TradingView .

The U.S. producer price index (PPI) for July rose 3.3% year-over-year, above the 2.5% forecast and up from a revised 2.4% in June — marking the highest annual increase since February. On a monthly basis, PPI climbed 0.9%, the largest gain since June 2022.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Optimism protocol introduces OP Succinct to enhance scalability

Succinct Labs has partnered with Optimism to develop OP Succinct, which can upgrade any OP Stack chain to use zero-knowledge proofs within an hour. This will improve transaction speeds and reduce fees for Ethereum Layer 2 scaling solutions. Succinct Labs has raised $55 million and claims its new approach is faster and cheaper than standard optimistic rollups. OP Succinct can be easily integrated into existing deployments, addressing scalability and transaction speed issues on the Ethereum mainnet. In June this year, OP Labs released a fault proof system that allows users to challenge and revoke invalid withdrawals, providing a mechanism for Ethereum Layer 2 networks. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Dogecoin Extends 16% Rally, Trades at $0.2471 as $0.2395 Support and $0.2529 Resistance Define Next Breakout Test

ARPA Consolidates Below Trendline as Bullish Structure Targets Breakout Toward $0.033

Pepe at $0.00001048 Consolidates Between $0.00001041 and $0.00001078 as Weekly RSI Hints Multi-Year Breakout, Gaining 0.6%