Key Notes

- Long-position traders suffered 80% of liquidations totaling $787.5 million, with over 215,000 affected participants.

- Ethereum dominated liquidation events with $322 million losses, representing nearly one-third of all trading casualties.

- Higher-than-expected PPI inflation data triggered market uncertainty, forcing Fed rate cut expectations to shift downward.

On August 14, the cryptocurrency market suddenly pivoted from bullish to bearish, drastically crashing and liquidating long-position traders on its way down. The ongoing volatility also punished some short sellers, although with a lower impact.

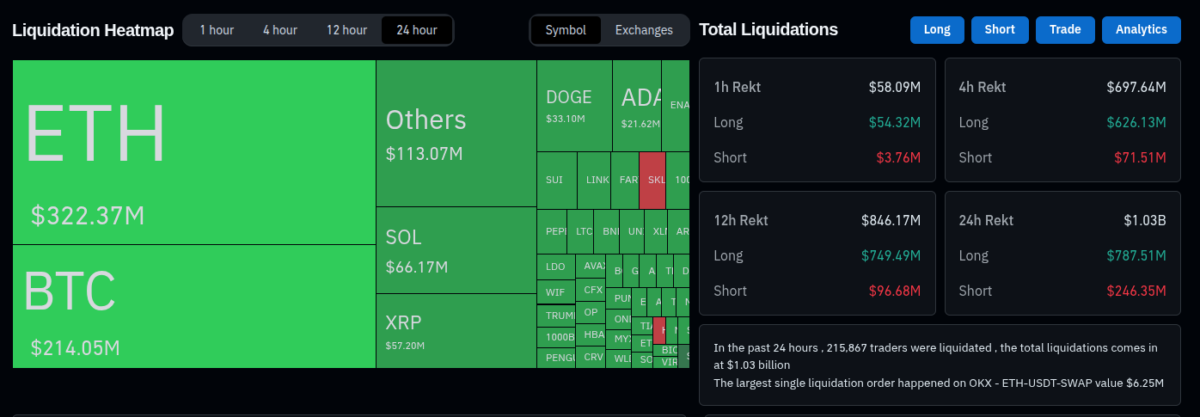

Data retrieved from Coinglass shows a total of $1.03 billion in liquidations in the last 24 hours, out of which nearly $700 million happened in the last four hours. Long positions were the most affected, considering the market was hit harder on its way down, as cryptocurrencies crashed following concerning PPI data.

Overall, around 80% of all liquidations in the day were from long-position traders, summing up to $787.5 million as of this writing. With over 215,000 traders affected, the largest single position to “get rekt” was from the ETH/USDT pair on OKX. The trader lost $6.5 million as the Ethereum price crashed below its margin threshold.

On that note, Ethereum ETH $4 488 24h volatility: 5.7% Market cap: $542.42 B Vol. 24h: $62.37 B dominated the 24-hour liquidations, with $322 million, accounting for nearly one-third of all liquidation events. Bitcoin followed with circa 20% of the liquidations , both summing up to more than half of all the losses in dollar value.

Liquidation Heatmap and Total Liquidations | Source: Coinglass

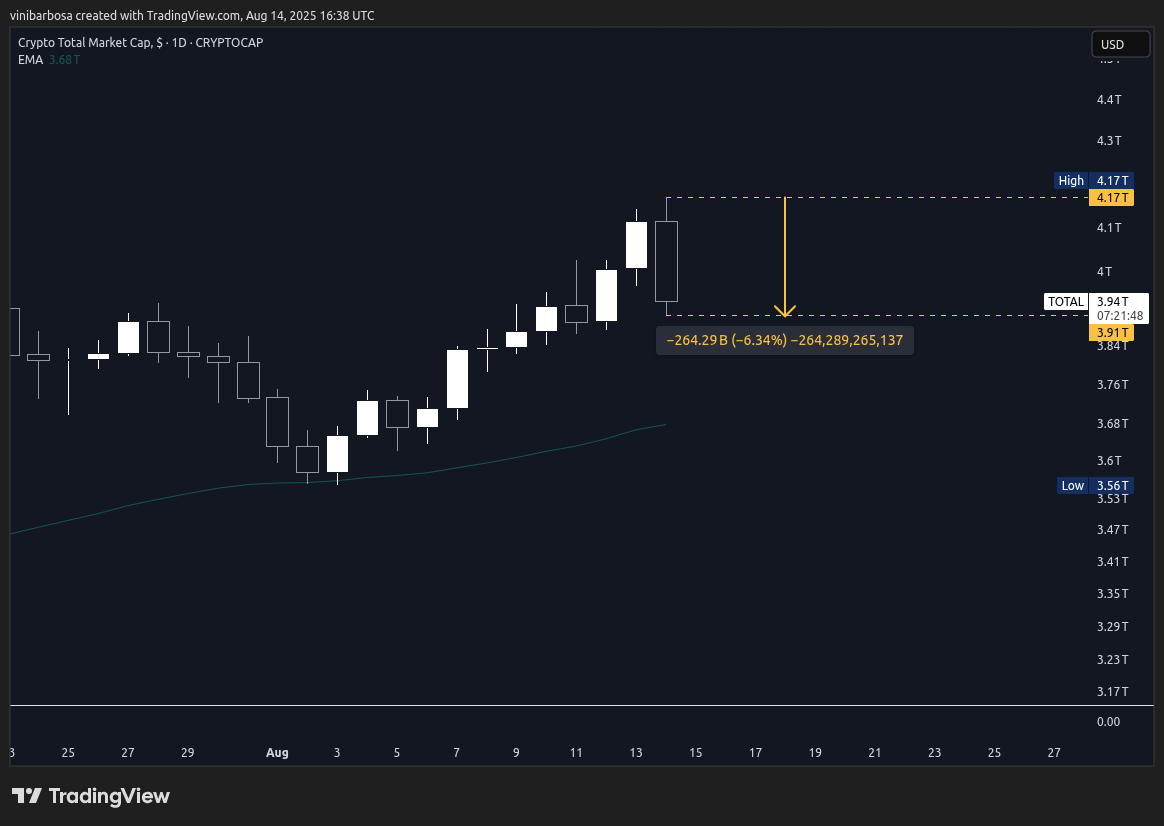

Cryptocurrencies Bleed, Losing Over $264 Billion in Market Cap

From top to bottom intraday, cryptocurrencies lost over $264 billion in market capitalization. Prior to the crash, short positions were being liquidated as Bitcoin BTC $117 747 24h volatility: 4.1% Market cap: $2.34 T Vol. 24h: $76.66 B made a new all-time high and an altseason appeared on the horizon —sending crypto’s total market cap to $4.17 trillion.

Nevertheless, the market suddenly pivoted, crashing down to $3.91 trillion, returning most gains from the past two days.

Crypto Total Market Cap Index (CRYPTOCAP:TOTAL 1) | Source: TradingView

The pivot can be partially explained due to uncertainties following a July PPI inflation of 3.3% against the expected 2.5%. Core PPI inflation rose to 3.7%, also above expectations of 2.9%. This is relevant because most analysts were waiting for a significant interest rate cut in the Federal Reserve’s September FOMC meeting. Current data now puts the Fed in a difficult position, causing traders to derisk.

next