Nasdaq-listed Bit Digital reports Q2 revenue drop amid pivot to Ethereum treasury strategy

Quick Take Bit Digital posted $25.7 million in total revenue for the second quarter, down 11.7% year-over-year. However, it reported a net income of $14.9 million, compared to the $12 million net loss recorded in the same period last year.

Nasdaq-listed Bit Digital reported a decline in total revenue for the second quarter of this year but achieved net income as the company pivoted to focus on its Ethereum treasury strategy .

Bit Digital posted $25.7 million in total revenue for the second quarter, down 11.7% year-over-year, the company announced in its quarterly earnings report .

"The decline was primarily driven by a decrease in digital asset mining revenue as the Company focused on Ethereum-native treasury and staking strategies, which was partially offset by growth across other segments," said Bit Digital.

The company posted a net income of $14.9 million ($0.07 per diluted share) for the second quarter, a turnaround from the $12 million net loss recorded in the same period last year.

The second quarter also "marked the beginning of Bit Digital’s transformation into a dedicated Ethereum treasury and staking platform," said Sam Tabar, CEO of Bit Digital.

In June, the company announced its ETH strategy launch while beginning to wind down its bitcoin mining operations. "[We] are methodically winding down our bitcoin mining operations and redeploying capital into ETH," said Tabar.

The company's crypto mining segment produced $6.6 million in revenue, down 58.8% from $16.1 million generated during the same quarter last year. "The decline was driven by increased network difficulty, the halving event in April 2024, and a reduction in active hash rate," the company said.

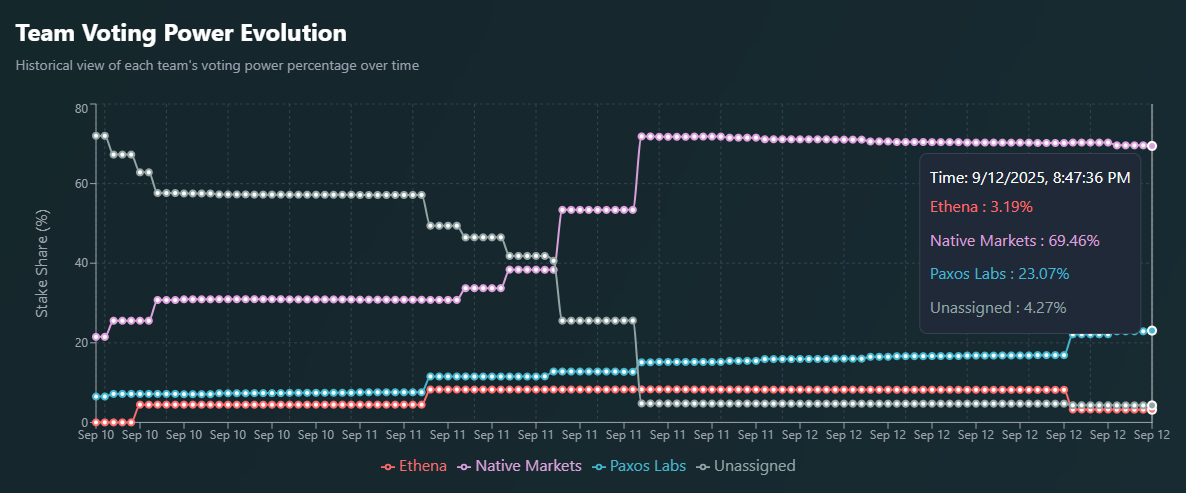

Also, during the second quarter, Bit Digital earned roughly 166.8 ETH in staking rewards. The company had around 21,568 ETH actively staked as of June 30, generating an annualized effective yield of 3.1% for the period.

As of Aug. 11, the company's active staking position had grown to 105,015 ETH.

"Our objective is to build one of the largest on-chain ETH balance sheets in the public markets and to generate attractive staking yields for shareholders," said Tabar.

Bit Digital is a crypto infrastructure company, providing services that encompass validator operations, enterprise-level custody, and yield optimization. It began accumulating and staking ether in 2022.

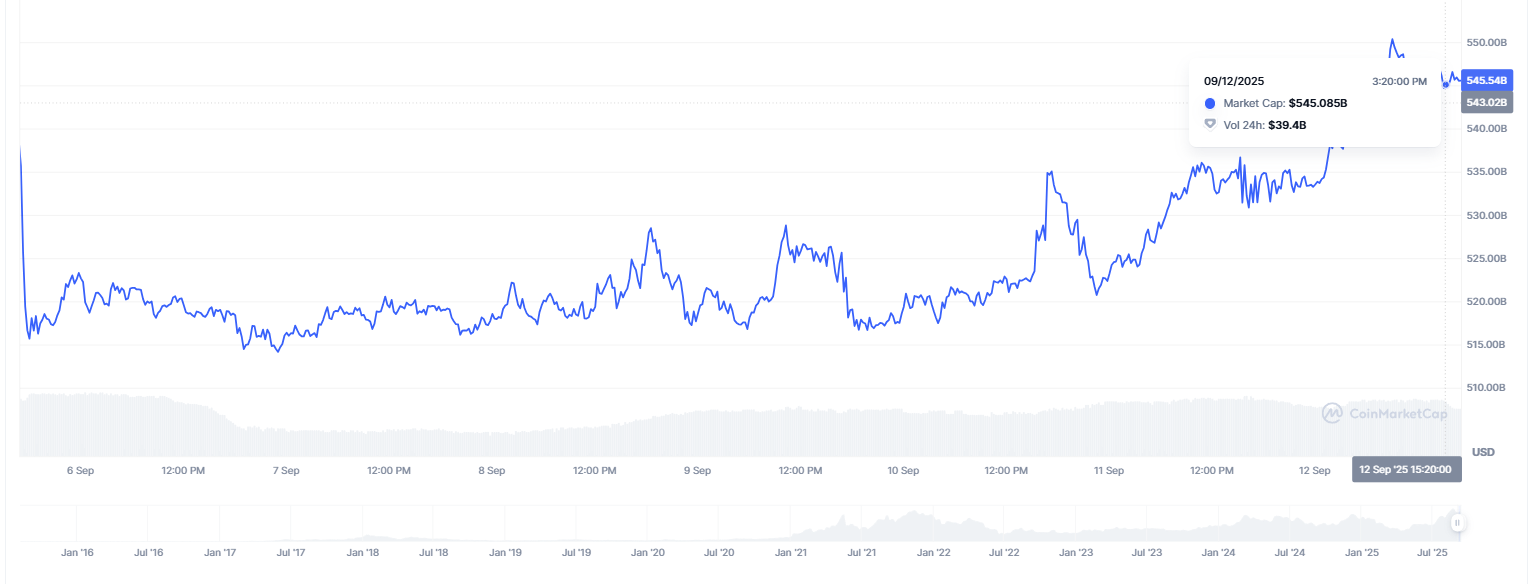

Bit Digital's stock price dropped 0.63% to $3.19 at Thursday's close, according to Yahoo Finance data . While down for the day, the shares have rallied 8.1% during the past five days and gained 8.9% since the beginning of the year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid may become an airdrop hub, with USDH one of the main mechanisms to farm points

Bitdeer Bitcoin Mining: Impressive 375 BTC Mined in August

Ethereum (ETH) to $25,000 in 2026: Key Reasons Why It Can Happen

Dogecoin price forecast after the DOJE ETF launch delay: analysis points to $3