Uncovering the "Oriental Micro Strategy" CanGu: How Did It Become the "Hidden Gem" in the Crypto Community

When the market's spotlight is still chasing those familiar cryptocurrency mining giants, Canyons is like a quiet "straight-A student," diligently honing its skills in the corner. Since announcing its entry into the field in November 2024, in just six months, it has surged to second place globally with a hashrate of 50 EH/s. In contrast to the trend of "slogans" and "painting grand visions," Canyons is truly speaking with strength and substance.

Article Source: Cango

While the market spotlight is still chasing those familiar crypto mining giants, Cango, like a quiet "straight-A student," has been quietly honing its skills in the corner. Since announcing its entry into the industry in November 2024, in just six months, it has soared to second place globally with 50 EH/s of hash rate, unlike the trend of "slogans" and "pie in the sky," Cango is truly speaking with strength.

Looking at the current market valuation, it is evident that the market is still viewing Cango with old eyes, as its current market cap is only around $800 million, while its Bitcoin holdings alone are worth over $500 million; on the other side of the story, for investors who are watching from the sidelines, now is the perfect time to get involved with Cango. Because Cango's story is far from just about mining.

Stripping Down and Reshaping

Since officially entering the cryptocurrency industry in November 2024, Cango, through a series of efficient capital operations, including cash acquisitions and equity swaps, has successfully increased its hash rate from zero to 50 EH/s, second only to MARA, CleanSpark, and IREN. This feat not only reflects the company's outstanding strategic execution but also demonstrates its ambition in the crypto mining field.

As we enter 2025, Cango's "transformation" continues. In May, it packaged and sold its old business on the mainland to Ursalpha Digital Limited, lightening its load and receiving nearly $352 million in cash. This way, its capital story and financial logic all focus on the core axis of Bitcoin mining. In June, through an equity transaction, it formally consolidated the remaining 18 EH/s of hash power, bringing the total hash rate to 50 EH/s.

Breaking Through to Build, Cango Aims to Become the "Superbrain" of the HPC World

The "mine only, no sell" strategy has allowed Cango to demonstrate greater resilience to market fluctuations. According to the data disclosed by the company in July, Cango holds a total of 4,529.7 BTC and mined 650.5 coins that month. Based on the current Bitcoin price estimates, its holdings are worth about $520 million, with a unit hash rate value of approximately $14.4 million/EH/s. In comparison, companies like MARA and Riot operate on a business model of "mine, sell, expand production," with their unit hash rate values at around $116 million/EH/s and $109 million/EH/s, respectively. Cango's unit hash rate value is only 1/5 to 1/7 of the industry leaders, further proving the market's cognitive bias towards Cango.

From the perspective of operational costs and efficiency, Cango also demonstrates significant advantages. Through a light-asset operation model, it has effectively reduced capital expenditures. At the same time, through negotiations with mining farms, it has gradually reduced operating costs such as electricity and hosting fees. This cost control ability enables Cango to have a stronger profitability and risk resistance in the fierce market competition. After the deployment of 50 EH/s hash rate, the company will achieve a daily output of 26-30 coins, leading the industry.

However, Cango' ambition goes beyond mining. It is also expanding into the energy and AI computing power fields. It carries out "green electricity + energy storage" projects in places rich in renewable energy, turning surplus electricity into income. By transforming mining facilities into AI high-performance computing service centers, Cango is opening up a second growth curve for itself, creating a diversified growth engine.

This strategic layout not only enhances the company's long-term competitiveness but also provides investors with a broader imagination space. Cango hopes to become an elastic computing power scheduler, dynamically allocating resources to BTC mining and AI computing, forming a composite business model of "mining revenue + AI service fees + green electricity trading", significantly improving asset utilization and countercyclical capabilities.

Cango, the "Hidden Gem" in the Value Valley

In the frenzy of the Bitcoin bull market, Cango has been greatly underestimated. It has a solid hash rate foundation, a transparent disclosure mechanism, and a strong governance structure, yet due to market perception bias, it has been severely undervalued. However, true value always lies in these overlooked places. For investors who are eager to find value in the crypto mining industry, Cango is not an option but a must-have. Perhaps the future of this industry lies in the hands of these underestimated "hidden gems."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Weekly Watch: Has the Market Code Emerged? Dynamic Take-Profit Strategy Suggestions Included

Monad airdrop query goes live, almost all testnet users “get rekt”?

This article analyzes the results of the Monad airdrop allocation and the community's reactions, pointing out that a large number of early testnet interaction users experienced a "reverse farming" situation, while most of the airdrop shares were distributed to broadly active on-chain users and specific community members. This has led to concerns about transparency and dissatisfaction within the community. The article concludes by suggesting that "reverse farmed" airdrop hunters shift their focus to exchange activities for future airdrop opportunities.

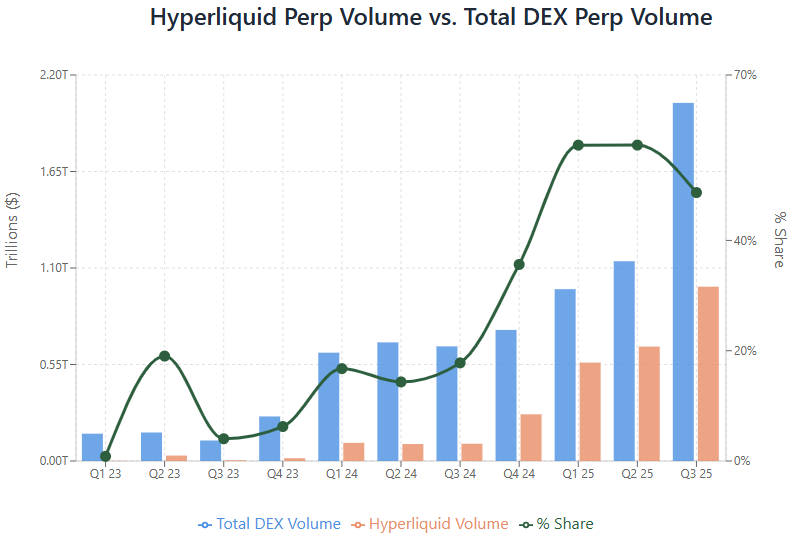

Arete Capital: Hyperliquid 2026 Investment Thesis, Building a Comprehensive On-chain Financial Landscape

The grand vision of unified development across the entire financial sector on Hyperliquid has never been so clear.

S&P Index Adjusted as Expected: Key Observations on Timing and Scope of the Adjustment!