S&P 500 climbs after solid retail sales data

U.S. stocks opened largely positive on Friday, with the Dow Jones Industrial Average rising 250 points and the S&P 500 adding 0.3% as Wall Street targets a winning week.

- Stocks traded higher on Friday as S&P 500 and Dow Jones Industrial Average rose.

- Risk assets soared after latest retails sales data.

While stocks slipped on Thursday amid jitters around the Federal Reserve and interest rate scenario, the outlook on Friday signaled renewed optimism.

The Dow Jones Industrial Average climbed 250 points, or 0.6% and the benchmark index S&P 500 added 0.3%. The Nasdaq Composite hovered near the flatline.

Notably, investors extended the positive sentiment seen throughout the week with an upbeat reaction to July’s retail sales report. The Dow also gained amid premarket upside for UnitedHealth (UNH), which jumped after a regulatory filing revealed Berkshire Hathaway had acquired 5 million shares of the healthcare insurance giant.

Retail sales rose in July

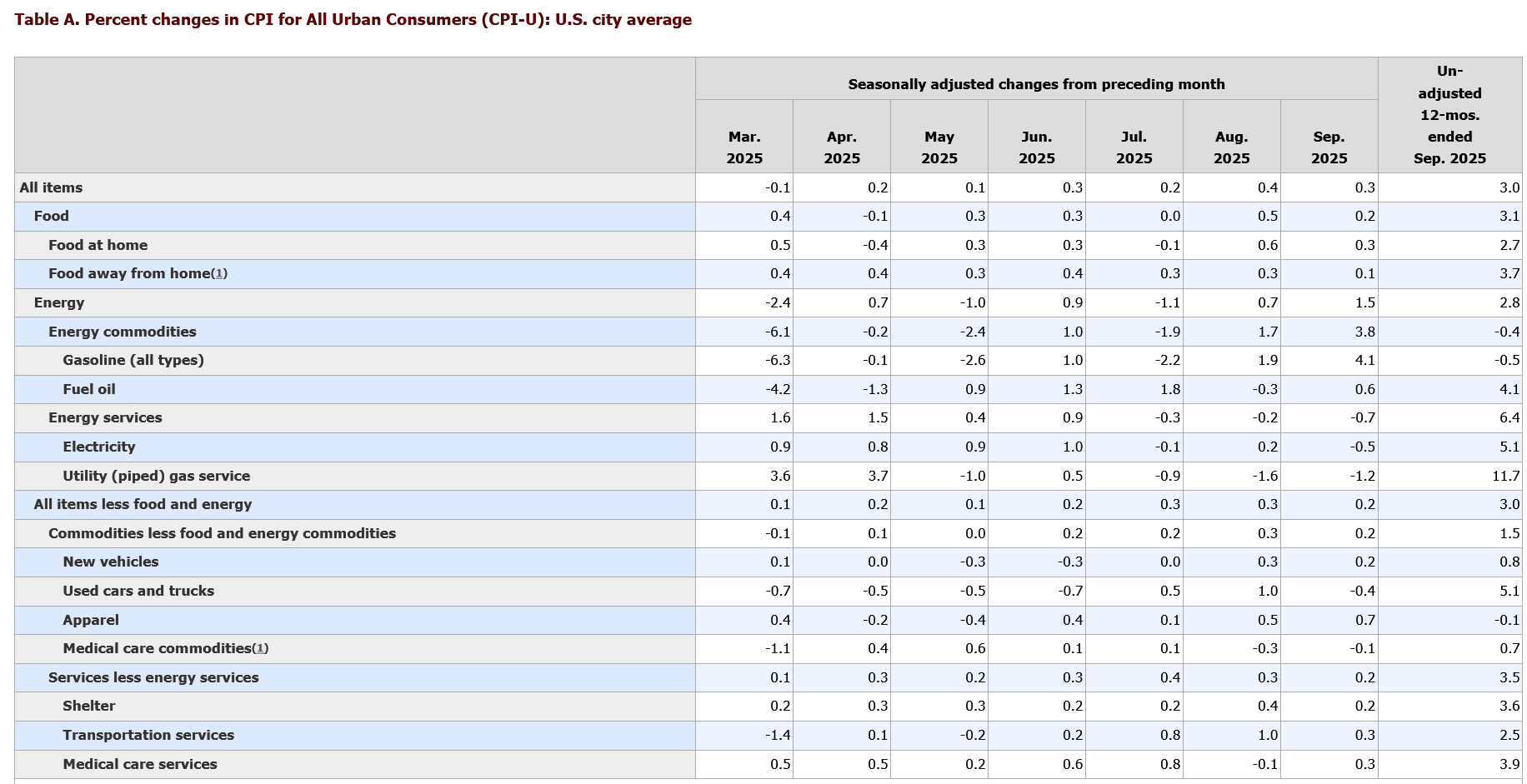

July’s producer price index data, released a day earlier, had dampened investor sentiment following hotter-than-expected inflation figures.

However, fresh economic data released before the bell showed that retail sales rose 0.5% in July, meeting consensus estimates. Retail sales excluding automobiles rose 0.3%, also in line with forecasts. The previous month’s data was revised up to 0.9%, signaling steady consumer spending despite ongoing concerns about the U.S. economy.

Stock markets’ reaction to the report saw the S&P 500 and Dow Jones Industrial Average climb further to hit record highs. Analysts say surge in retail sales is a pointer to the robust U.S. consumer market. Data also showed import prices rose in July amid higher consumer goods prices.

In this context, the S&P 500 is bidding to extend its push above its all-time high, supported by gains in technology stocks and the cooler consumer price inflation data released earlier in the week. The S&P 500 and Nasdaq are both up more than 1% over the past week, while the Dow is up 2%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

As inflation eases slightly, will XRP break its downward trend?

After several weeks of decline, XRP is finally showing signs of recovery as US inflation slightly cools.

XRP price eyes rally to $3.45 after Ripple CEO tells investors to ‘lock in’

Why is Prop AMM flourishing on Solana but still absent on EVM?

In-depth analysis of the technical barriers and EVM challenges faced by Prop AMM (Professional Automated Market Makers).

Zero Knowledge Proof Whitelist Coming Soon: Where Builders Find Purpose in the Next Blockchain Era