The current Bitcoin price volatility presents both challenges and opportunities. With Bitcoin testing highs of $123.7k and lows of $116.9k, Ethereum shows signs of accumulation, potentially marking a shift in market trends.

-

Bitcoin (BTC) undergoes significant price fluctuations, indicating market volatility.

-

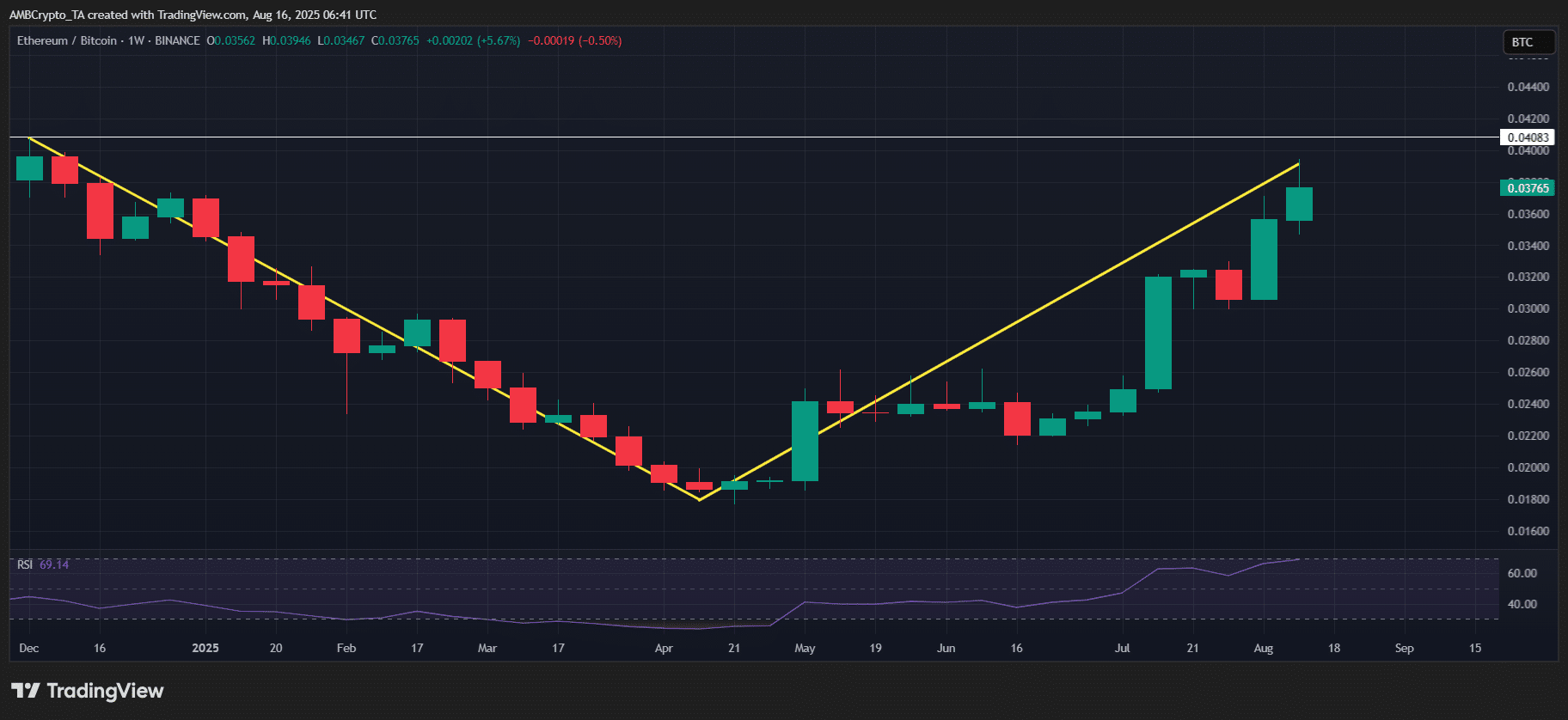

Ethereum (ETH) is gaining strength, hinting at possible dominance over BTC.

-

Recent trading patterns suggest a shift in market dynamics, with ETH capturing more market share.

Bitcoin faces intense volatility while Ethereum shows signs of strength. Stay informed on market trends!

What is Bitcoin Volatility?

Bitcoin volatility refers to the rapid price changes in the cryptocurrency market, often caused by market sentiment and trading activity. BTC’s recent fluctuations highlight investor reactions and market dynamics.

How Does Ethereum Factor Into Bitcoin’s Volatility?

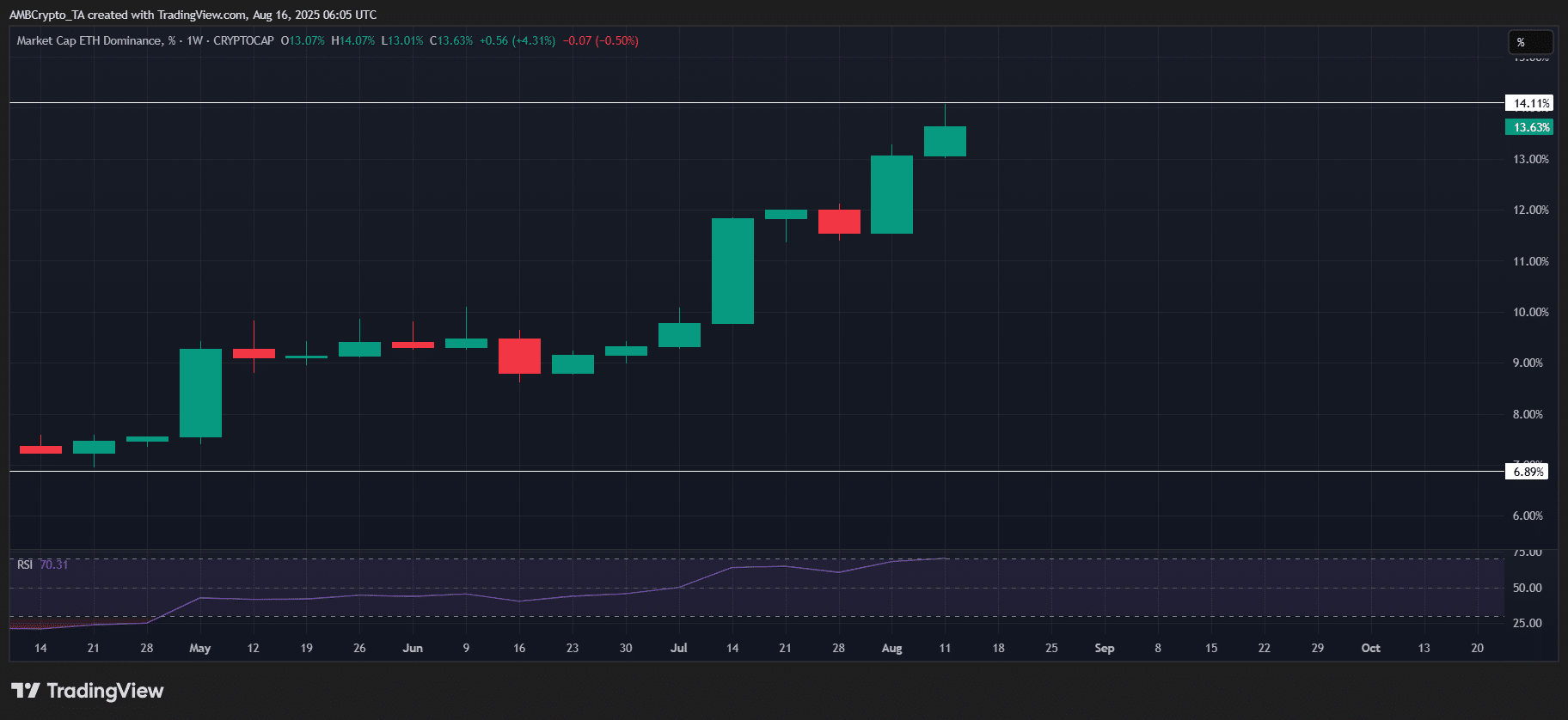

Ethereum is showcasing significant accumulation, reflecting its potential rise in market share as BTC experiences fading dominance. Market indicators reveal that Ethereum’s dominance has increased by 4% recently, suggesting shifts in capital flow.

Frequently Asked Questions

What should investors know about Bitcoin’s price swings?

Investors need to recognize that Bitcoin’s price swings can indicate market sentiment, often driven by news events and trader psychology.

How can I track Ethereum’s growth against Bitcoin?

Monitoring the ETH/BTC trading pair provides insights into Ethereum’s relative strength. Traders can use various market tracking tools available on cryptocurrency exchanges.

Key Takeaways

- Bitcoin faces increased volatility: The price fluctuates between $123.7k and $116.9k, prompting caution among investors.

- Ethereum is gaining momentum: ETH’s dominance is rising, with market shares approaching 14%.

- Volatility offers trading opportunities: Investors are advised to remain alert to market shifts and potential re-ratings.

Conclusion

Bitcoin’s volatility paired with Ethereum’s strengthening metrics suggests a pivotal moment in cryptocurrency trading. Investors should stay informed and ready to adjust their strategies as market dynamics evolve.

Source: TradingView (ETH.D)

Source: TradingView (ETH/BTC)