Ether ETFs Record $17B Volume While BMNR Adds 135K ETH

- Ether ETFs reached $17B in weekly volume, fueling a record $40B in crypto ETF trading.

- BMNR bought 135K Ethereum in hours, raising holdings to 1.3M valued near $5.77B.

- Record ETF flows and secretive whale moves point to a possible ETH supply squeeze.

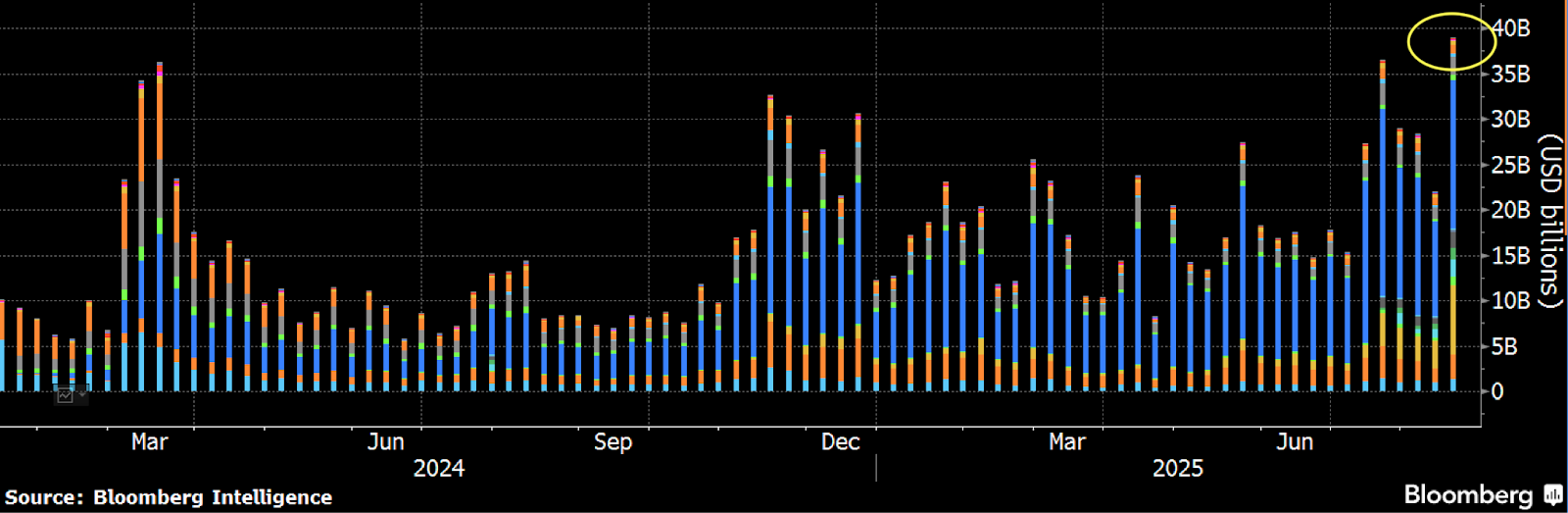

Spot Bitcoin and Ether ETFs recorded their largest week ever, reaching nearly $40 billion in trading volume, according to Bloomberg senior ETF analyst Eric Balchunas on X. The surge placed these funds among the top five U.S. ETFs and top ten stocks by volume. Ether ETFs contributed $17 billion of the total, setting their own record for weekly activity. Balchunas described the figure as “massive,” comparing it to benchmark equity volumes.

Source: X

The Bloomberg chart he posted illustrated ETF flows from early 2024 through August 2025. Trading activity showed divided peaks in March 2024 but achieved consistent growth throughout 2025, culminating in the record-breaking week. The highlighted bar on the chart crossed $40 billion, thus showing the scale of institutional and retail participation in crypto-linked funds.

Nate Geraci, president of ETF Store, confirmed Ether ETFs recorded their largest day of net inflows on Monday, totaling $1.01 billion. Across the first two weeks of August, Ether ETFs attracted over $3 billion in net inflows, marking their second-strongest monthly showing to date.

Institutional Buying Moves Off-Exchange

While the ETF boom commanded attention, institutional accumulation quietly advanced. Analyst EmberCN reported on X that Bitmine (BMNR) acquired 135,135 ETH worth $600 million within ten hours. Purchases occurred through FalconX, Galaxy Digital, and BitGo.

The inflows lifted BMNR’s Ethereum reserves to 1.297 million ETH, valued at $5.77 billion at present prices. Transaction records disclosed large single transfers, including 26,145 ETH valued at $115.68 million and 21,287 ETH valued at $93.79 million. Additional transfers included 17,023 ETH worth $75.32 million and 14,232 ETH worth $62.83 million, each directed into BMNR wallets.

Galaxy Digital continued to trade during the time, including two almost $30 million transfers. The scale of big participation showed that high-value trades were increasingly being conducted on structured venues. BMNR’s accumulation showed that, despite a 2.18% price drop in Ethereum to $4,450.6, there was unabated confidence in the asset’s long-term trajectory.

Crypto Markets Face Dual Narrative of ETFs and Supply Squeeze

The developments provide a dual-sided narration shaping the present crypto market cycle. On one side ETFs attract mass participation and hence generate retail enthusiasm, while trading volumes hit highs never witnessed before. On the other hand, institutional entities are directly absorbing supply off-exchange, potentially walking into structural constraints.

Balchunas had stated that the Ether ETFs seemed dormant for almost a year after debuting in July 2024 and then squeezed one year’s worth of activity into about six weeks. Initial demand was low, raising questions about Wall Street’s interest. Yet inflows picked up in a hurry just around the time Ethereum stood close to hitting an all-time high of $4,878 set back in November 2021.

Related: Bitcoin, Ethereum At Key Levels Amid ETF and Regulatory Shift

In sum, Ether ETFs delivered $17 billion in weekly activity, contributing to a $40 billion total for spot crypto ETFs. At the same time, BMNR’s stealthy purchases expanded reserves to nearly 1.3 million ETH. Together, the movements confirm Balchunas’s assertion that crypto ETFs now operate on par with the world’s largest equity benchmarks.

The post Ether ETFs Record $17B Volume While BMNR Adds 135K ETH appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock Expects “Tremendous” Growth for Its Bitcoin ETF

CZ calls for audit of DAT companies after alleged theft of QMMM carpets

RFK Jr Bitcoin Remarks Highlight Importance of Financial Freedom

James Wynn Denies $500M Short Amid Market Rumors