Bitcoin Dip Setting BTC Up for ‘Final Price Discovery Uptrend’ to New All-Time Highs, According to Trader That Called January Correction

A closely followed crypto analyst says that Bitcoin’s latest dip is setting BTC up for one last explosive breakout this cycle.

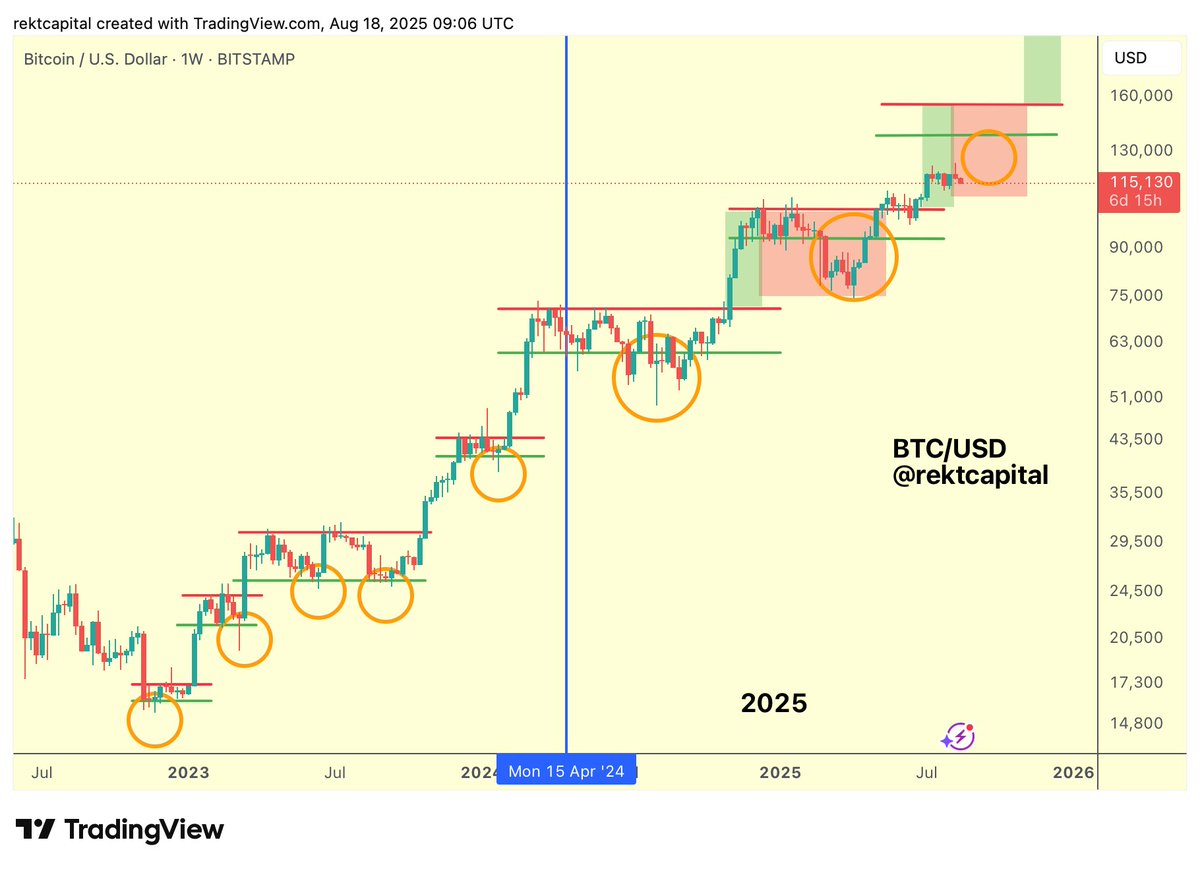

Crypto trader Rekt Capital tells his 556,900 followers on X that Bitcoin is likely on the verge of entering a third and final price discovery phase, based on patterns seen in prior cycles.

In trading, price discovery generally refers to an asset soaring to uncharted territory and new all-time high levels.

“At this moment in the cycle, Bitcoin started pullbacks in 2017 and 2021. In 2017, it was a one-week retrace that was -29% deep. In 2021, it was a three-week retrace that was -25% deep. Each of these were shallower and quicker compared to previous retraces in their respective cycles. And the shallow and quick nature of each of these retraces were key technical ingredients to preceding strong upside in the respective uptrends that followed.

Should Bitcoin indeed start a retrace now, a shallower and quicker retrace would not just align with historical cycles, but also represent key technical ingredients to setting up a strong, final Price Discovery Uptrend Three.”

The analyst also says that Bitcoin may first have to decline below the $114,000 level before printing new all-time highs.

“Bitcoin could be on the cusp of Price Discovery Correction Two, but it would need to convincingly lose $114,000 first. And seeing as the final pullbacks in the cycle have been shorter and shallower, it’s key this one becomes shorter and shallower as well.”

Source: Rekt Capital/X

Source: Rekt Capital/X

Lastly, the analyst says that Bitcoin is expected to retrace this week based on historical precedent.

“Historically, Bitcoin Price Discovery Uptrend One tends to end between week six and eight of its uptrend, whereas in Price Discovery Uptrend Two, Bitcoin tends to end its uptrend between week five and seven. Week seven of Price Discovery Uptrend Two begins [Monday].”

Bitcoin is trading for $116,366 at time of writing, down 1.6% in the last 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK