TeraWulf Stock Soars as Google Stake Increases to 14%

TeraWulf shares surged after Google increased its stake to 14%, supporting AI data center expansion. Partnerships with Fluidstack secure hundreds of megawatts, signaling major growth potential beyond bitcoin mining operations.

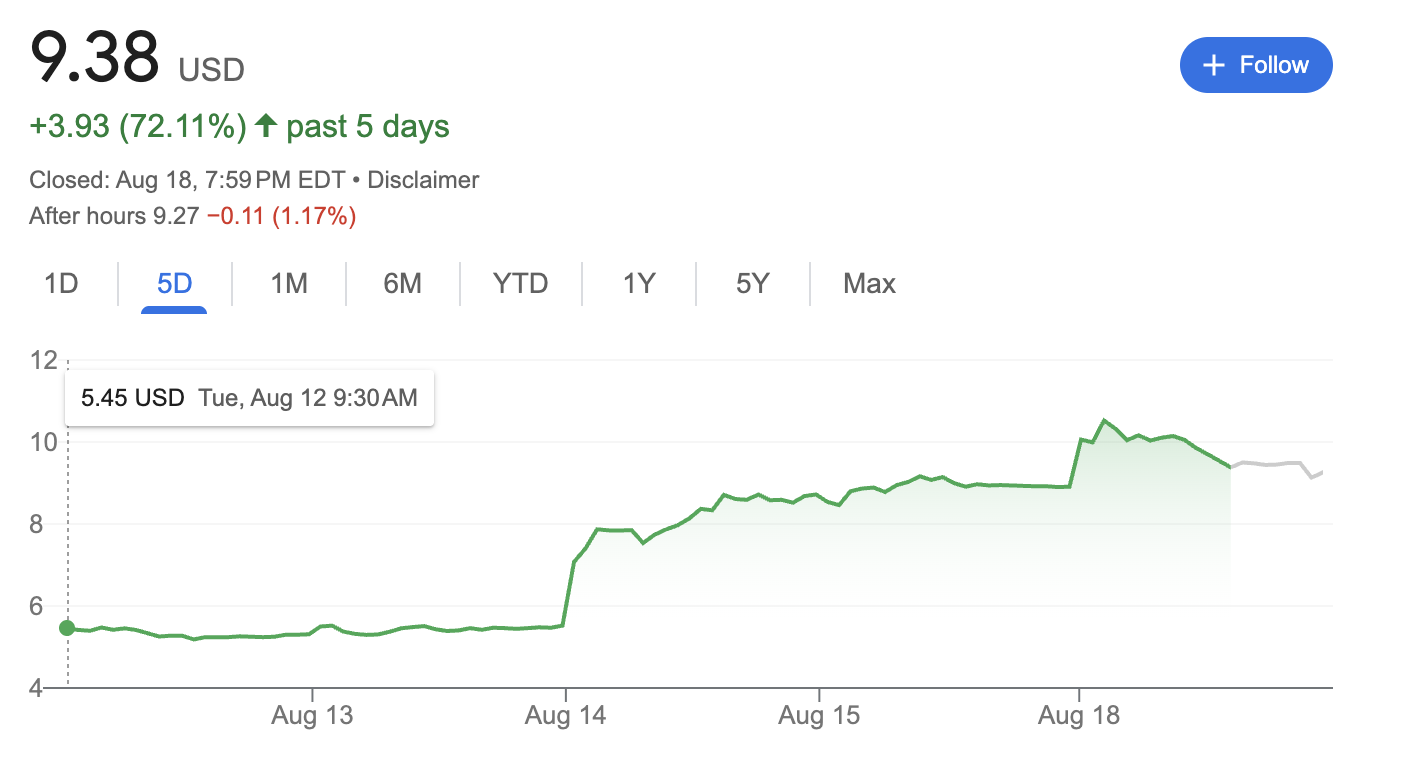

Bitcoin miner TeraWulf’s stock jumped more than 72% last week after Google increased its stake in the company for its data center expansion. TeraWulf secured funding from AI cloud platform Fluidstack to build its new CB-5 data center earlier.

The move underscores a growing trend of tech giants and cryptocurrency firms repurposing idle mining capacity for the AI industry.

Google Boosts Stake, Stock Jumps

Shares of TeraWulf rallied over 12% Monday after Google committed additional financial support, increasing its stake from 8% to 14%. The deal gives Google warrants to purchase 32.5 million shares, providing up to $1.4 billion in new backstop funding for project-related debt. Including prior commitments, Google’s total stake and support now reach $3.2 billion.

This incremental backstop helps TeraWulf secure project-related debt financing for the CB-5 data center and strengthens investor confidence in the company’s expansion plans. By receiving warrants, Google gains the right to purchase additional shares at predetermined prices, potentially benefiting from future stock appreciation.

TeraWulf CEO Paul Prager described the agreement as strengthening the company’s “strategic alignment with Google” to build next-generation AI infrastructure.

He emphasized that combining strong energy resources and operational expertise positions Lake Mariner as a key site for AI and crypto operations.

Over the last week, TeraWulf’s shares increased approximately 90%, reflecting investor optimism over these developments.

"This is a game changer in the industry."– $WULF CEO @PaulBPrager If you have the energy infrastructure, the right management team, and the right people on the ground, this is the time and Lake Mariner is the place for #AI #HPC

— TeraWulf (@TeraWulfInc) August 15, 2025@CNBC @PowerLunch @SullyCNBC pic.twitter.com/WjDvxJZyjF

Fluidstack Partnership Expands Data Center Capacity

Last week, TeraWulf signed two ten-year agreements with AI cloud provider Fluidstack, providing over 200 megawatts at Lake Mariner. Fluidstack also exercised an option for another 160 megawatts, bringing the total contracted IT load to roughly 360 MW.

TeraWulf’s project operations at the new CB-5 facility will begin in the second half of 2026.

TeraWulf CTO Nazar Khan highlighted that Fluidstack’s early expansion underscores the infrastructure’s reliability, scalability, and readiness. The agreements could generate $6.7 billion in contracted revenue and potentially reach $16 billion through lease extensions, signaling a major growth opportunity beyond traditional bitcoin mining.

While the pivot to AI infrastructure offers significant opportunities, industry analysts caution that the transition is challenging. It requires different infrastructure and various technological adjustments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Giants Secure MiCA Licenses for EU Expansion

x402 & ERC 8004 Narrative Research and Target Analysis

Identify the most noteworthy and strategic directions for x402/ERC-8004.