More Pain For Bitcoin? Open Interest Surpasses $40 Billion As Longs Crowd In

After hitting a new all-time high (ATH) of $124,474 on Binance on August 13, Bitcoin (BTC) has tumbled toward $113,000, with the next major support zone around $110,000. Analysts warn that more downside could still be ahead for the top cryptocurrency.

Bitcoin To Fall More? Crowded Long Trade Gives Hint

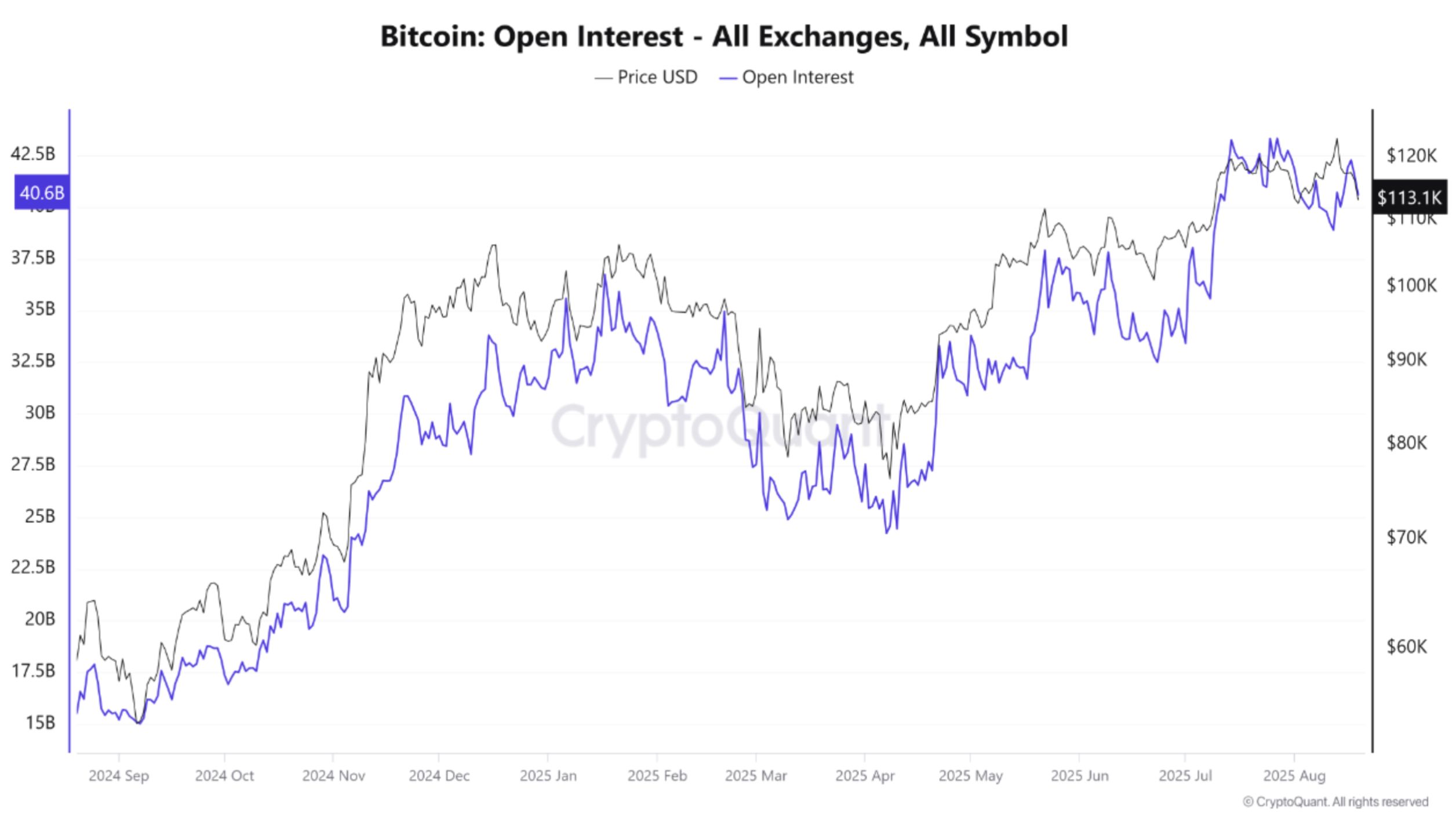

According to a CryptoQuant Quicktake post by contributor XWIN Research Japan, Bitcoin open interest across all exchanges has surged past $40 billion, nearing ATH territory. This rise shows both whales and short-term traders are piling into leveraged positions.

The chart below highlights the recent spike in BTC open interest, now hovering at $40.6 billion. Compared to August 2024 levels of $15 billion, open interest has grown by more than 150%.

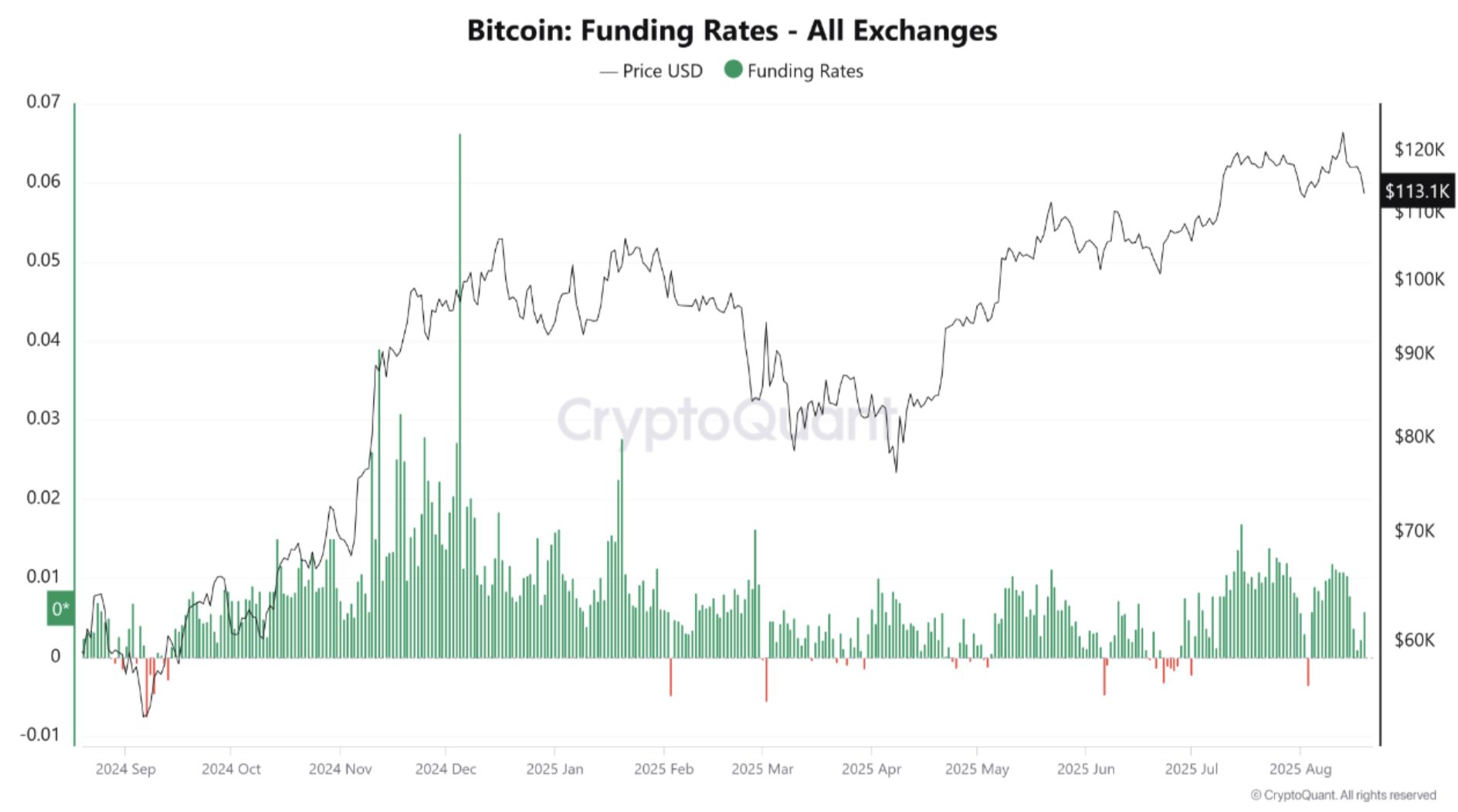

The CryptoQuant contributor added that despite this surge, the funding rate has remained positive, showing a strong long bias. While this reflects market optimism, it also signals a crowded trade, with most participants betting on further BTC appreciation.

As a result, the risk of a long squeeze – forced liquidations of long positions due to aggressive leverage – has risen. XWIN Research Japan explained in their analysis:

A sudden price drop can trigger a cascade of forced selling, amplifying volatility. In other words, Bitcoin’s short-term moves remain at the mercy of speculative flows.

BTC Fund Holding By Institutions Rises

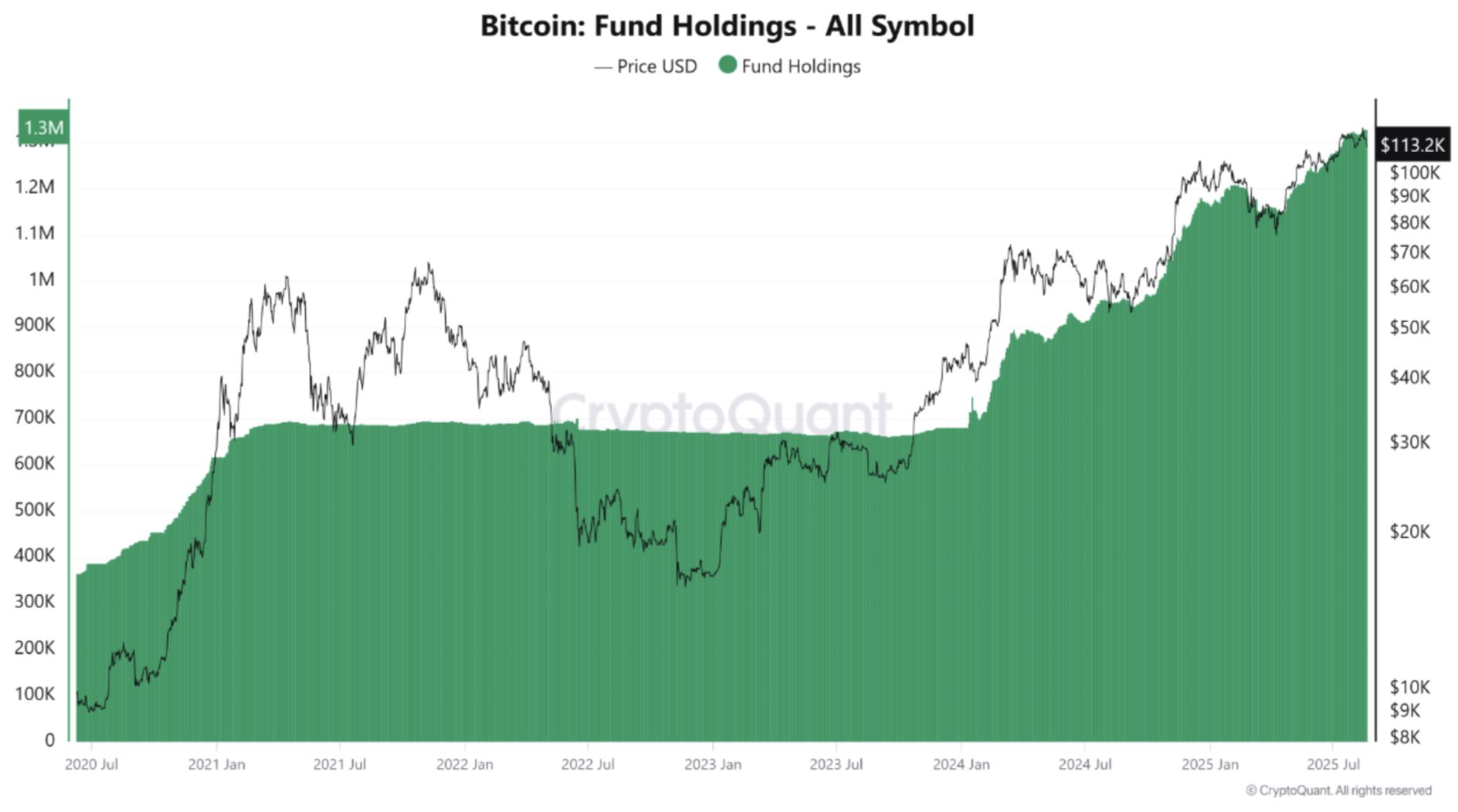

Despite speculative froth from excessive leverage in the market, BTC fund holdings by Bitcoin exchange-traded funds (ETFs) and institutional investors continue to surge, exceeding 1.3 million according to latest data.

Spot ETFs and corporate treasuries absorbing BTC provides the digital asset a structural bid that steadily reduces its available supply. According to data from SoSoValue, US-based spot Bitcoin ETFs currently hold $146 billion in net assets – representing 6.47% of BTC’s market cap.

That said, this week alone has seen more than $645 million in outflows from spot Bitcoin ETFs, following two consecutive weeks of inflows totaling nearly $800 million. Among the ETFs, BlackRock’s IBIT leads with $84.78 billion in net assets as of August 19.

Still, not all signals are bearish. For instance, while BTC slipped below $115,000, its spot trading volume surged past $6 billion, giving bulls hope for a potential rebound.

Similarly, technical analyst AO recently suggested that BTC could be mirroring gold’s trajectory, with an ambitious target of $600,000 by early 2026. At press time, BTC trades at $113,845, down 1.5% in the past 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto markets tumble amid US regional bank stress, prolonged government shutdown

EIGEN Large Unlock Incoming: 10% Market Cap Dilution Each Month, Smart Money Exits Early

The article, based on on-chain data analysis, points out that the recent sharp decline of the $EIGEN token (a 53% plunge on October 10) is not merely a result of market panic, but rather a manifestation of a deeper underlying issue. The real core risk lies in the massive and continuous token unlocks over the next two years, which will exert tremendous selling pressure. The smartest and most profitable traders had already anticipated this and systematically exited their positions weeks before the market crash.

How does market microstructure determine the real movement of candlestick charts?

Which crypto and AI projects will take the lead in the x402 payment protocol?