API3 Price Rally Stuck Between Bullish Buys and Bearish Bias

API3; a decentralized oracle solution — has surged nearly 90% in just 7 days. But one bearish metric now threatens to stall the rally.

API3, a decentralized oracle solution that aims to make real-world data accessible via blockchain APIs, saw its token price explode nearly 90% over the past seven days, peaking above $1.80.

But in the last 24 hours, it dropped nearly 10%, sparking confusion among traders. Is this the start of a deeper correction, or just a short cooldown before more upside?

Shorts Stack Up as Funding Rate Drops

Funding rates on API3 flipped deeply negative over the past 24 hours. On August 19, the OI-weighted funding rate stood at -0.47%. By August 20, it plunged further to -1.10%. That means most traders are now paying to hold short positions, betting heavily on a price drop.

API3 shorts in focus:

API3 shorts in focus:

This shows aggressive short-side sentiment. Yet, the API3 price hasn’t collapsed. It dipped slightly from the peak, but API3 bulls haven’t fully backed off. So despite bearish bets piling up, sellers haven’t taken control at press time.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Smart Money Buys While CMF and Exchange Data Stay Bullish

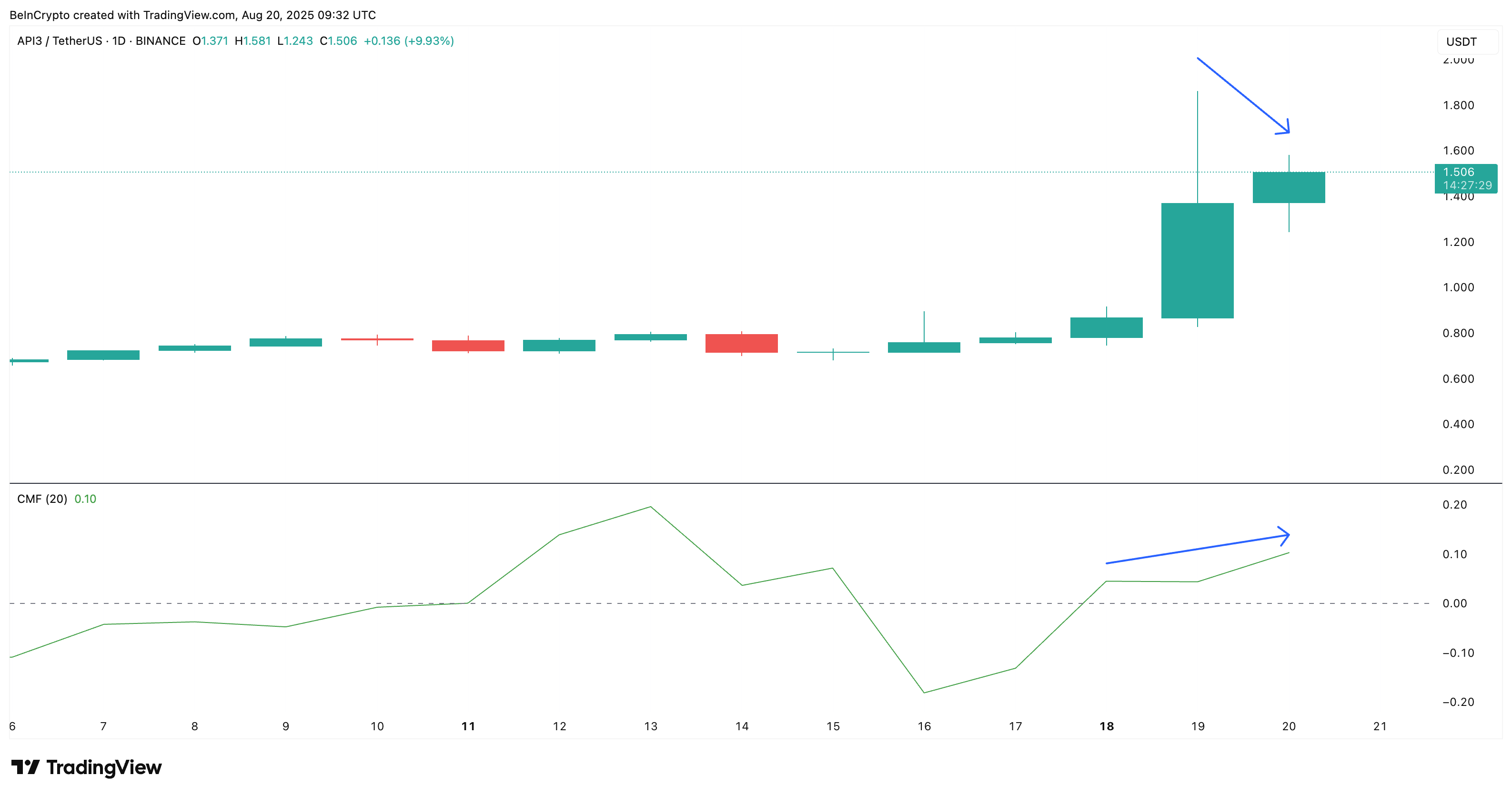

Under the hood, buyers are still stepping in. The Chaikin Money Flow (CMF) on the daily chart has climbed steadily from 0.04 to 0.10 over the last few hours, even while the API3 price cooled down slightly. CMF increasing despite a small price pullback suggests accumulation: more capital is flowing in than out.

CMF is a volume-weighted indicator that shows if money is flowing into or out of a token based on price and volume.

API3 keeps seeing steady money flow:

API3 keeps seeing steady money flow:

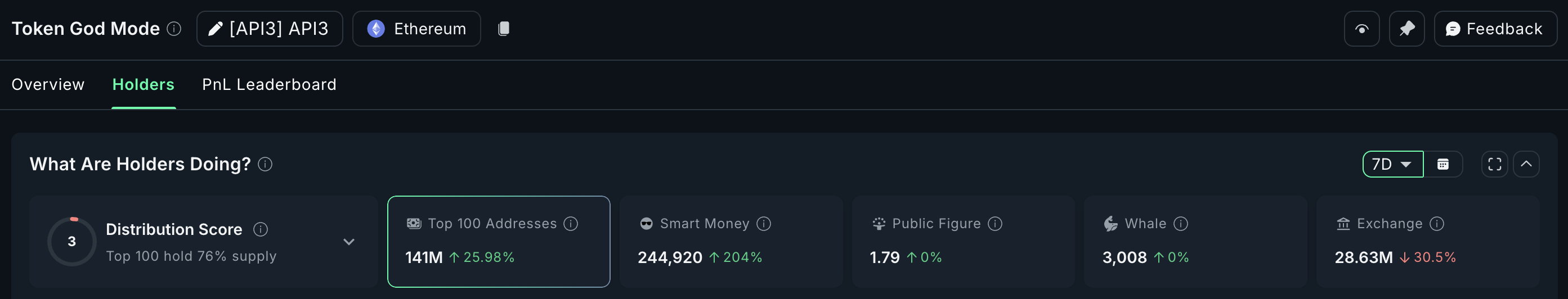

Exchange reserves confirm this. Over the past 7 days (during the rally), API3’s exchange balances fell 30.5%, now sitting at 28.63 million tokens.

At the same time, the top 100 addresses increased holdings by 25.98%, while Smart Money wallets jumped 204%.

API3 buying continues:

API3 buying continues:

API3 Price Chart Shows Bullish Bias

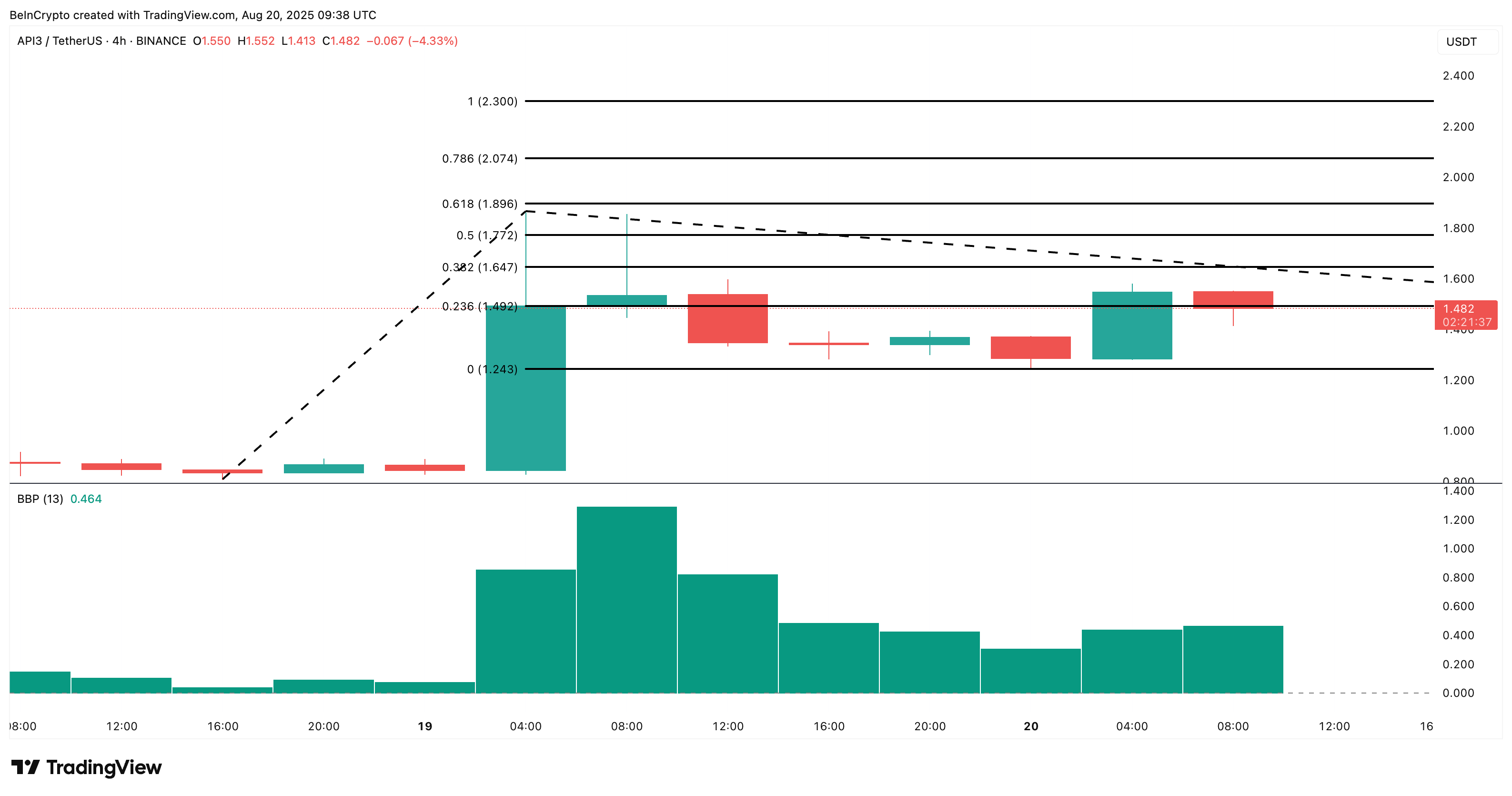

On the 4-hour chart, API3 is still showing bullish momentum. The price bounced off the 0.236 Fibonacci level near $1.49, and the Bull-Bear Power (BBP) index remains positive at 0.464.

This suggests bulls aren’t done, and if buying continues, the short-heavy crowd or the bearish bets could get liquidated fast. That would push the prices higher, with the immediate targets sitting at $1.64 and $1.77.

As the bullish momentum seems to be picking up, with rising green bars, an API3 price rally continuation looks more likely. The BBP indicator measures the strength of bulls vs. bears by comparing highs and lows with a moving average.

API3 price analysis:

API3 price analysis:

But if price breaks lower than $1.24 and buyers cool off, the same shorts could win the round, invalidating the bullish outlook. Longs would then be exposed, and liquidations could deepen the drop fast.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pudgy Penguins NFT surpasses Bored Ape in one month: A quick overview of what the PENGU token is

PENGU is the official token of the Pudgy Penguins NFT series and will be launched on the Solana blockchain by the end of 2024. Pudgy Penguins is an NFT project featuring 8,888 unique penguin images, initially released on Ethereum, and has now become the second-largest NFT project by market capitalization. The launch of PENGU aims to expand the community, attract new users, and is planned for deployment on multiple blockchains. The total token supply is 88,888,888,888, allocated to the community, liquidity pools, project team, and others. Solana was chosen to reach a new audience and leverage its fast transactions and low-cost advantages. Summary generated by Mars AI This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Glassnode: Bitcoin Weakly Fluctuates, Is Major Volatility Coming?

If signs of seller exhaustion begin to appear, a short-term move towards $95,000 and the short-term holder cost basis is still possible.

Should You Still Believe in Crypto

No industry has always been right from the beginning, until it truly changes the world.

Zeus unveils institutional-grade MPC infrastructure blueprint at Solana Breakpoint 2025, enabling Bitcoin to enter Solana’s on-chain capital markets

The focus will now shift to building MPC tools and providing support for developers, driving the creation of more native UTXO applications on Solana.