Asia’s Wealthy Families Boost Crypto Exposure Amid Favorable Regulation

Asia’s wealthiest families boost crypto exposure as regulation improves, shifting from ETFs to direct tokens for stronger, diversified portfolios.

Asia’s wealthiest families and family offices have significantly increased crypto exposure, taking advantage of improving regulations and strong returns.

These high-net-worth investors now consider digital assets integral to a modern diversified portfolio.

Wealth Managers Report Rising Crypto Allocation

Wealth managers across major Asian markets report surging interest. UBS indicates some overseas Chinese family offices plan to grow crypto holdings to roughly 5 percent of their portfolios. Reuters reported that institutions that initially tested bitcoin ETFs are now embracing direct token exposure.

One catalyst is the performance of a crypto equity fund. Jason Huang, founder of NextGen Digital Venture, stated:

“We raised over $100 million in just a few months, and the response from LPs has been encouraging.”

That fund achieved a 375 percent return in under two years. Market-neutral strategies such as arbitrage also attract sophisticated investors seeking low-correlation returns.

Regulatory Clarity Drives Confidence

Regulation plays a critical role. Hong Kong passed legislation covering stablecoins, while US policymakers advanced the GENIUS Act, further legitimizing digital assets. According to Reuters, these developments are encouraging wealthy families to expand their crypto holdings.

BeInCrypto reported that Asia’s Web3 regulations complement global frameworks, ensuring compliance while supporting innovation. This alignment reduces barriers for investors seeking exposure to tokenized products and custody services.

Hong Kong and Singapore remain regional hubs. Authorities now support bond tokenization, digital gold platforms, and custody frameworks.

According to the Financial Times, recent reforms include streamlined licensing and tax considerations designed to attract family offices and fund managers.

Bitcoin’s surge above $124,000 coincided with record daily volumes at HashKey Exchange and major South Korean exchanges, signaling robust demand across Asia.

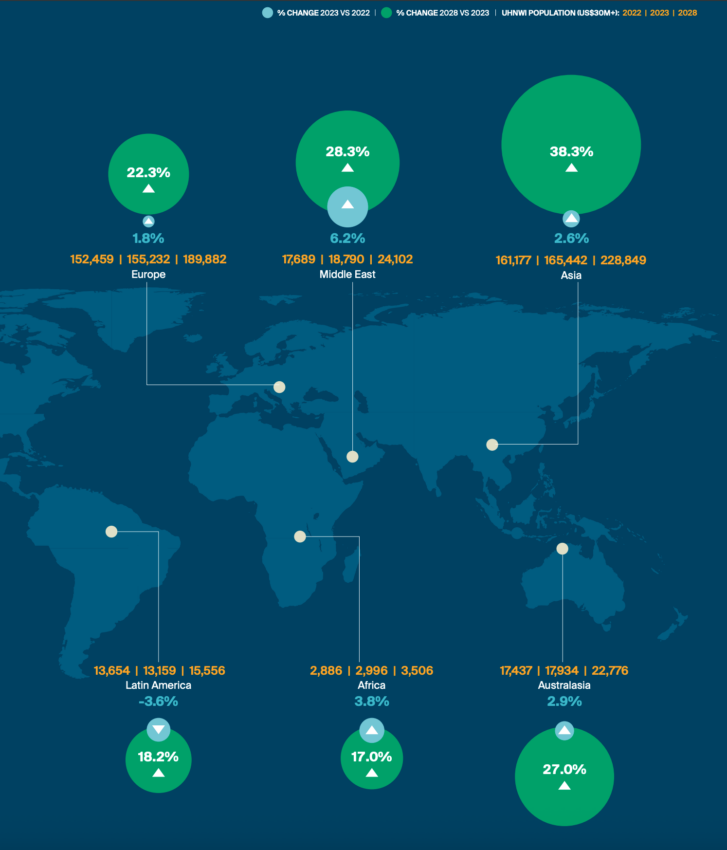

The Knight FrankWealth Sizing Model | Knight Frank

The Knight FrankWealth Sizing Model | Knight Frank

Global wealth trends reinforce this shift. Knight Frank’s Wealth Report highlighted that Asia-Pacific now leads in ultra-high-net-worth growth, creating stronger demand for diversified digital investment vehicles.

Strategic Implications for Family Offices

Shifts in investment strategy highlight several trends:

- Capital flow security: Regulatory clarity lowers entry risks, making long-term exposure more attractive.

- Product innovation: Diversified crypto instruments appeal to traditional families and new investors.

- Regional advantage: Singapore and Hong Kong’s frameworks reinforce Asia’s leadership in digital wealth.

These moves coincide with growing allocations into tokenized products and custody services, building a sustainable ecosystem for institutional-grade crypto investment.

Many family offices have shifted from ETFs to direct token ownership. This change reflects a desire for flexibility, liquidity, and control over holdings as crypto markets mature.

Clarity on taxation, licensing, and custody standards is fostering greater trust in digital assets. Regional frameworks provide the infrastructure for long-term adoption, while family offices leverage their position to capture growth in tokenized wealth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid Activates HIP-3, Allowing Decentralized Futures Market Listings

In Brief Hyperliquid's HIP-3 upgrade enables fully decentralized futures market listings on its platform. This upgrade follows significant market volatility, questioning centralized exchanges' reporting transparency. HIP-3 underscores the need for more transparent, decentralization-focused governance in crypto trading.

Cryptocurrency Whales Drive Market Volatility with Aggressive Short Strategies

In Brief Crypto whales adopt new strategies in altcoins, focusing on XRP and Ethereum. LookOnChain data shows high-leverage positions with potential for large losses. Fed Chairman Powell's speech may influence market direction and investor caution.

Solana Partners with Wavebridge to Develop KRW-Pegged Stablecoin

Top 3 Altcoins for November Gains: Experts Highlight ETH, ADA, and LINK