Ethereum Reaches All-Time High After Powell’s Speech

Ethereum reached a new all-time high, driven by Powell’s speech and massive institutional inflows, with analysts predicting an upcoming altcoin season.

Ethereum reached an all-time high today as Jerome Powell’s recent speech caused a major spike. Recent institutional inflows are allowing it to contest Bitcoin’s market dominance.

ETH’s performance may even trigger an altcoin season soon, as some analysts have theorized. At present, the token has a lot of forward momentum.

Ethereum’s New All-Time High

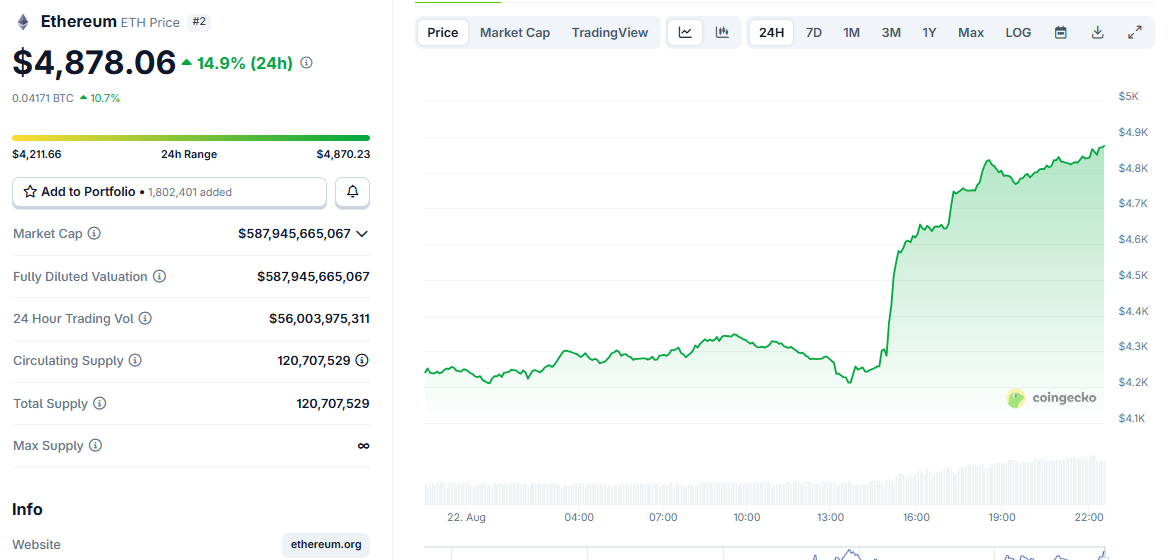

Ethereum’s price has gone up and down lately, balancing rampant institutional inflows on one hand with massive trader liquidations on the other. Still, today, the token began a substantial price spike after Jerome Powell’s Jackson Hole speech. This was a big boost for Ethereum, which just reached a new all-time high:

Ethereum Price Chart. Source:

Ethereum Price Chart. Source:

A few factors can help explain Ethereum’s recent performance. $5 billion in ETH and BTC options were set to expire during or before Powell’s speech, and Ethereum is seriously contesting Bitcoin’s market dominance right now. $245 million worth of ETH short positions were liquidated today as Ethereum reached this all-time high.

Moreover, CoinMarketCap is predicting that an altcoin season may be imminent, and ETH is a clear favorite to lead it. Between these factors, Ethereum has a lot of things supporting it, and it could keep growing past this all-time high.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!