US House Ties CBDC Ban to Defense Policy Bill

In a significant move impacting the future of digital currency, the US House of Representatives has inserted a sweeping provision into its annual defense policy legislation that would prohibit the Federal Reserve from developing or issuing a central bank digital currency (CBDC).

In a significant move impacting the future of digital currency, the US House of Representatives has inserted a sweeping provision into its annual defense policy legislation that would prohibit the Federal Reserve from developing or issuing a central bank digital currency (CBDC).

The updated version of HR 3838—the House’s draft of the 2026 National Defense Authorization Act (NDAA) was released Thursday by the House Rules Committee. The nearly 1,300-page bill now includes language blocking the Fed from creating, testing, or studying a digital currency, while also barring the central bank from offering financial services directly to individuals.

Source

:

US House of Representatives

Source

:

US House of Representatives

The NDAA is considered “must-pass” legislation because it dictates military spending and national security priorities, making it a frequent vehicle for unrelated policy measures that may otherwise stall in Congress.

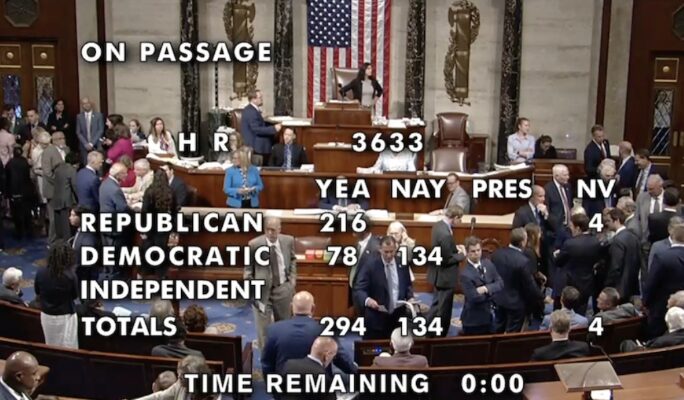

Republicans have been pushing to outlaw a US CBDC for more than a year. In July, the House narrowly approved the Anti-CBDC Surveillance State Act in a 219–210 vote, though that bill faces an uncertain path in the Senate. Conservative Republicans secured a promise from party leaders to attach the CBDC ban to the defense bill after threatening to block movement on other crypto-related legislation. At one point, their standoff delayed House proceedings for more than nine hours, the longest such holdup in the chamber’s history.

The new NDAA language makes clear that the restriction does not apply to stablecoins. It explicitly states that “any dollar-denominated currency that is open, permissionless, and private” would not fall under the ban.

House Republicans have repeatedly framed CBDCs as a threat to privacy and financial freedom. Representative Tom Emmer first introduced a version of the CBDC Anti-Surveillance State Act in early 2023, but the proposal lapsed at the end of the last Congress. He reintroduced it this year, with GOP leaders arguing it aligns with President Donald Trump’s January executive order opposing CBDCs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

French Banking Titan Launches Groundbreaking Stablecoin Tied to the Euro

In Brief ODDO BHF launches Euro-pegged stablecoin EUROD on Bit2Me for broad market access. EUROD aligns with E.U.'s MiCA framework, enhancing trust with bank support. EUROD aims to fill corporate demand and diversify currency in a dollar-dominated arena.

Top 3 Altcoins Set for Huge Gains — Buy Before the Next Rally

XRP Tests Critical $2.21 Level While Oversold RSI Suggests Possible Short-Term Reboun

XRP Liquidity Map Highlights Major $3.6 Cluster as Price Holds Above Support