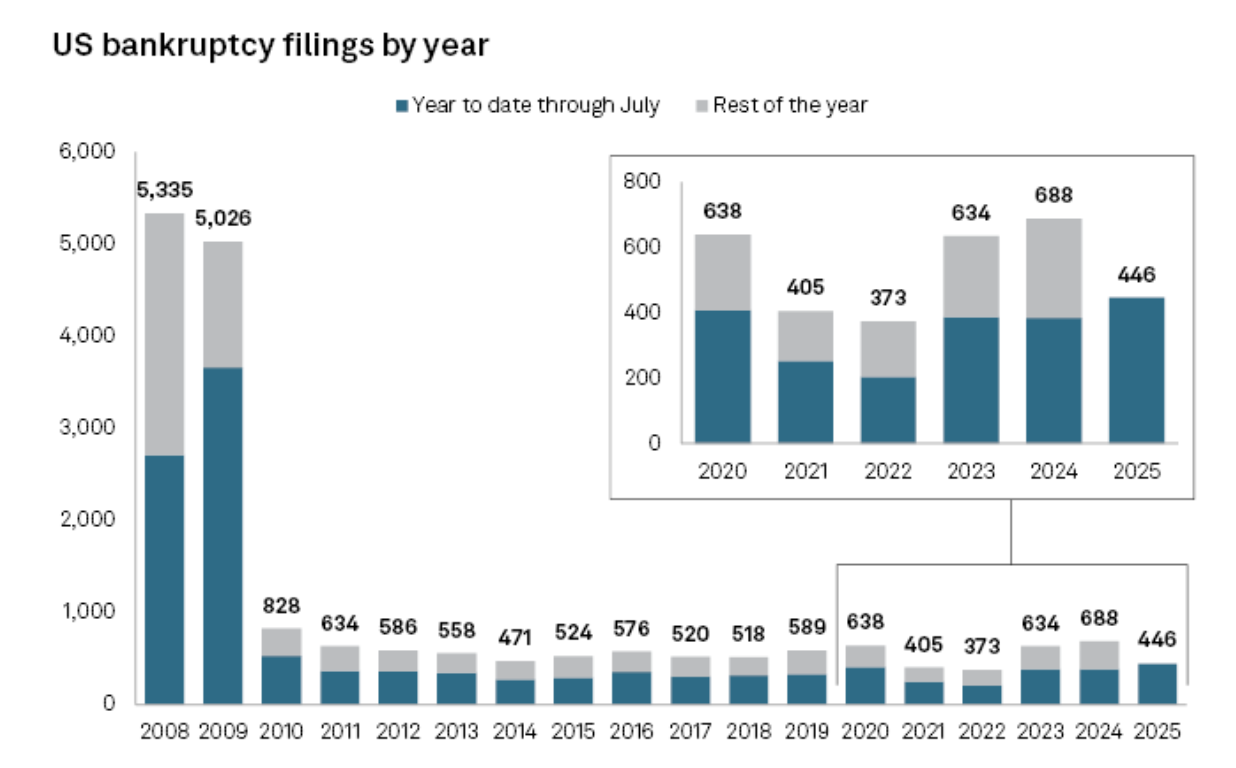

Bankruptcies in US Surge to Highest Level Since Pandemic As Once-Iconic Brands Quietly Fade Away: Report

Companies in the US are going bankrupt at a rate not seen since July of 2020, according to a new report.

In an August financial update , S&P Global says there were 446 bankruptcies year-to-date at the end of July, the most for the seven-month period since 2010.

The firm’s data includes companies with public debt and assets or liabilities of at least $2 million or private companies with assets or liabilities of at least $10 million at the time of filing.

Source: S&P Global

Source: S&P Global

The bankruptcies include some of the more recognizable American brands, including retail clothing chain Forever 21, fashion retailer Claire’s, and produce company Del Monte.

Industrials was the leading category for bankruptcies, followed by consumer discretionary, healthcare and consumer staples.

In a thread on the social media platform X, macro analyst Adam Kobeissi says that following the wave of bankruptcies, a spike in unemployment is likely to follow.

“Next, we expect the unemployment to surge.

In July, 11% of small businesses said poor sales were their most important problem, most since 2020.

This is a prominent leading indicator of US unemployment.

Small firms employ ~62.3 million workers, or 45.9% of all employees.

And, youth unemployment is surging:

The US unemployment rate for youth graduates aged 20-24 has averaged 8.1% over the last 3 months, the highest in 4 years.

This matches 2008 levels.

Companies are leaning on AI to cut costs and entry-level jobs amid the squeeze.”

Kobeissi says the surge in unemployment will most likely lead to the Federal Reserve resuming cutting interest rates in September, lowering the Fed Funds Rate by 25 basis points, setting up the US for a rebound in inflation heading into 2026.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin will ‘dump below $70K’ thanks to hawkish Japan: Macro analysts

Bitcoin ‘extreme low volatility’ to end amid new $50K BTC price target

Crypto cards have no future

Having neither the life of a bank card nor the problems of one.