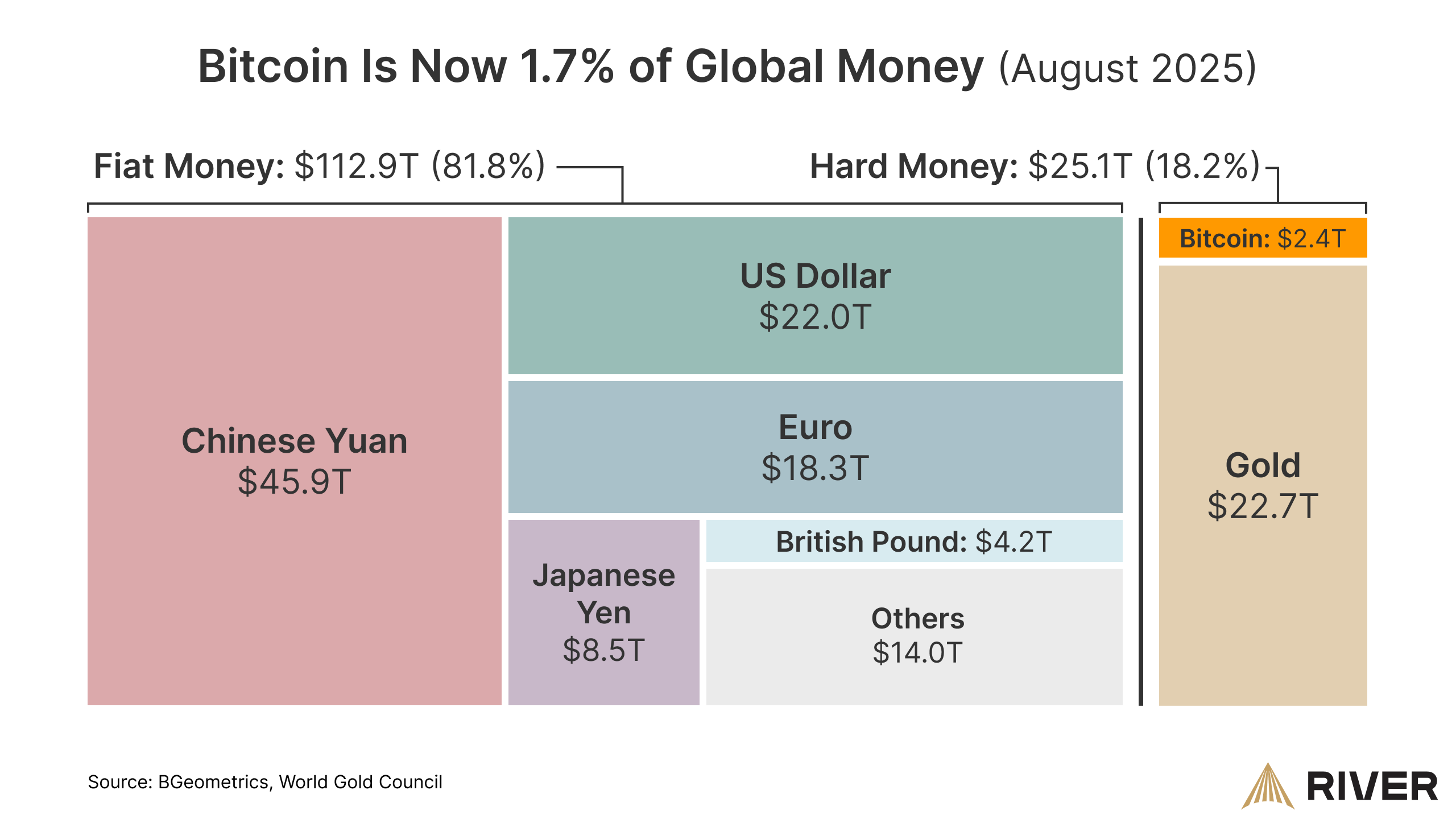

Bitcoin’s share of global money is roughly 1.7% when measured against a $112.9 trillion fiat basket plus $25.1 trillion in gold, per River’s analysis; at a current market cap near $2.29 trillion that share is about 1.66%, highlighting growing allocation to hard money amid monetary expansion.

-

Bitcoin accounts for approximately 1.7% of global money

-

River compared Bitcoin’s market cap to a $112.9T fiat basket and $25.1T gold market cap.

-

At $2.29T market cap Bitcoin’s share is about 1.66%; Fed signals and liquidity dynamics are driving demand for hard money.

Bitcoin share of global money 2025: Bitcoin at ~1.7% vs global M2 and gold—read data, Fed impact, and investor implications. Learn more.

What is Bitcoin’s share of global money?

Bitcoin’s share of global money is the percentage of aggregate global money represented by Bitcoin’s market capitalization versus a combined fiat money and gold basket. Using River’s figures, Bitcoin reached about 1.7% at a $2.4 trillion market cap and sits near 1.66% at $2.29 trillion.

How did analysts calculate Bitcoin’s global money share?

River, a Bitcoin financial services firm, weighed Bitcoin’s market capitalization against a $112.9 trillion basket of fiat currencies (aggregate M2 equivalents across major and selected minor currencies) plus a $25.1 trillion valuation for gold. The calculation excludes silver, platinum and exotic metals, focusing on major hard-money alternatives.

River stated: “In 16 years, Bitcoin went up to 1.7% of global money.” The methodology compares market caps to a broad measure of global liquidity rather than GDP or narrow domestic aggregates. Using a $2.4 trillion Bitcoin market cap yields ~1.7%; at the time of writing a $2.29 trillion cap produces ~1.66%.

Bitcoin market cap compared to global money. Source: River

Why is Bitcoin gaining share as central banks expand liquidity?

Front-loaded liquidity and sustained monetary expansion have eroded fiat purchasing power, prompting allocation to scarce digital assets. Investors increasingly view Bitcoin and gold as hard-money hedges when central banks ease or signal rate cuts.

At the Jackson Hole Economic Symposium, Federal Reserve chair Jerome Powell indicated policy is moving closer to neutral and signaled cautious consideration of rate reductions: “Our policy rate is now 100 basis points (BPS) closer to neutral than it was a year ago…” Markets interpreted the tone as dovish, contributing to a short-term Bitcoin price surge.

Federal Reserve chairman Jerome Powell delivers keynote address at the Jackson Hole Economic Symposium. Source: Kansas City Fed

Crypto markets tend to react positively to monetary easing expectations. Data from the Chicago Mercantile Exchange (CME) Group shows roughly 75% of investors expect a 25-basis-point cut in September, a sentiment that supports increased allocations to Bitcoin and other risk assets.

How does Bitcoin’s share compare to gold and other stores of value?

Using the same global-money framework, gold’s market cap is included at $25.1 trillion. Bitcoin’s ~1.7% share is still small relative to gold but notable given Bitcoin’s 16-year history and recent market-cap growth. The trend suggests incremental reallocation toward digital hard money.

Frequently Asked Questions

How much did Bitcoin rise after the Powell speech?

Markets reacted quickly to Powell’s remarks at Jackson Hole; Bitcoin rose over 2% in the immediate aftermath, with reports noting a price near $116,000 per BTC during the move.

Who provided the global-money comparison data?

River, a Bitcoin financial services company, published the comparison using aggregated fiat and gold market-cap figures. Data references include River’s analysis and market data providers for Bitcoin’s market cap.

Key Takeaways

- Rising allocation: Bitcoin now represents roughly 1.7% of an aggregated global money measure, signaling growing investor allocation to digital hard money.

- Monetary context: Fed signals toward rate cuts and continued liquidity expansion are supportive factors for Bitcoin demand.

- Methodology matters: Results depend on the fiat basket and hard-money components used; River’s framework uses $112.9T in fiat equivalents and $25.1T for gold.

Conclusion

Bitcoin’s increased share of global money — roughly 1.7% at peak and about 1.66% at current valuations — reflects expanding investor interest in scarce digital assets amid global monetary expansion. Continued monitoring of central bank policy, liquidity indicators, and market-cap trends will determine whether Bitcoin’s share rises further. For ongoing coverage and data-driven analysis, COINOTAG will track updates and market developments.