U.S.-listed Ethereum ETF outflows hit $241 million in a rare weekly reversal after 15 weeks of inflows, even as on-chain indicators show sustained retail activity and a spike in failed transactions — a split that can signal short-term volatility but continued grassroots participation in ETH markets.

-

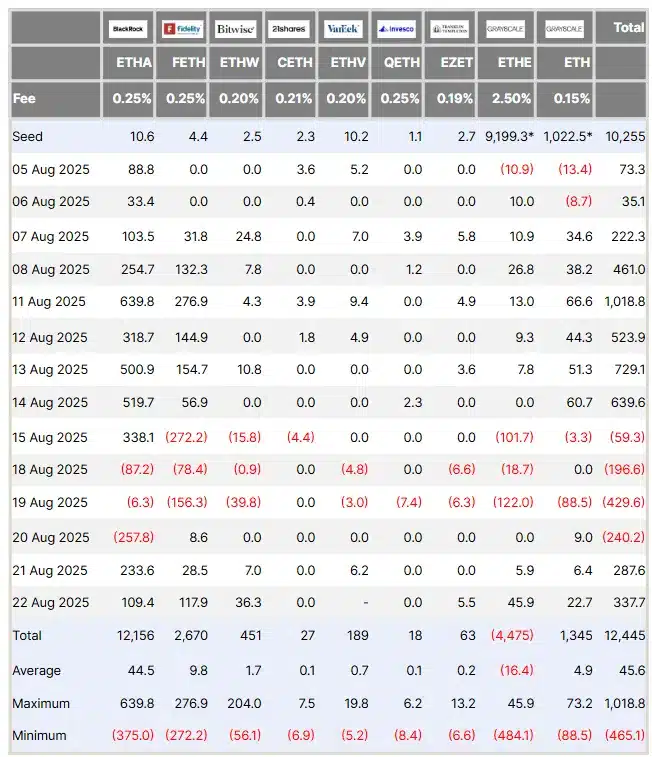

ETF outflows: $241M pulled from U.S.-listed Ethereum ETFs — first weekly outflow in 15 weeks.

-

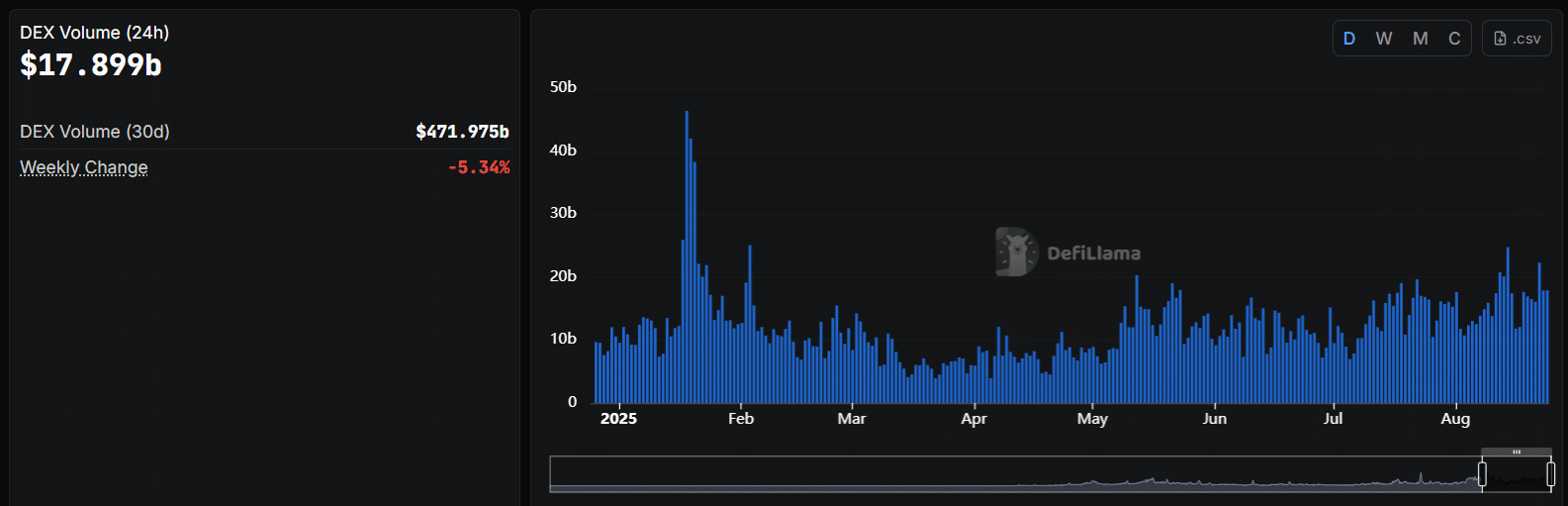

On-chain retail activity remains strong: failed transactions exceeded 200K and DEX volumes stayed elevated.

-

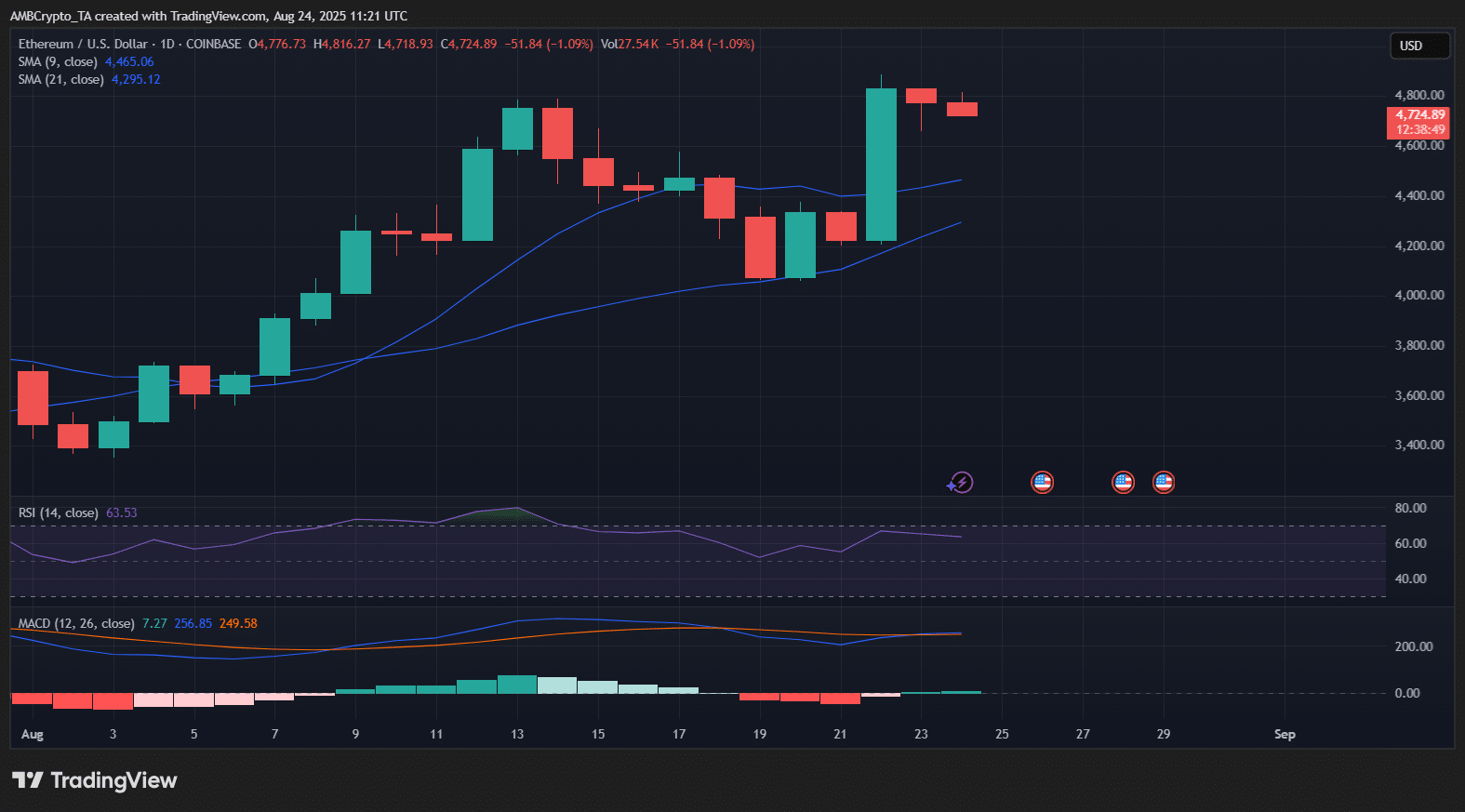

Price resilience: ETH held major short-term SMAs while momentum indicators stayed constructive (RSI ~63).

Ethereum ETF outflows $241M as retail on-chain activity stays strong; read our analysis of flows, on-chain data, and near-term technicals.

What caused the recent U.S.-listed Ethereum ETF outflows?

U.S.-listed Ethereum ETF outflows were driven primarily by a short-lived risk-off reaction to hotter-than-expected inflation data, prompting large redemptions totaling $241 million during the week of August 22, 2025. The pullback included a $429 million single-day redemption and was partially reversed after a dovish Fed tone later in the week.

How is retail activity on Ethereum holding up despite ETF withdrawals?

Retail participation remained robust: failed Ethereum transactions spiked above 200,000 — a historical pattern that has preceded price recoveries. Decentralized exchange (DEX) trading volumes stayed elevated through the summer, indicating sustained grassroots demand even while institutional flows paused. Sources: Farside Investors, CryptoQuant, DeFiLlama.

Key takeaways

Ethereum is showing a divergence: institutional ETF flows paused with $241M in outflows, but on-chain retail metrics — failed txs and DEX volumes — signal persistent grassroots activity supporting ETH’s recovery.

Ethereum’s [ETH] rally is showing a split in momentum between Wall Street and Main Street.

U.S.-listed Ethereum ETFs have just recorded their first outflows in 15 weeks, with $241 million pulled, even as data points to growing grassroots activity.

Institutional flows take a breather

U.S.-listed Ethereum ETFs ended a 15-week inflow streak after $241 million left funds during the week of August 22, 2025. The bulk of withdrawals came during a single-day spike of $429 million linked to inflation concerns and risk re-pricing.

Source: Farside Investors

A later, more dovish Federal Reserve communication eased some market stress and produced late-week inflows, but those gains did not fully offset the earlier redemptions, leaving ETFs with a rare net weekly outflow.

Grassroots activity firm despite ETF pullback

On-chain metrics paint a different picture. Failed transactions on Ethereum surged above 200,000, a level that has historically coincided with heightened retail trading and, in prior cycles, marked local lows ahead of recoveries.

Source: CryptoQuant

DEX volumes remained steady according to DeFiLlama, which suggests retail traders continued to execute trades across decentralized venues even as ETF investors temporarily stepped back.

Source: DeFiLlama

This divergence — cautious institutional exits counterbalanced by resilient retail flows — suggests short-term volatility but continued market support from grassroots participants.

How is ETH trading and what do technicals show?

At press time, Ethereum traded at $4,724, down 1.09% for the day after testing resistance near $4,816. Short-term moving averages provided support: the 9-day SMA sat at $4,465 and the 21-day SMA at $4,295.

Source: TradingView

Momentum indicators are constructive: the RSI hovered around 63 and the MACD retained a bullish alignment. The post-surge consolidation looks like a healthy pause rather than a reversal, leaving ETH well-positioned for additional upside if institutional flows resume.

Frequently Asked Questions

Why did U.S.-listed Ethereum ETFs record outflows this week?

Investors reacted to hotter-than-expected inflation data, prompting redemptions that included a $429M single-day outflow. A later dovish Fed message reduced selling pressure but inflows were insufficient to offset earlier withdrawals.

Do failed transactions indicate selling pressure?

Failed transactions often reflect intense retail activity and network congestion, not direct sell pressure. Spikes above 200K have historically coincided with local bottoms and subsequent recoveries.

Key Takeaways

- ETF flows paused: $241M in weekly outflows after 15 weeks of inflows.

- Retail remains active: failed transactions and steady DEX volumes point to grassroots participation.

- Technicals supportive: ETH holds near short-term SMAs with momentum indicators remaining constructive.

Conclusion

U.S.-listed Ethereum ETF outflows created a short-term divergence between institutional and retail participants, but on-chain indicators and technicals suggest underlying resilience for ETH. Monitor ETF flows and failed transaction trends for early signals of market direction; COINOTAG will continue to track developments and on-chain metrics.

By COINOTAG — Published: 25 Aug 2025 — Updated: 25 Aug 2025

Sources: Farside Investors, CryptoQuant, DeFiLlama, TradingView.