Bitcoin is at a decisive point this week, with traders closely watching whether the flagship cryptocurrency can defend the $114,600 support.

At press time, Bitcoin trades at $114,614, down 3% over the past seven days, as volatility increases and analysts debate the next move.

Support in Focus

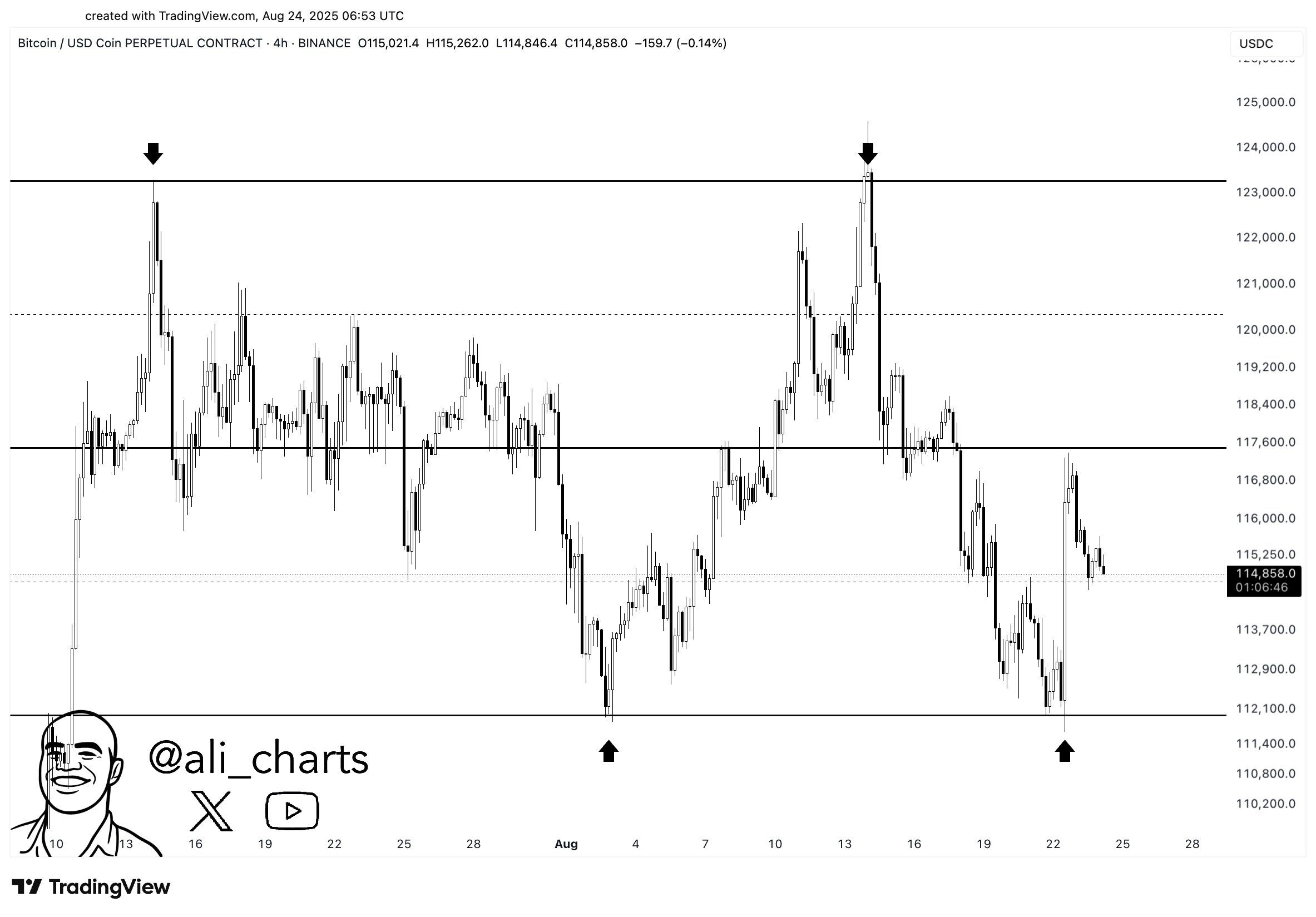

Crypto analyst Ali pointed out that $114,600 remains the line in the sand for bulls. If this level holds, Bitcoin could rebound toward $117,600 and possibly extend to $120,000. Failure to do so, however, may leave the market vulnerable to deeper corrections.

“The support at $114,600 decides the next move,” Ali noted, highlighting how price structure over the past month reinforces this zone as a critical pivot.

Diverging Analyst Views

Not all experts share the same outlook. Michaël van de Poppe stressed that Bitcoin needs to form a higher low in this region to maintain bullish structure. If not, he warned, the market risks “giving it all back” and setting new local lows — though he described such a scenario as an ideal accumulation opportunity for long-term investors.

Both analysts agree that the coming week could set the tone for September, with heightened volatility expected across crypto markets.

Technical Setup

The charts reflect Bitcoin’s struggle between buyers and sellers.

- On the 1-hour timeframe, Bitcoin has pulled back from above $118,000, consolidating just above support.

- The RSI hovers around 42, suggesting bearish pressure but no extreme oversold conditions.

- The MACD remains in negative territory, with momentum tilting toward sellers, though bearish strength appears to be weakening.

This technical picture leaves Bitcoin at a crossroads. A strong bounce could propel the price back toward $120,000, but a breakdown may expose downside targets near $111,000–$112,000.

Market Implications

Bitcoin’s market cap currently sits at $2.28 trillion, while its fully diluted valuation is around $2.4 trillion. Daily trading volume has slipped to $51 billion, down more than 25% in the past 24 hours — signaling reduced market participation.

Lower volume during a critical support test could make Bitcoin more vulnerable to sharp swings, increasing the probability of sudden liquidations if support fails. Conversely, if bulls defend this level convincingly, it could reset momentum and attract sidelined buyers.

What Comes Next?

The immediate focus for traders remains $114,600. Defending this zone could restore confidence and fuel another push toward $117K–$120K, levels many see as the next major resistance. On the flip side, failure could drag Bitcoin into a deeper correction, giving investors a fresh chance to accumulate at lower prices.

With sentiment split and technicals finely balanced, the coming days may prove decisive for Bitcoin’s trajectory heading into September.