3 US Economic Signals Crypto Traders Must Watch This Week

Crypto traders should monitor key US economic indicators this week. Consumer confidence, jobless claims, and PCE data may sway Bitcoin and Ethereum trends.

Crypto traders have three US economic signals to watch this week. After the weekend lull, these signals could influence the Bitcoin (BTC) price trajectory this week.

Amid the growing hype around Ethereum (ETH), US economic indicators could also sway sentiment, as it happened with Jerome Powell’s Jackson Hole Speech on Friday.

US Economic Events this Week

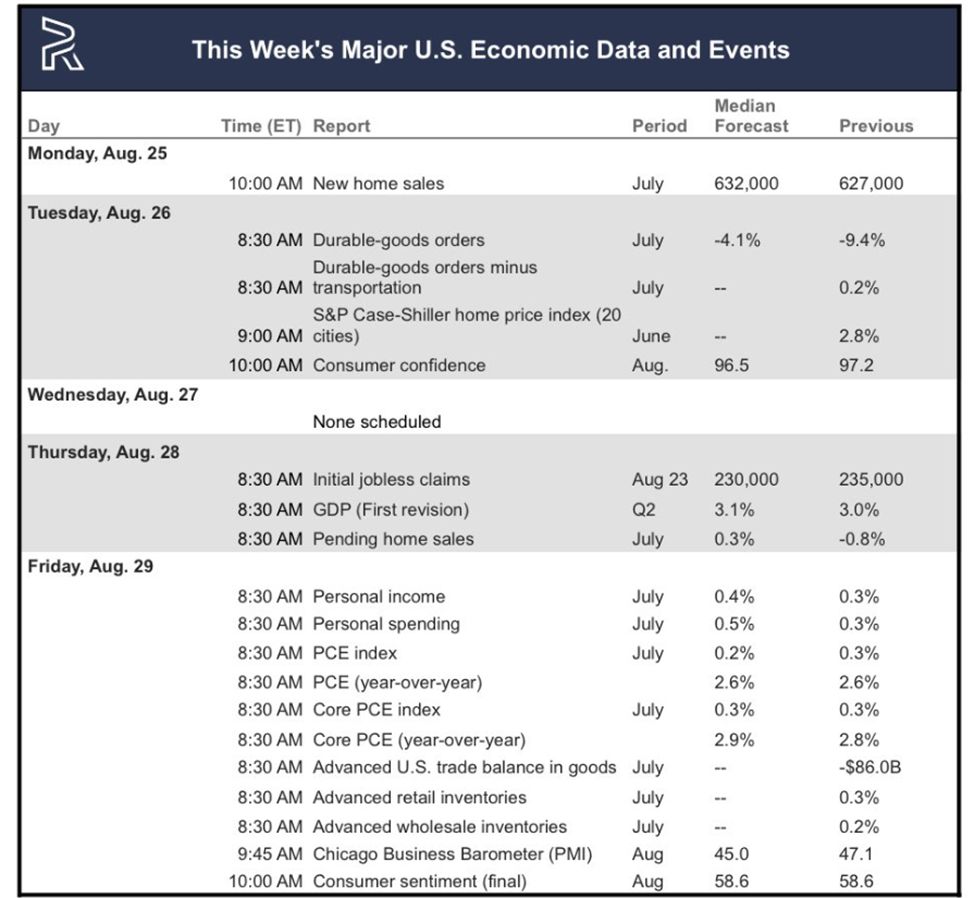

The following US economic signals and data could influence the portfolios of crypto traders and investors this week.

US Economic Signals. Source:

US Economic Signals. Source:

Consumer Confidence and Consumer Sentiment

Two economic events on Monday and Friday will reflect consumer optimism, or a lack thereof. Data on Market Watch shows economists expect August US Consumer Confidence, due on Tuesday, to dip slightly to 96.5, down from July’s 97.2.

Meanwhile, the Consumer Sentiment report is due on Friday. Economists expect August US Consumer Sentiment to hold steady at 58.6.

Meanwhile, analysts cite crisis levels for the US consumer sentiment, with 58.6 presenting as one of the lowest readings this century.

Softer confidence implies weakening consumer spending power, which can pressure risk assets, including crypto. Similarly, a flat sentiment reading signals caution among households, reinforcing a fragile economic outlook.

Such readings matter for Bitcoin and crypto markets as they shape overall risk sentiment. Together, these gauges shape risk appetite and often ripple into Bitcoin and crypto markets.

For traders, weaker consumer metrics may stoke bets on Fed easing, indirectly supporting Bitcoin. Conversely, stronger readings typically boost equities, pulling liquidity away from digital assets in the short term.

Initial Jobless Claims

Another US economic signal this week is the initial jobless claims, which are coming into focus as labor market data grows as a fundamental driver for Bitcoin.

For the week ending August 16, 235,000 US citizens filed for unemployment. In the week ending August 23, however, experts see a drop in these filings to 230,000.

Meanwhile, data also shows that it is taking a long time for jobless Americans to get new jobs. Continuing jobless claims have been steadily grinding higher at new post-2021 highs.

If jobless claims fall below the previous 235,000 reading, it would signal labor market resilience, potentially reducing Fed rate-cut bets and weighing on Bitcoin’s short-term upside.

However, rising continuing claims would probably suggest deeper cracks in employment. This divergence keeps crypto markets sensitive to macro shifts, balancing growth optimism against recessionary risks and potential liquidity pivots.

PCE

Another US economic data point to watch is the PCE (Personal Consumption Expenditures), which tracks consumer spending on goods and services.

Indeed, data on MarketWatch shows economists forecast the headline to be 2.6% YoY while anticipating core PCE to be 2.9%, slightly higher than July’s 2.8% reading.

Higher core PCE at 2.9% signals sticky inflation, potentially reducing chances for Fed rate cuts. That could pressure Bitcoin and crypto in the short term by tightening liquidity.

However, persistent inflation may also revive Bitcoin’s long-term appeal as a hedge against monetary debasement.

Bitcoin (BTC) Price Performance. Source:

Bitcoin (BTC) Price Performance. Source:

As of this writing, Bitcoin was trading for $112,579, down by over 2% in the last 24 hours. Meanwhile, Ethereum is exchanging hands for $4,711, after testing new highs over the weekend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK