Key Notes

- Michael Saylor hints at fresh Bitcoin purchases as MicroStrategy’s holdings hit 629,376 BTC, nearing $26B in profit.

- Bitcoin price consolidates between $117,300 and $114,400 amid ETF outflows and weak corporate demand.

- MicroStrategy’s renewed Bitcoin buying could counterbalance waning ETF inflows, boosting speculative demand for the week ahead.

After falling behind top altcoins in last week’s late rally following dovish remarks from US Fed Chief Jerome Powell, Bitcoin consolidated in a tight 2% weekend range between $117,300 and $114,400. The lackluster price action reflected both weak corporate demand and persistent ETF outflows, as Bitcoin ETFs shed $1.2 billion over the week without logging a single day of inflows.

However, fresh signals from Michael Saylor, co-founder and executive chairman of MicroStrategy, suggest this lull in institutional appetite may be close to reversing. In a cryptic post on X published around noon Sunday, Saylor wrote “Bitcoin is on Sale,” accompanied by an image showing his firm’s recent BTC acquisitions.

Bitcoin is on Sale pic.twitter.com/azJIYk2xDe

— Michael Saylor (@saylor) August 24, 2025

According to SaylorTracker, MicroStrategy’s Bitcoin holdings have now reached 629,376 BTC, valued at approximately $72.3 billion, with profits climbing to $25.9 billion at press time. The possibility of renewed large-scale purchases from Saylor’s firm provides two potential tailwinds for Bitcoin price action.

First, it could restore confidence among retail traders and strategic investors discouraged by last week’s underperformance. Second, the early hint may encourage short-term traders to enter fresh bets speculating on Strategy’s imminent purchase confirmation. If these scenarios materialize, this could considerably boost market liquidity and trigger a positive BTC price reaction.

Bitcoin Price Forecast: Can Bulls Overcome Resistance Below $117,800?

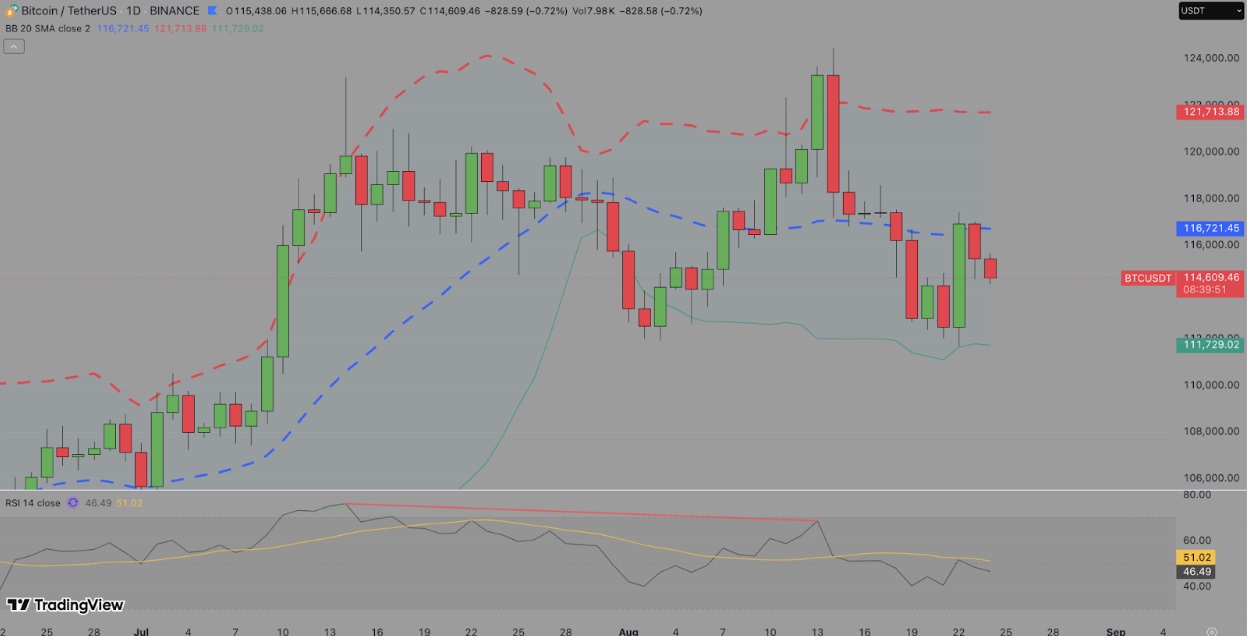

Bitcoin price opened the new week on a cautious note, trading near $114,600 at press time. The daily chart shows BTC consolidating just under the middle Bollinger Band around $116,722, while resistance at the upper band near $121,713 continues to cap upside momentum.

Momentum indicators remain mixed. The Relative Strength Index is holding at 46.53, pointing to a neutral stance, neither overbought nor oversold. This leaves room for directional movement depending on whether buyers or sellers gain control in the coming sessions.

Bitcoin price forecast | Source: TradingView

On the bullish side, a sustained close above $117,800, where more than $3 billion in short positions are clustered , would likely validate further upside toward $121,700 and potentially retest $124,000, levels last seen earlier this month. Renewed corporate demand and confirmation of MicroStrategy’s rumored purchases could serve as the catalyst for such a breakout.

Conversely, immediate downside support is seen at $111,700 near the lower Bollinger Band. A decisive drop below this threshold would risk extending losses toward the $108,000 region, where prior consolidation established a temporary floor in late July.

In summary, without a significant increase in corporate demand, Bitcoin price is expected to remain range-bound between $114,000 and $118,000.

Maxi Doge Presale Gains Momentum as Bitcoin Consolidates

As Bitcoin price lags below key resistance levels and investors await fresh institutional cues, some traders are turning to highly speculative alternatives like Maxi Doge (MAXIDOGE). Promoted as a high-risk, high-reward community token, Maxi Doge has gained traction by offering 1000x leverage with no stop-loss, drawing interest from traders seeking outsized returns.

Maxi Doge Presale

The ongoing presale has gained considerable traction with more than $1.27 million already raised toward a $1.53 million target. Priced at $0.000253 per token, the sale has just two days remaining before the next price increase. Visit the official Maxi Doge website to secure early access.

nextDisclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.