BTC Market Pulse: Week 34

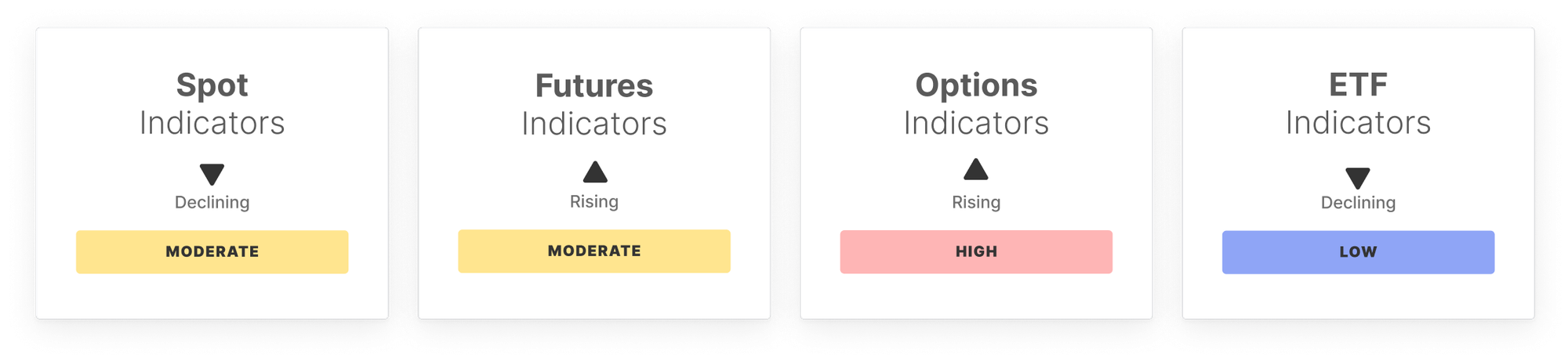

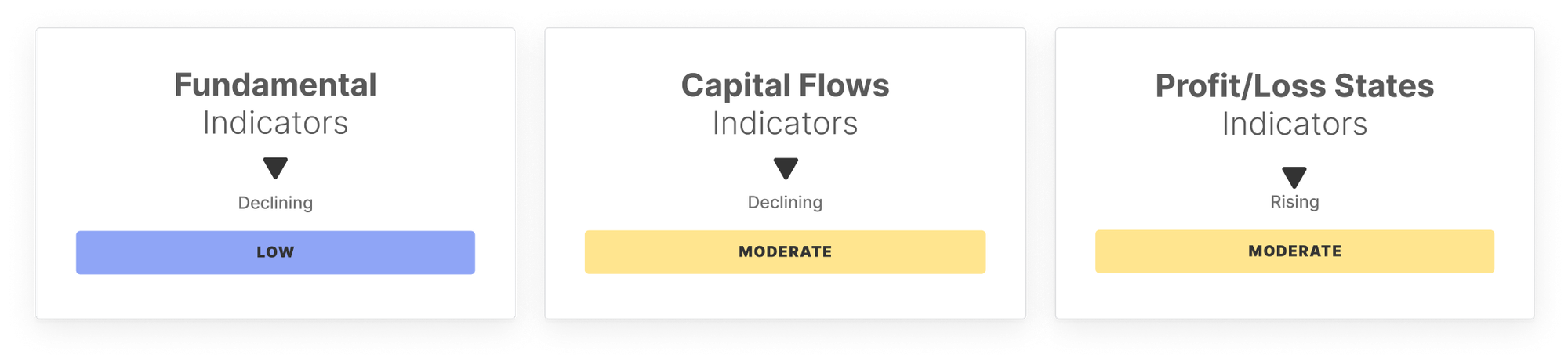

Bitcoin faced sharp volatility last week, surging to $117K before retreating to $111K. Spot momentum weakened, futures leverage contracted, and ETF flows turned negative with $1B outflows. On-chain demand softened as activity fell, profits faded, and caution grew across traders and institutions.

Overview

Over the past week, Bitcoin's market saw significant volatility, with prices surging to $117k before a sharp leg down to $111k. In the spot market, momentum weakened as the RSI slipped toward oversold conditions, cumulative selling pressure deepened, and volumes remained steady but uninspired, all pointing to fragile buyer conviction.

In the futures market, open interest contracted, signaling reduced leverage, while funding payments spiked as longs pressed their advantage. Net positioning improved modestly, easing some sell pressure, yet uncertainty lingers as speculative appetite softens.

The options market reflected rising caution. Open interest climbed modestly, but volatility spreads narrowed sharply, suggesting complacency. At the same time, 25-delta skew broke higher, highlighting a rush for downside protection as traders hedged against potential declines.

Flows through US-listed spot ETFs painted a more bearish picture. Netflows reversed to a sharp $1.0B outflow, trade volumes moderated, and ETF MVRV ratios weakened, showing profit pressure mounting and TradFi demand cooling after weeks of heavy inflows.

On the on-chain demand side, daily active addresses and transaction fees fell, reflecting softer network usage, while transfer volumes spiked on volatility-driven reallocations. This divergence suggests subdued organic activity, offset by short-term speculative repositioning.

Capital flow metrics pointed to cooling momentum. Realized Cap inflows slowed, Hot Capital Share stalled near the high band, and the STH/LTH supply ratio edged higher, showing modest short-term rotation but little long-term conviction.

Profit and loss states also softened. The share of supply in profit fell sharply, NUPL retreated from euphoric levels, and Realized P/L dropped toward balance. Together, these trends highlight fading unrealized gains and weaker conviction, with the market stepping away from extremes and leaning into caution.

In sum, the market structure has shifted from euphoria toward fragility. Spot and futures show weakening momentum, options highlight hedging demand, and ETF flows reveal institutional caution. On-chain signals confirm softer demand, slower capital inflows, and fading profitability. With volatility elevated, the coming weeks hinge on whether sidelined liquidity returns to stabilize the market, or if selling cascades into deeper consolidation.

Off-Chain Indicators

On-Chain Indicators

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowPlease read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Unveiling Solana's "Invisible Whale": How Proprietary AMMs Are Reshaping On-Chain Trading

The rapid rise of proprietary AMMs on Solana is no coincidence; rather, it is a logical and even inevitable evolution as the DeFi market pursues ultimate capital efficiency.

XRP Reenters Global Top 100 With Market Cap Near HDFC

Quick Take Summary is AI generated, newsroom reviewed. XRP has entered the Top 100 Global Assets at $181.8B XRP trades at $3.05 showing strong annual growth and volume activity XRP has surpassed companies like Adobe, Pfizer, and Shopify in valuation ETF filings and Ripple’s U.S. banking license could boost XRP adoption Japan’s banks and RippleNet partners highlight growing global use of XRPReferences $XRP reenters the top 100 global assets by market cap.

Solana Treasury Fund, operated by Sharps Technology, and Pudgy Penguins have announced a strategic partnership

Through this partnership, Pudgy Penguins' top-tier IP will be combined with STSS's institutional-grade Solana vault, creating a brand-new interactive opportunity for retail and institutional users.

Magma Finance Officially Launches ALMM: Sui's First Adaptive & Dynamic DEX, Pioneering a New Liquidity Management Paradigm

Magma Finance today officially announced the launch of its innovative product ALMM (Adaptive Liquidity Market Maker), becoming the first Adaptive & Dynamic DEX product on the Sui blockchain. As an improved version of DLMM, ALMM significantly enhances liquidity efficiency and trading experience through discrete price bins and a dynamic fee mechanism, marking a major upgrade to the Sui ecosystem's DeFi infrastructure.