NASDAQ Listed ETHZilla Is Buying More Ethereum Despite Stock Price Crash

ETHZilla announces a $250 million stock buyback to stabilize after shares dropped, but concerns over long-term growth and Ethereum acquisitions remain.

ETHZilla, an Ethereum treasury firm, announced a $250 million stock buyback after company shares fell nearly 30% last week. This caused a brief bounce, relieving stock dilution concerns.

Still, this kind of move won’t directly enable the next Ethereum purchase. ETHZilla holds around $489 million in ETH, representing a recent acquisition, but it needs to keep building this stockpile.

ETHZilla’s Ethereum Plan

Ethereum has been doing well lately, reaching an all-time high last Friday, and corporate investment is doing a lot to power the trend. The token is receiving a lot of institutional confidence, and one recent development illustrates this.

Although ETHZilla’s shares tanked after its last Ethereum purchase, it’s preparing to do it again:

“At ETHZilla, we continue to deploy capital to accelerate our Ethereum treasury strategy with discipline and record speed. As we continue to scale our ETH reserves and pursue differentiated yield opportunities, we believe an aggressive stock repurchase program at the current stock price underscores our commitment to maximizing value,” claimed McAndrew Rudisill, Executive Chairman.

Specifically, the firm is conducting a $250 million stock buyback to stabilize its valuation. Despite Ethereum’s solid performance, concerns of share dilution sapped ETHZilla investors’ confidence.

Last week, the company planned to offer 74.8 million shares to fund ETH purchases, representing a 46% in the total number of shares.

In other words, share dilution means that ETHZilla stockholders could lose money, even if Ethereum continues rising.

To remedy this, the firm’s $250 million stock buyback plan has helped momentarily stabilize things, opening the door to future acquisitions:

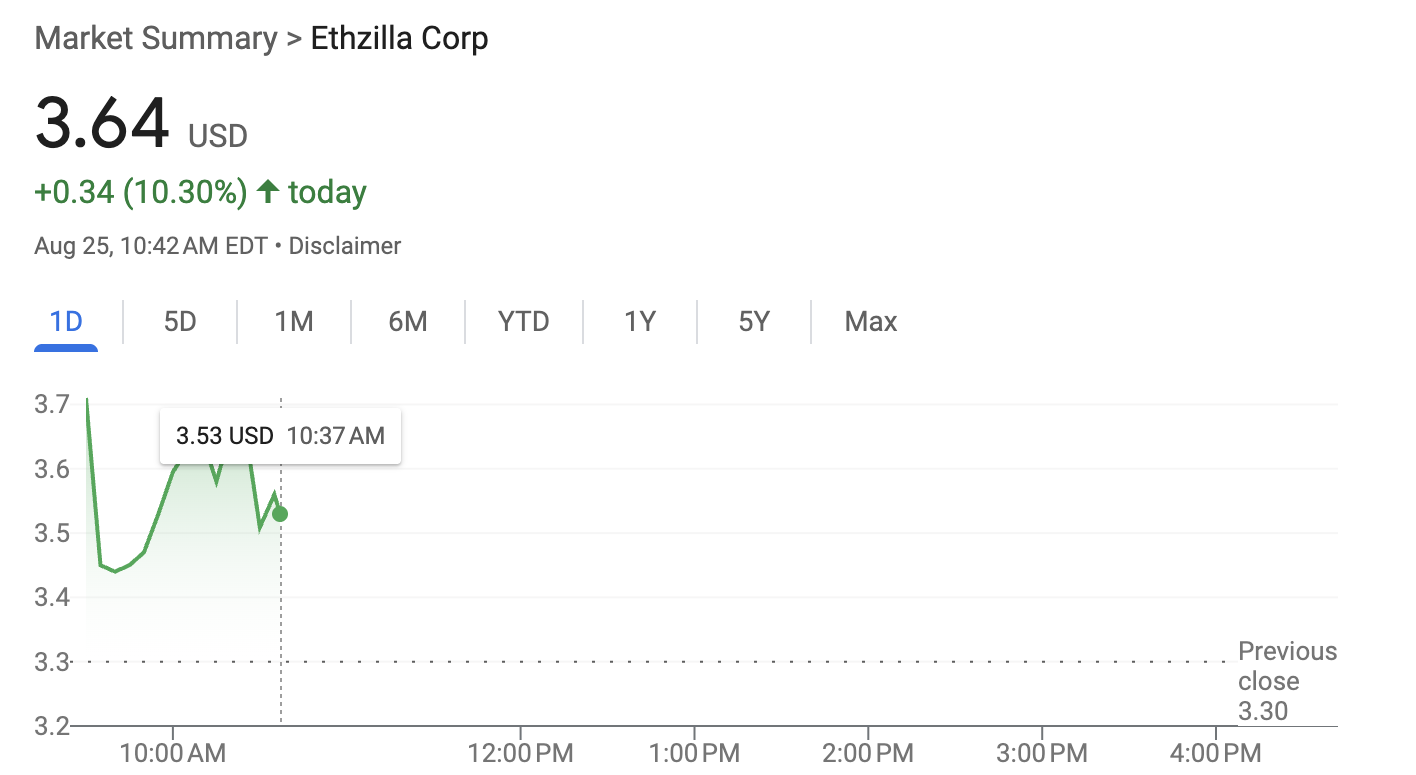

ETHZilla Price Performance. Source:

Google Finance

ETHZilla Price Performance. Source:

Google Finance

A Brief Reprieve

SEC documents related to this buyback reveal that ETHZilla currently holds around $489 million worth of Ethereum, making it a substantial private holder.

This is significantly higher than the firm’s reported holdings last week, so it has made a solid purchase recently.

Still, a $250 million stock buyback will also cut into its purchasing capabilities. ETHZilla has attracted corporate investment, but stock sales are its main vehicle for ETH purchases.

These purchases, in turn, are the only way it can promise future value to potential investors.

There’s an inherent contradiction here. If this trade collapses due to diminishing returns, it could cause serious problems.

Stock buybacks may bring temporary stability, but they can’t power real growth.

ETH staking its massive treasury could provide passive income, but Vitalik Buterin warned that this might not be sustainable either.

In other words, ETHZIlla may now be caught in a similar pickle to Strategy.

Last week, Saylor’s company claimed it would start selling shares for other reasons than BTC acquisition. This prompted a little backlash and fears that the firm is losing its momentum.

ETHZilla’s new buyback program is similarly untethered from Ethereum, although unverified social media rumors claim it bought $35.2 million in ETH today.

Between this alleged acquisition and last week’s purchase, the firm has some staying power. Still, it always needs to keep moving.

Otherwise, the inherent risks of a DAT strategy could blow up in ETHZilla’s face.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Brevis receives collective praise from the Ethereum community—Is ZK finally becoming practical?

Brevis has achieved proof for 99.6% of Ethereum blocks within 12 seconds, with an average of only 6.9 seconds, using just 64 RTX 5090 GPUs.

From SDK to "Zero-Code" DEX Building: Orderly's Three-Year Masterpiece

Orderly ONE proves that sticking to one thing and doing it to the extreme is the right approach.

The Ethereum community collectively gives a thumbs up: Has ZK technology finally moved from the lab to production-grade tools?

Brevis has achieved proof for 99.6% of Ethereum blocks within 12 seconds, with an average time of only 6.9 seconds, using just 64 RTX 5090 GPUs.

When the market complains about CZ, people begin to miss SBF

SBF interview: The bankruptcy lawyers won, the creditors received full repayment, and the one who could have made them even richer is now waiting for the day when the world recognizes the truth.