Polymarket Bettors Doubt Trump Can Topple Jerome Powell or Lisa Cook This Year

Prediction markets are signaling skepticism that Donald Trump will be able to bend the Federal Reserve to his will this year, even as the U.S. President moves to fire a Fed Governor for what he believes is just cause.

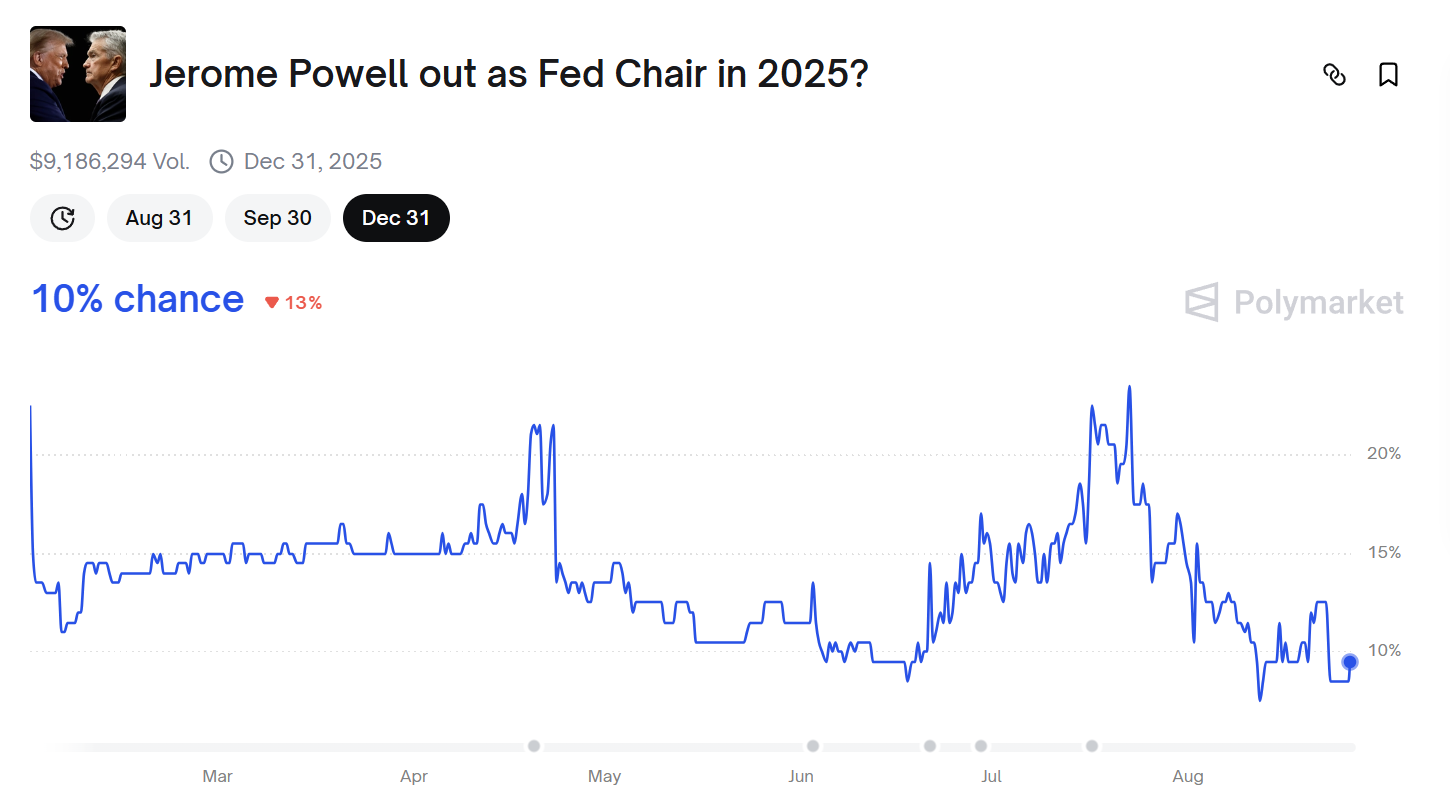

On Polymarket, bettors put the chance of Jerome Powell being forced out as Fed Chair in 2025 at just 10%, suggesting investors don’t believe Trump can override the central bank’s independence before Powell’s term expires in May 2026.

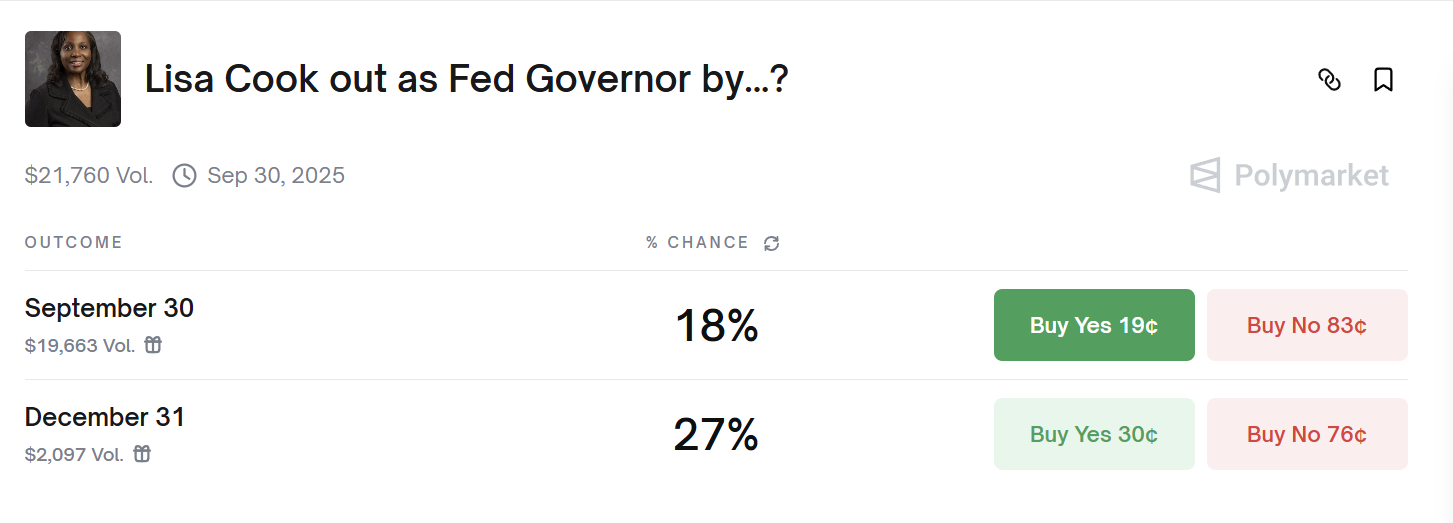

Trump’s push to fire Fed Governor Lisa Cook tells a different story. He wants her removed over allegations of mortgage fraud, per a letter posted on Truth Social, making her the first sitting governor ever targeted by a presidential dismissal.

Cook, however, has refused to step down, arguing that “for cause” removals must apply to misconduct in office, not private financial dealings predating her appointment.

Markets are pricing a 27% chance of Cook's ouster by December 31, indicating some risk of legal or political fallout but still a strong expectation she survives the challenge.

History shows that previous Presidents have also pressured the Fed, with the Cato Institute pointing out in an October 2024 piece that it's more common than some would lead you to believe.

Harry Truman pushed out Chairman Thomas McCabe in 1951 to secure wartime debt financing, Lyndon Johnson famously berated William McChesney Martin at his Texas ranch for raising rates during the Vietnam War, and Richard Nixon leaned heavily on Arthur Burns in the early 1970s a campaign economists later tied to runaway inflation.

A 2013 Cato study by Thomas F. Cargill and Gerald P. O’Driscoll Jr. argues that Federal Reserve independence is more myth than reality, noting that both parties have interfered when politically expedient.

If Trump were to remove Powell, it would be certainly controversial, but markets might welcome it if seen as clearing the way for easier monetary policy. A Fed more aligned with the White House could cut rates faster, weaken the dollar, and lift risk assets broadly creating a supportive backdrop for bitcoin BTC$110,281.75.

Beyond the near-term rally, Powell’s firing would underscore one of crypto’s core arguments: that fiat systems are inherently political and subject to capture, while bitcoin remains outside those pressures.

For bitcoin, that combination looser liquidity conditions plus a reinforced “hard money” narrative could be a powerful catalyst for adoption.

A changing of the guard at the Fed would obviously be a bullish narrative for bitcoin, which is why the market's reaction to Trump's move on Cook reflects a consensus that this is largely hot air.

Bitcoin barely moved on the news, up 0.3% in the immediate aftermath, with the largest digital asset still down 2.6% on-day according to CoinDesk market data.

The CoinDesk 20, an index tracking the performance of the largest crypto assets, is trading below 4,000, down 5.3% by mid-day 东八区.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Boros: Swallowing DeFi, CeFi, and TradFi to Unlock Pendle's Next 100x Growth Engine

The profit potential of Boros yield space can even surpass that of Meme.

SUI Targets Wave 3 Rally as $1.71 Level Defines Bullish Breakout Path

VELO Holds $0.0084 as Price Consolidates Above Fib 0.236, Mirroring 1,500% Historical Rally Setups

Fetch.ai Holds $0.26 Support as Chart Confirms Long-Term Bullish Channel Setup