AI Tokens Tumble As Elon Musk Sues Apple and OpenAI For Billions in Damages

Elon Musk’s antitrust suit against Apple and OpenAI sparks chaos in AI crypto markets. Investors panic as sector tokens slump amid regulatory uncertainty.

AI crypto coins slid sharply on Tuesday, almost posting double-digit losses and effectively marking the worst-performing sector.

It follows Elon Musk’s X Corp. and xAI filing an antitrust lawsuit against Apple and OpenAI, calling them out for monopolizing artificial intelligence (AI) access on iPhones.

AI Tokens Dip on Musk’s Antitrust Clash with Apple and OpenAI

The case, filed in the Northern District of Texas, targets Apple’s June 2024 decision to make OpenAI’s ChatGPT the exclusive AI chatbot integrated into iOS.

Per the filing, this arrangement locks out competitors such as xAI’s Grok. This gives OpenAI “billions of user prompts” from iPhone users. Further, the deal offers OpenAI control of more than 80% of the generative AI chatbot market.

Based on this, complainants push that Apple and OpenAI engaged in an “anticompetitive conspiracy.” Supposedly, they grant ChatGPT privileged access to Siri and core iPhone functions.

Therefore, in their lawsuit, they seek “billions” in damages and pursue injunctive relief to dismantle the exclusive integration. They see it as an obstacle to innovation and consumer choice.

The sentiment is that this deal disadvantages rivals like Grok, unable to measure up to the data scale. Additionally, it gives OpenAI an unfair advantage, an expansive real-time feedback loop that could enable dominance.

Reportedly, Apple also manipulated App Store rankings to suppress competing apps.

Despite Grok boasting more than a million reviews, a 4.9-star average, and a second-place ranking in Apple’s “Productivity” category, Musk claims the app has been excluded from the prominent “Must-Have Apps” section, where ChatGPT is featured.

A million reviews with 4.9 average for @Grok and still Apple refuses to mention Grok on any lists

— Elon Musk (@elonmusk) August 25, 2025

Notably, Grok’s capabilities recently attracted the messaging platform Telegram, which had unsuccessfully pursued integration.

Beyond App Store practices, the lawsuit claims Apple is preparing to collect “monopoly rents” through revenue-sharing agreements tied to ChatGPT’s premium service, projected to rise to $44 per month by 2029.

Apple, which controls around 65% of the US smartphone market, allegedly views potential super apps like Grok as existential threats to the iPhone’s dominance.

The filing cites multiple violations, including restraint of trade, monopolization, and unfair competition under federal and Texas law.

Tech Competitors’ Fallout Hits AI Tokens

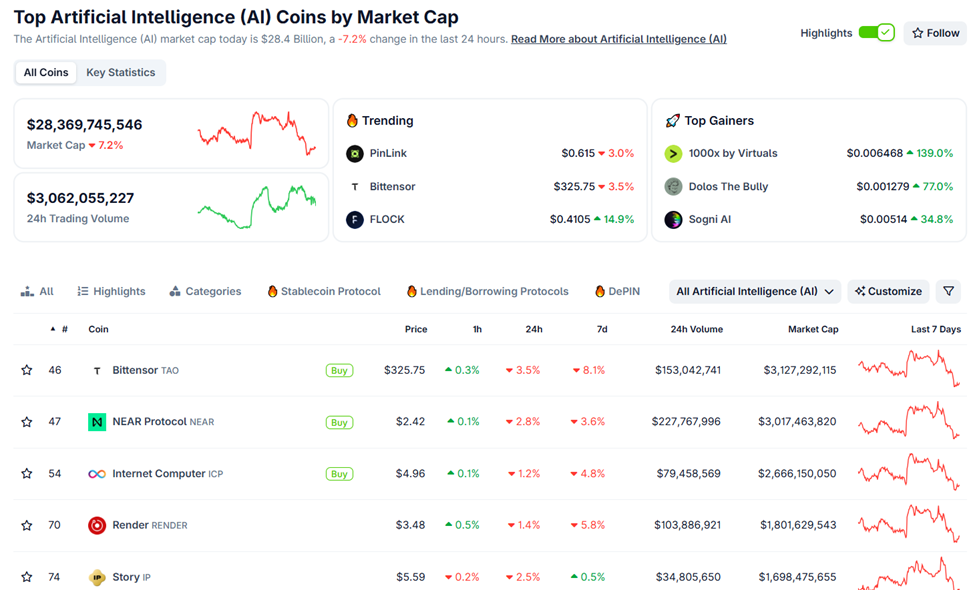

According to CoinGecko data, the aggregate market capitalization of AI-linked tokens dropped more than 7%. This suggests that the lawsuit’s effects reverberated quickly in crypto markets.

This includes projects tied to decentralized computing and machine learning platforms.

AI Crypto Coins’ Market Cap Tumble. Source:

CoinGecko

AI Crypto Coins’ Market Cap Tumble. Source:

CoinGecko

Traders cited fears that heightened antitrust scrutiny and corporate infighting could dampen investor enthusiasm for AI-focused crypto plays.

The turnout is unsurprising, given that whenever there is uncertainty around the biggest AI incumbents, smaller AI tokens in crypto suffer.

The reverse is true, with positive developments such as positive earnings reports for firms in the AI space boding well for sector crypto coins. Similarly, AI tokens surged in February amid Elon Musk’s $97 billion OpenAI acquisition bid.

Nevertheless, reactions across the tech and crypto sectors remain divided. Some view Musk’s lawsuit as a legitimate challenge to entrenched monopolies. Meanwhile, others see it as a tactical move to elevate Grok’s visibility.

“Apple’s refusal to applaud innovation and success just shows how they will be left behind, like all before it,” analyst Jacob King wrote on X.

The analyst referenced once-dominant giants such as BlackBerry, Nokia, and AOL, among others.

With billions at stake and AI adoption accelerating, the lawsuit could become a pivotal test case in defining the policing of monopolies in an artificial intelligence-focused era.

The sentiment could spill over beyond Silicon Valley, potentially influencing the crypto economy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

a16z Annual Report: The 17 Most Exciting Web3 Ideas for 2026

Stablecoins will become the infrastructure of Internet finance, AI agents will gain on-chain identity and payment capabilities, and the advancement of privacy technologies, verifiable computation, and compliance frameworks will drive the crypto industry from pure trading speculation towards building decentralized networks with lasting value.

Morning Brief | a16z Crypto releases annual report; crypto startup LI.FI completes $29 million financing; Trump says the rate cut is too small

A summary of important market events on December 11.

Trend Research: The "Blockchain Revolution" is Underway, Remain Bullish on Ethereum

The integration trend in the crypto market and Ethereum's value capture.

Interest Rate Cuts Implemented, Why Are Assets Acting "Rebellious" Collectively?