Celestia (TIA) Faces 90% Decline: Will Support Hold or Further Losses Loom?

- Celestia plunges over 90% from $20 peak, struggling near $1.62 as sentiment collapses.

- Bears dominate as token stalls under resistance, with $1.50 and $1.00 acting as support.

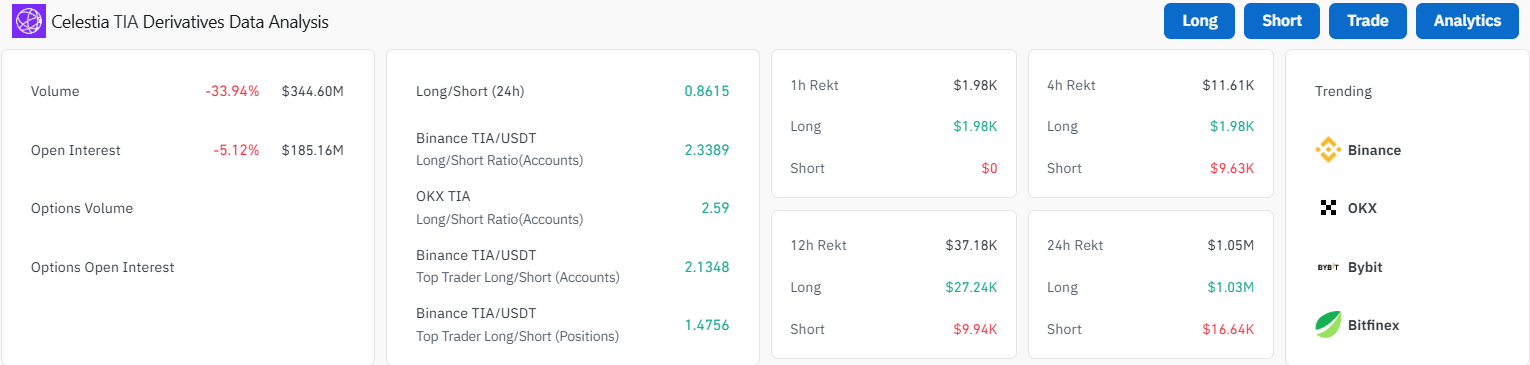

- Trading slows as volume drops 33.94% to $344.6M and open interest dips 5.12% to $185.16M.

Celestia (TIA) has experienced one of the worst setbacks among major blockchain projects. The token has gradually declined since reaching its all-time high of around $20. The token is trading at $1.62 at press time. This constitutes a decline of over 90% of its ATH. The drop has shaken investors and spawned a debate on whether better times have arrived or endure more misery.

Celestia’s Decline: From Optimism to Despair

The optimism surrounding the token has faded and has entered a prolonged downtrend. Analysts note that many holders are moving from optimism into despair. Investor sentiments are shifting toward capitulation and disbelief, a stage often linked to market bottoms.

Analyst Ali compared the current price action with classic cycle charts. He suggested that Celestia holders may be living through the harshest phase. This stage is marked by emotional exhaustion. Traders often give up, convinced that recovery will not arrive.

Source:

X

Source:

X

The prolonged decline has dragged the price near key support. The $1 level is viewed as both psychological and technical support. If the token holds, it could become a base for accumulation. A decisive breakdown, however, risks further selling and entry into uncharted territory.

Celestia Faces Strong Resistance and Weak Momentum

The daily chart shows repeated failures to move higher. Price action has stalled below important resistance levels. Sellers remain in control of momentum. Moving averages paint a clearer picture. The 50-day average is at $1.82. The 100-day average sits at $1.89. Both act as near-term barriers. The 200-day average is much higher at $2.47. This shows the distance Celestia must cover before any real trend reversal could form.

Momentum indicators also show a bearish picture. The MACD line is at -0.027. The signal line stands at -0.015. The histogram is flat at -0.012. These values highlight the lack of buying pressure. Analysts say no strong reversal signals are present.

Source:

TradingView

Source:

TradingView

The support is found near $1.50. A break below this level could accelerate losses. Recovery requires the price to close above $1.90 with high volume. Until then, the broader outlook remains bearish.

Related: Stellar XLM Poised for Final Dip Before Targeting $1 Breakout

Market data shows a clear slowdown, with trading volume down 33.94% at $344.60 million. Open interest also declined 5.12% to $185.16 million. The figures reflect reduced participation as traders pull back from active positions.

In the past 24 hours, total liquidations reached $1.05 million. Long liquidations accounted for $1.03 million, while Shorts accounted for only $16.64K. This indicates traders with bullish outlooks are facing heavier losses.

Source:

Coinglass

Source:

Coinglass

The future of Celestia is currently dependent on the ability of the token to hold on to the support levels. The major support that traders are observing is at $1.50 and $1.00. A rebound could be generated by these areas to create new optimism. However, a breakdown under them would worsen the cycle. At this point, the market confidence is declining, and sentiment is feeble. It would be an uphill task in Celestia to regain its value.

The post Celestia (TIA) Faces 90% Decline: Will Support Hold or Further Losses Loom? appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Recall Network(RECALL)

HYPE Trader Targets $50 After Fresh Entry Setup at $37 Range

Dogecoin Holds Above $0.1973 Support as Weekly Triangle Pattern Persists