Cardano’s Midnight Glacier Airdrop Details Revealed — Are You Eligible?

What Is the Midnight Glacier Airdrop?

Cardano has unveiled the details of its Midnight Glacier Airdrop, distributing 12 billion NIGHT tokens to eligible holders of ADA and other major cryptocurrencies. This initiative aims to foster privacy and decentralization within the Cardano ecosystem, with the Midnight Network at its heart. The airdrop will play a crucial role in shaping the future of privacy-focused projects on the blockchain.

Eligibility Criteria for the Airdrop

To qualify for the airdrop, users must have held at least $100 worth of ADA in their Cardano wallet at the time of the snapshot taken on June 11, 2025. The snapshot has now been finalized, and eligible users can begin claiming their tokens starting in July 2025. This criterion ensures that a wide range of Cardano holders will be involved in the airdrop, further promoting adoption of the Midnight Network.

Airdrop Phases and Token Distribution

The distribution of the NIGHT tokens will occur in multiple phases:

- Claim Phase (60 days): Eligible users can claim their full NIGHT token allocation during this period. Tokens will be locked in a smart contract and will unlock in 25% increments over 360 days.

- Scavenger Mine (30 days): Unclaimed tokens will be redistributed to users who contribute computational power to the Midnight Network, utilizing a mechanism resembling proof-of-work mining.

- Lost-and-Found Phase (4 years): Users who miss the initial claiming window will have the opportunity to recover a portion of their tokens through self-verification.

How to Claim Your NIGHT Tokens

To claim your NIGHT tokens, simply sign in with your Cardano wallet and provide a valid Cardano address. The process is gas-free and does not require KYC. As long as you held at least $100 worth of ADA during the snapshot, you’re eligible for the airdrop. Make sure to complete the process before the claiming phase ends.

Implications for Cardano’s Ecosystem

The Midnight Glacier Airdrop is a significant step toward achieving greater privacy and decentralization within the Cardano network. By distributing tokens widely, the Midnight Network encourages more users to participate in the ecosystem. It also emphasizes Cardano’s commitment to creating privacy-preserving financial solutions for decentralized applications (dApps).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

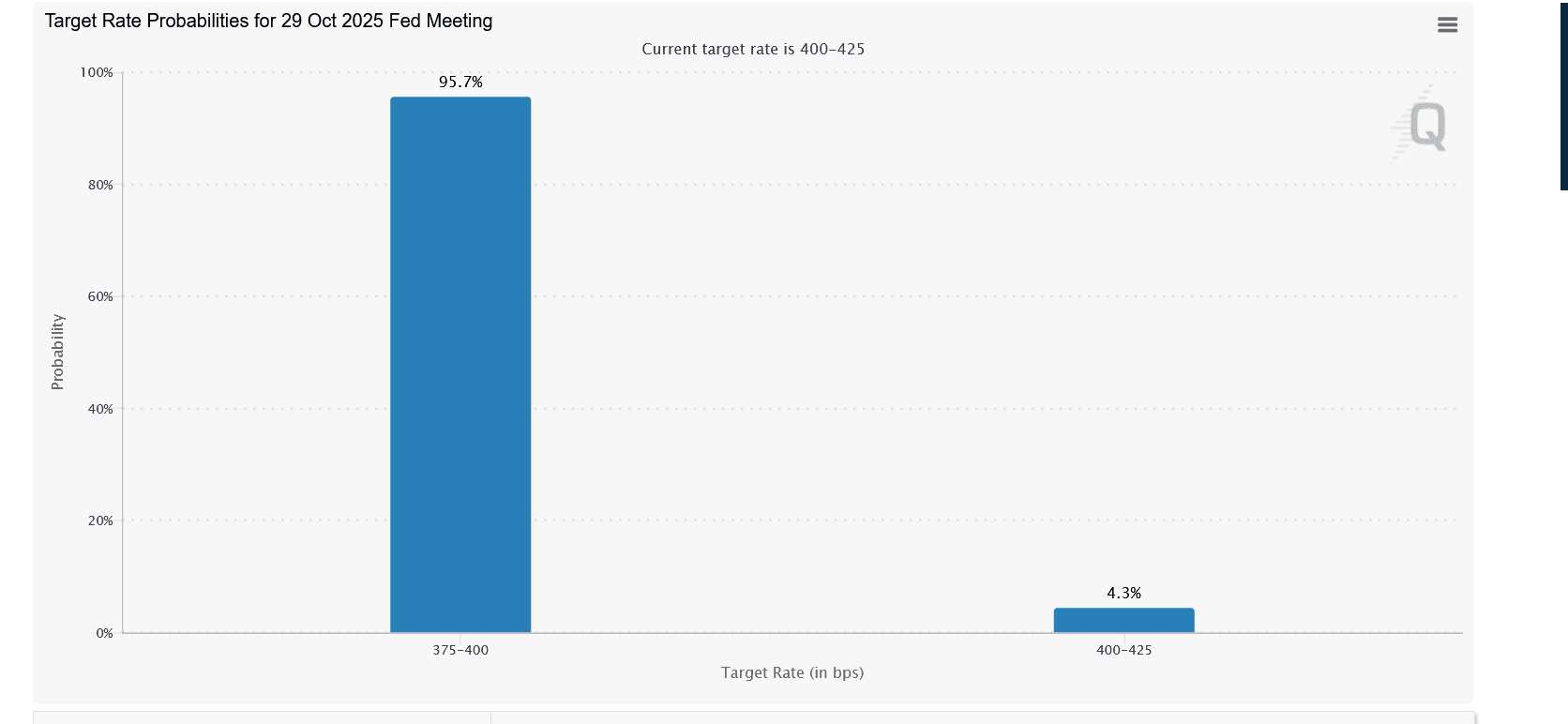

Is Cardano (ADA) About to Rebound as the Fed Turns Dovish?

Sorare CEO still bullish on Ethereum despite ‘upgrading’ to Solana

Base co-founder discusses token issuance again—what does Zora’s launch of live streaming at this moment signify?

The current $850 million FDV still has reasonable room for growth considering Zora's ecosystem status and growth potential.

The last mile of blockchain, the first mile of Megaeth: Taking over global assets

1. The blockchain project Megaeth has recently reached a critical milestone with its public sale, marking the official start of the project. Its goal is to build the world's fastest public chain to solve the "last mile" problem of blockchain's management of global assets. 2. Industry observations indicate that the crypto punk spirit has been weakening year by year, and the industry's focus is shifting towards high-performance infrastructure. Against this backdrop, Megaeth is advancing the implementation of its project, emphasizing that the blockchain industry has moved past the early exploratory phase, and high performance has become key to supporting the next stage of application scenarios. 3. Industry insiders believe that all infrastructure has a "late-mover advantage," and blockchain also needs to go through a process of performance upgrades to drive scenario expansion. High performance is seen as the key to unlocking larger-scale applications. 4. With multiple chains exploring performance pathways, Megaeth positions itself as aiming to be the "fastest public chain," attempting to solve the challenge of "trillions of transactions on-chain." The team believes that addressing real-world problems is the most effective path, regardless of whether it is Layer1 or Layer2. 5. Megaeth's public sale is seen as the beginning of its "first mile" journey. Although it may face technical challenges, the potential brought by its differentiated underlying architecture is highly regarded and is expected to give rise to new industry paradigms.