Exceed Finance Launches Super Staking on Solana with 40% APY

Officially, the Exceed Finance has launched the Super Staking on the Solana network, heralding a new era of the high-yield and flexible staking. In Super Staking, the APY can reach 40% compared to other traditional staking on Solana which provides returns of between 1.5 and 8 percent depending on the inflation and the rewards accrued to the validator. With JLP trading commissions and dynamic asset allocation, Exceed Finance uses the benefits of the ultra-fast finality of 100ms on Solana and the high level of throughput to maximize user rewards. Super Staking is not only more profitable than the traditional methods, but more flexible to the market conditions.

How Synthetic LSTs Drive Super Staking

Such tokens are pegged to staked assets, allowing their holders to be liquid without missing out on the compound interest. The synthetic LSTs would be able to apply in the Solana DeFi ecosystem, whereby stakers can stake their assets as collateral without unbonding them in the process of staking. This system can be related to the research on liquid staking that Chainlink carries out and which shows that synthetic tokens enable more collateral and capital efficiency and productivity in decentralized finance.

Solana and Ethereum Staking

With the comparison of Solana Super Staking and the Ethereum staking, the performance and flexibility differences are evident. Ethereum staking provides interest rates of about 325 to 5per cent APY with a slower finality of 12 to 15 seconds and heavily reliant on centralized liquid staking providers including Lido. However, Solana has a transaction time of only 100 milliseconds and offers 40 percent APY with the help of Exceed Finance with a market‑driven approach. This makes the Super Staking on Solana much more lucrative, fluid and versatile compared to the Ethereum stance pool.

The Future of Super Staking

Super Staking offered by Exceed Finance may completely transform the DeFi market as it combines high returns with the ability to circulate easily. Having synthetic LSTs will allow stakers to provide high returns without losing the ability to access their funds and open up new use cases of cross-protocol utility and collateralization on Solana. The integration of audited security procedures with market‑sensitive rewarding incentives makes the Exceed Finance an early adopter of next generation staking solutions. This innovation does not only confront the conventional models of the CeFI but also promotes the image of Solana as the center of high-performance decentralized finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

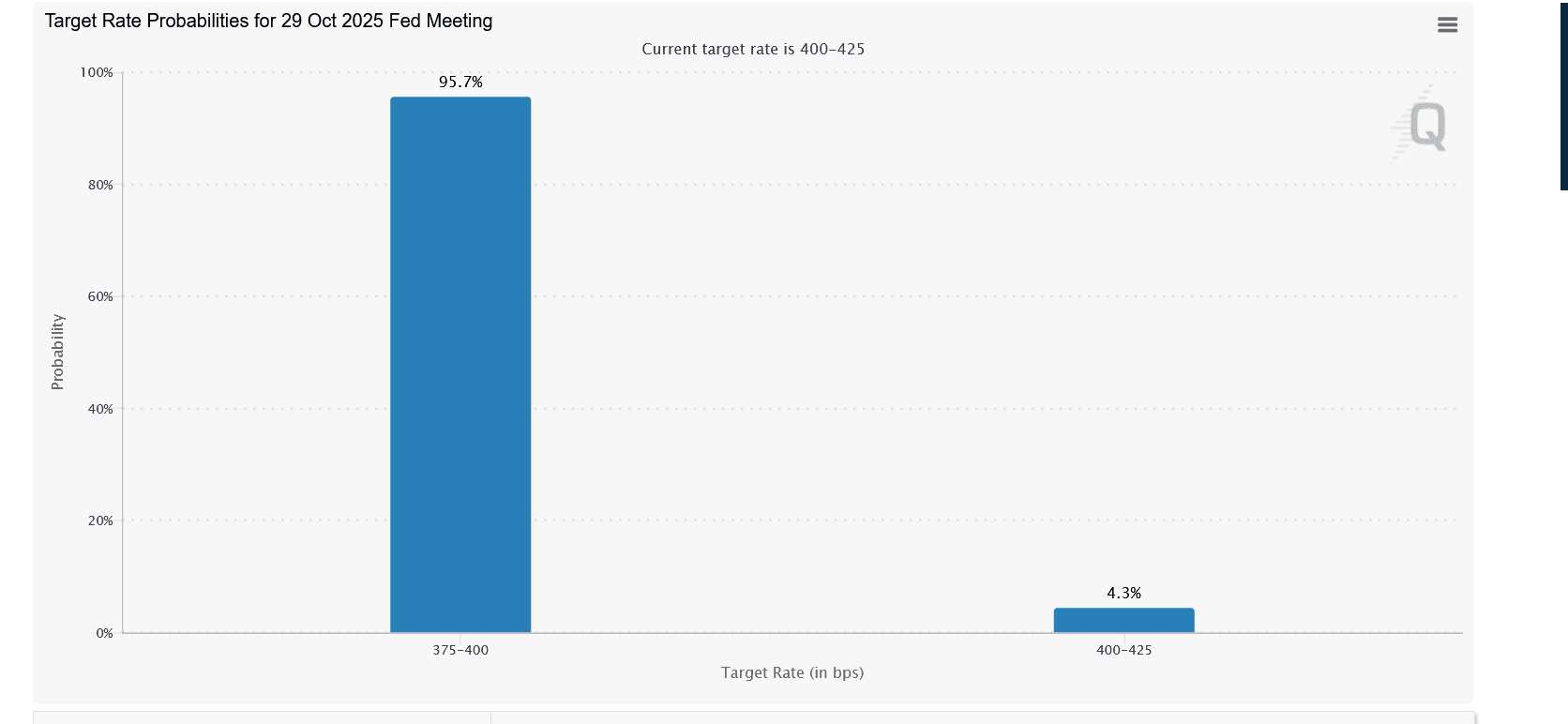

Is Cardano (ADA) About to Rebound as the Fed Turns Dovish?

Sorare CEO still bullish on Ethereum despite ‘upgrading’ to Solana

Base co-founder discusses token issuance again—what does Zora’s launch of live streaming at this moment signify?

The current $850 million FDV still has reasonable room for growth considering Zora's ecosystem status and growth potential.

The last mile of blockchain, the first mile of Megaeth: Taking over global assets

1. The blockchain project Megaeth has recently reached a critical milestone with its public sale, marking the official start of the project. Its goal is to build the world's fastest public chain to solve the "last mile" problem of blockchain's management of global assets. 2. Industry observations indicate that the crypto punk spirit has been weakening year by year, and the industry's focus is shifting towards high-performance infrastructure. Against this backdrop, Megaeth is advancing the implementation of its project, emphasizing that the blockchain industry has moved past the early exploratory phase, and high performance has become key to supporting the next stage of application scenarios. 3. Industry insiders believe that all infrastructure has a "late-mover advantage," and blockchain also needs to go through a process of performance upgrades to drive scenario expansion. High performance is seen as the key to unlocking larger-scale applications. 4. With multiple chains exploring performance pathways, Megaeth positions itself as aiming to be the "fastest public chain," attempting to solve the challenge of "trillions of transactions on-chain." The team believes that addressing real-world problems is the most effective path, regardless of whether it is Layer1 or Layer2. 5. Megaeth's public sale is seen as the beginning of its "first mile" journey. Although it may face technical challenges, the potential brought by its differentiated underlying architecture is highly regarded and is expected to give rise to new industry paradigms.