In-depth Look at Four.meme's Latest Project Creditlink: On-chain Credit Unlocks Trillion-Dollar Market

This article will provide a comprehensive analysis of Creditlink from both market and product perspectives, helping readers gain a better understanding of on-chain credit as an important application scenario, as well as the value and potential of Creditlink.

On August 26, the market finally welcomed the latest collaborative project from Four.meme—the on-chain credit scoring platform Creditlink. This article will comprehensively analyze Creditlink from both market and product perspectives, helping everyone better understand this important application scenario of on-chain credit, as well as the value and potential of Creditlink.

Over the past decade, the development path of the blockchain industry has been clear:

-

Bitcoin initiated the experiment of decentralized currency;

-

Ethereum brought about smart contracts and asset prosperity;

-

DeFi, NFT, GameFi, and DAO have gradually built a diverse ecosystem.

But behind all this prosperity, a long-standing unresolved issue remains:on-chain credit.

Wallets can be created at will, identities can be repeatedly forged, and Sybil attacks are commonplace. For project teams, airdrops are often exploited by “airdrop hunters”; for investors, it’s hard to distinguish between genuine and fake tokens, and contract risks are frequent; for the entire industry, the lack of a verifiable credit system is becoming a major bottleneck preventing large-scale entry of capital and users.

According to research institutions, once on-chain credit is widely adopted, it will directly unlock a trillion-dollar-level market—covering multiple fields such as DeFi lending, decentralized identity, compliance review, and on-chain financing.

Exploration of Existing Tools

Currently, there are already some representative tools on the market that have made good progress:

-

DeBank: Known for wallet asset display and multi-chain visualization, suitable for individual users to view assets, but lacks in-depth credit analysis capabilities, especially in batch address identification.

-

Trusta: Has made certain breakthroughs in community sentiment analysis and contract monitoring, but data depth and coverage are limited, unable to support systematic credit evaluation in complex scenarios.

It can be seen that these tools focus more ondata presentation and basic analysis, while Creditlink’s market entry point is how to achieve true “on-chain credit infrastructure.”

Creditlink’s Entry and Advantages

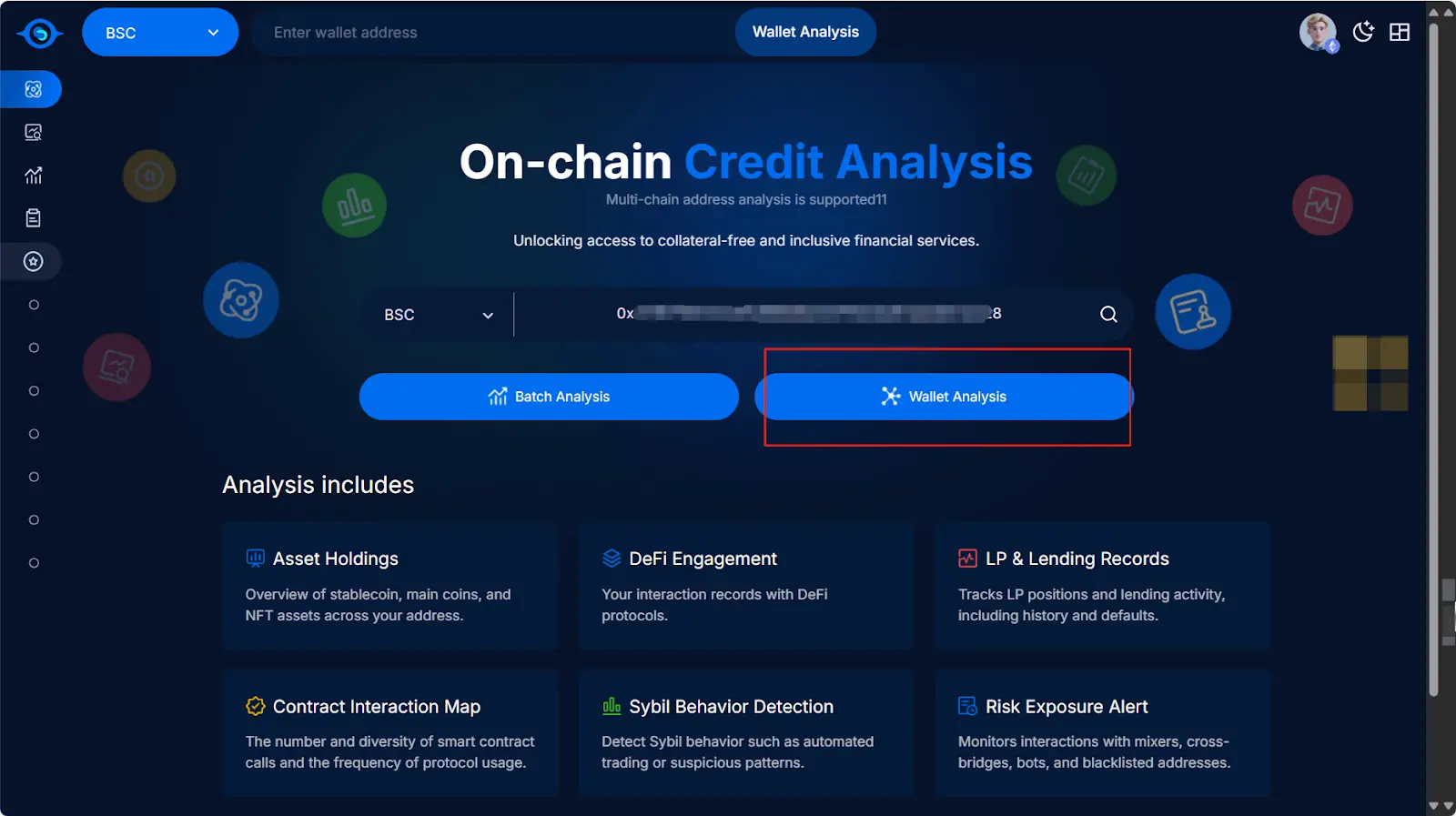

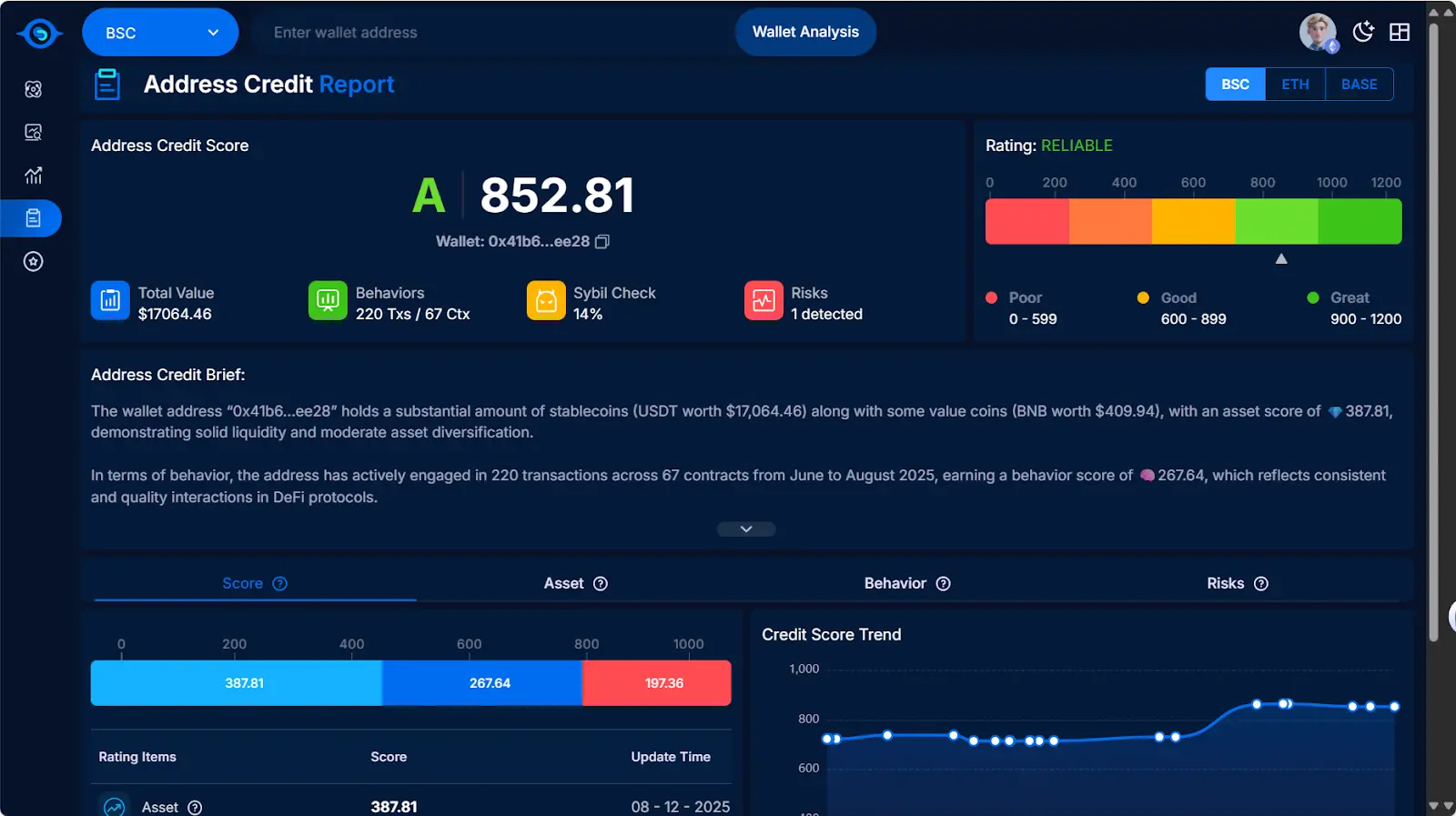

As the latest project launched by the Fourmeme platform,Creditlink has a very clear positioning: focusing on “on-chain credit analysis” as the core, building a complete closed-loop system from data collection, intelligent analysis to user incentives.

1. Intelligent Analysis: AI-Driven Credit Identification Engine

Creditlink introduces intelligent algorithm models that can:

-

Automatically identify potential Sybil networks and suspicious transaction patterns;

-

Generate comprehensive health scores for addresses and tokens;

-

Predict future risk trends based on historical behavior.

This shifts credit analysis from “post-event statistics” to “real-time alerts.”

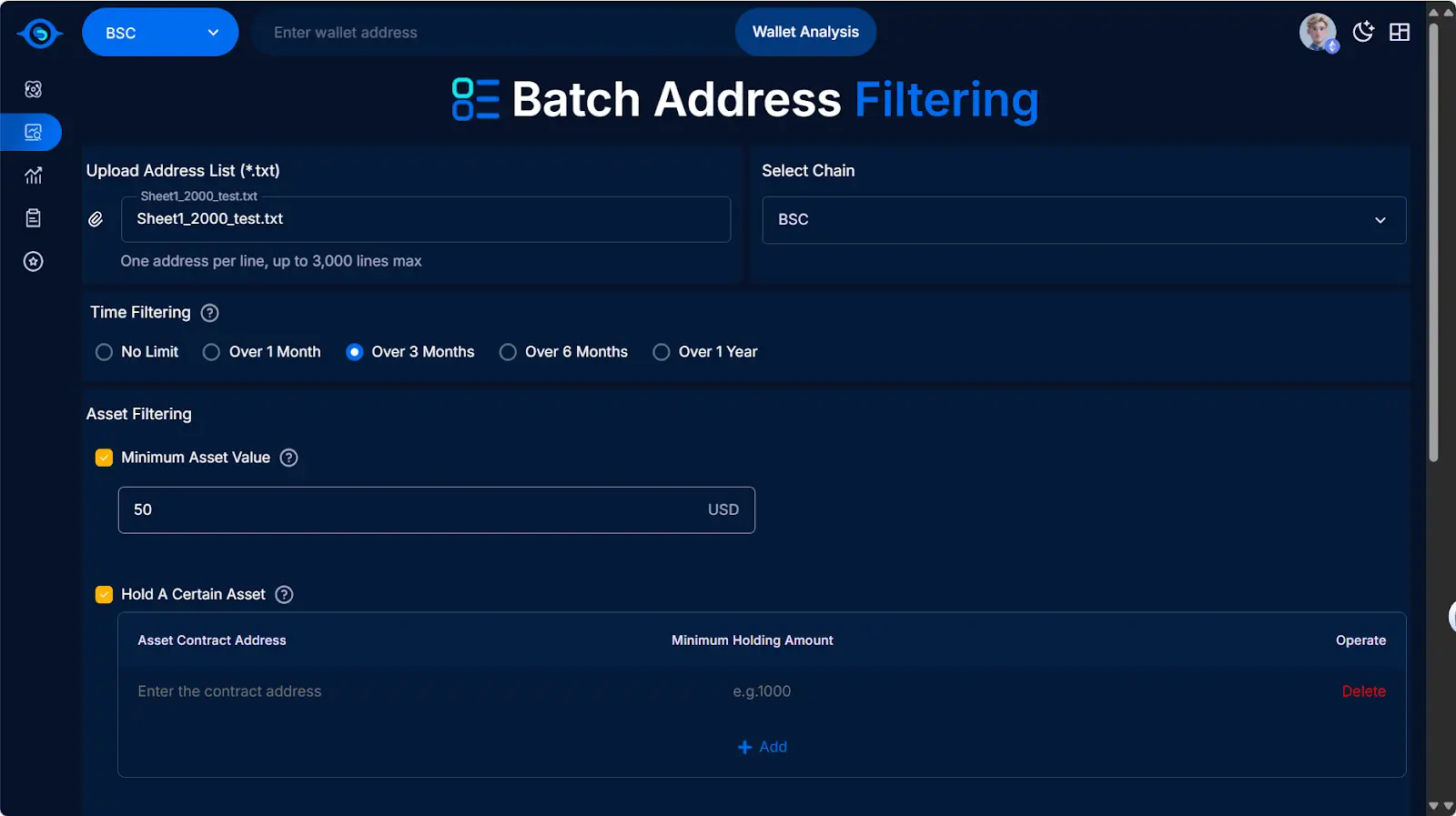

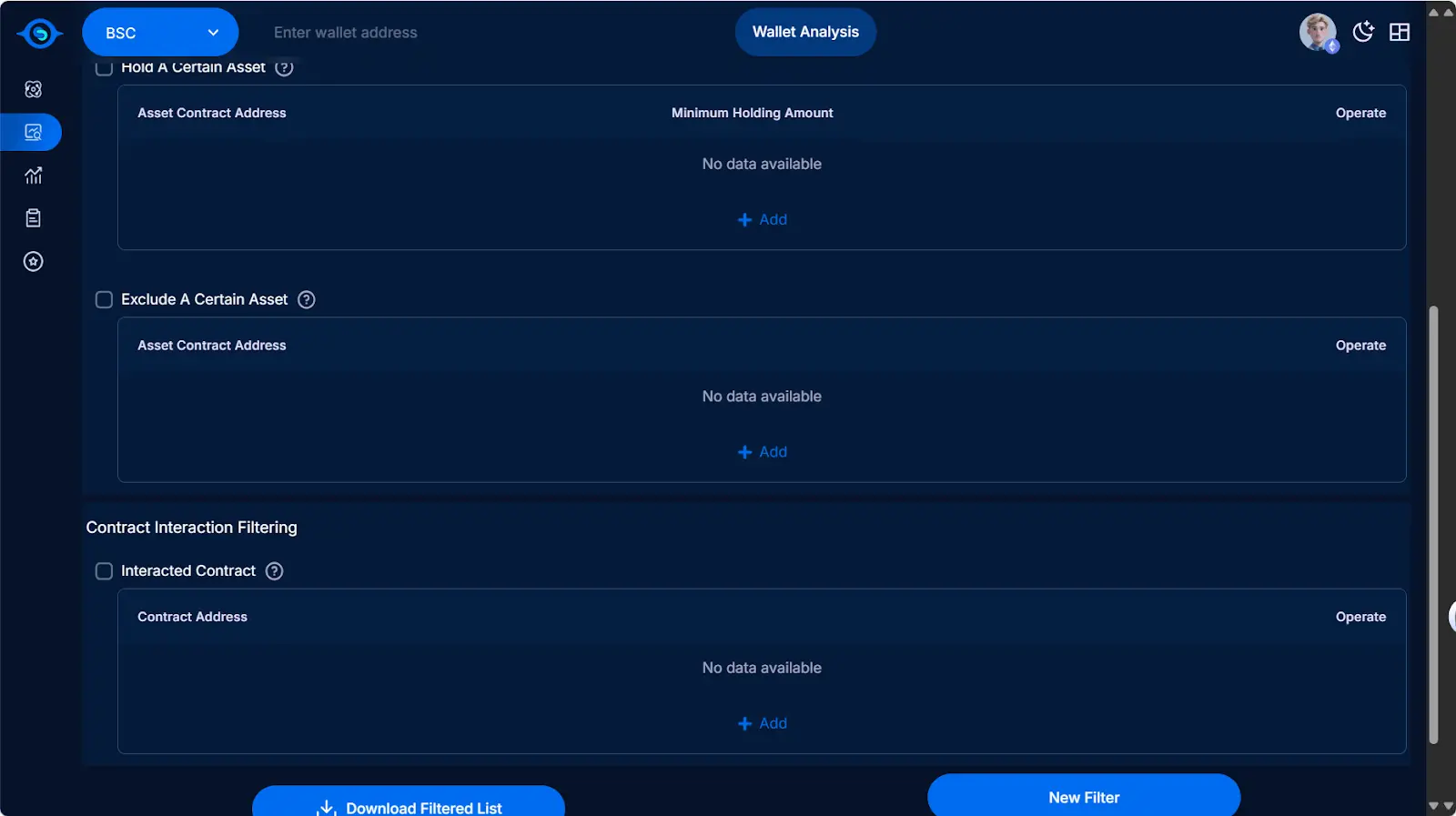

2. Batch Address Analysis: A Tool for Operations and Investment

Creditlink allows users to upload hundreds or thousands of addresses and filter them through custom conditions:

-

Wallet creation time, balance threshold

-

Whether there has been interaction with specific contracts

-

Whether airdrops have been received

Through this feature, project teams can accurately target real users and reduce resource waste; investment institutions can also quickly assess the wallet profiles of target communities.

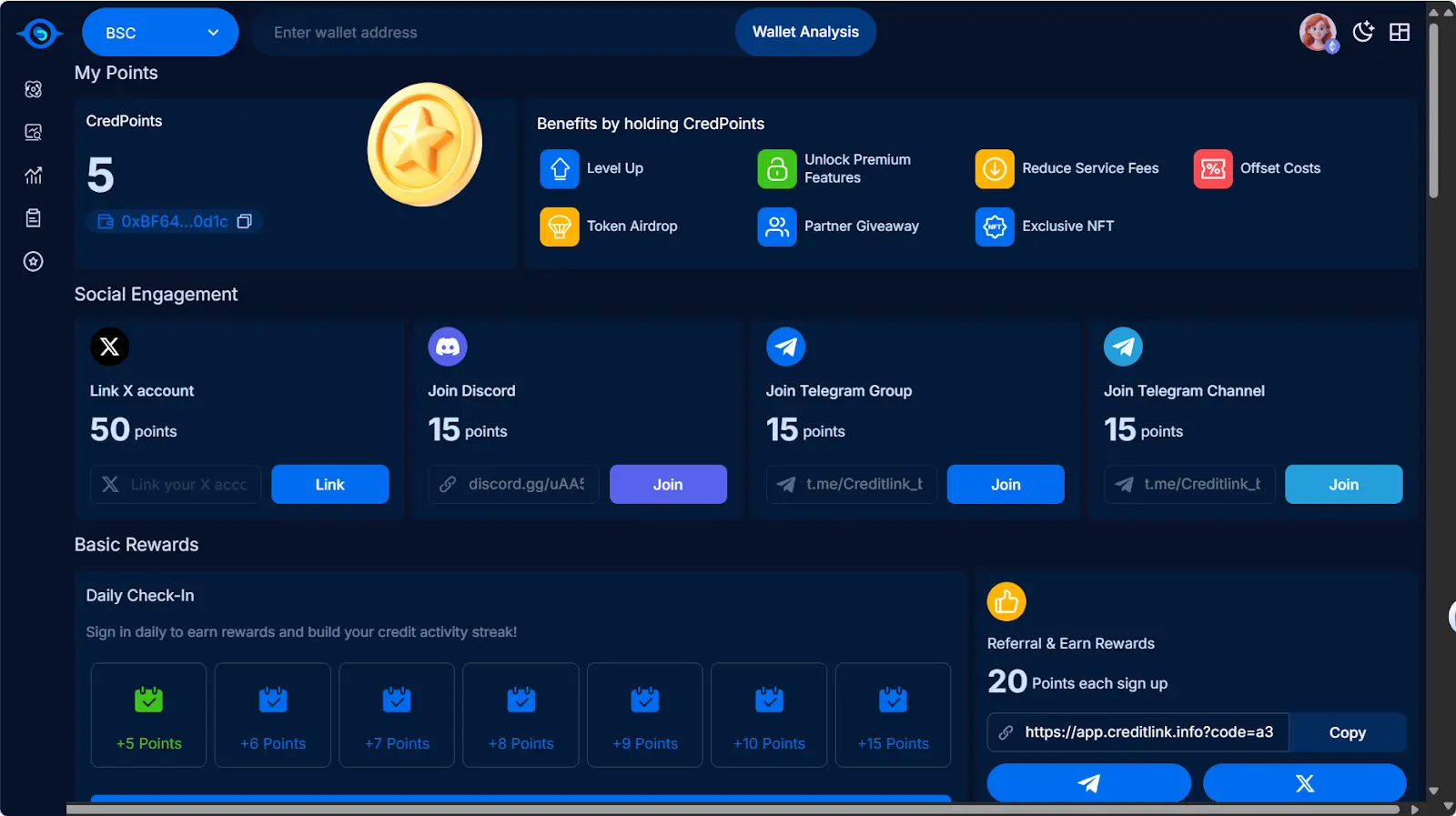

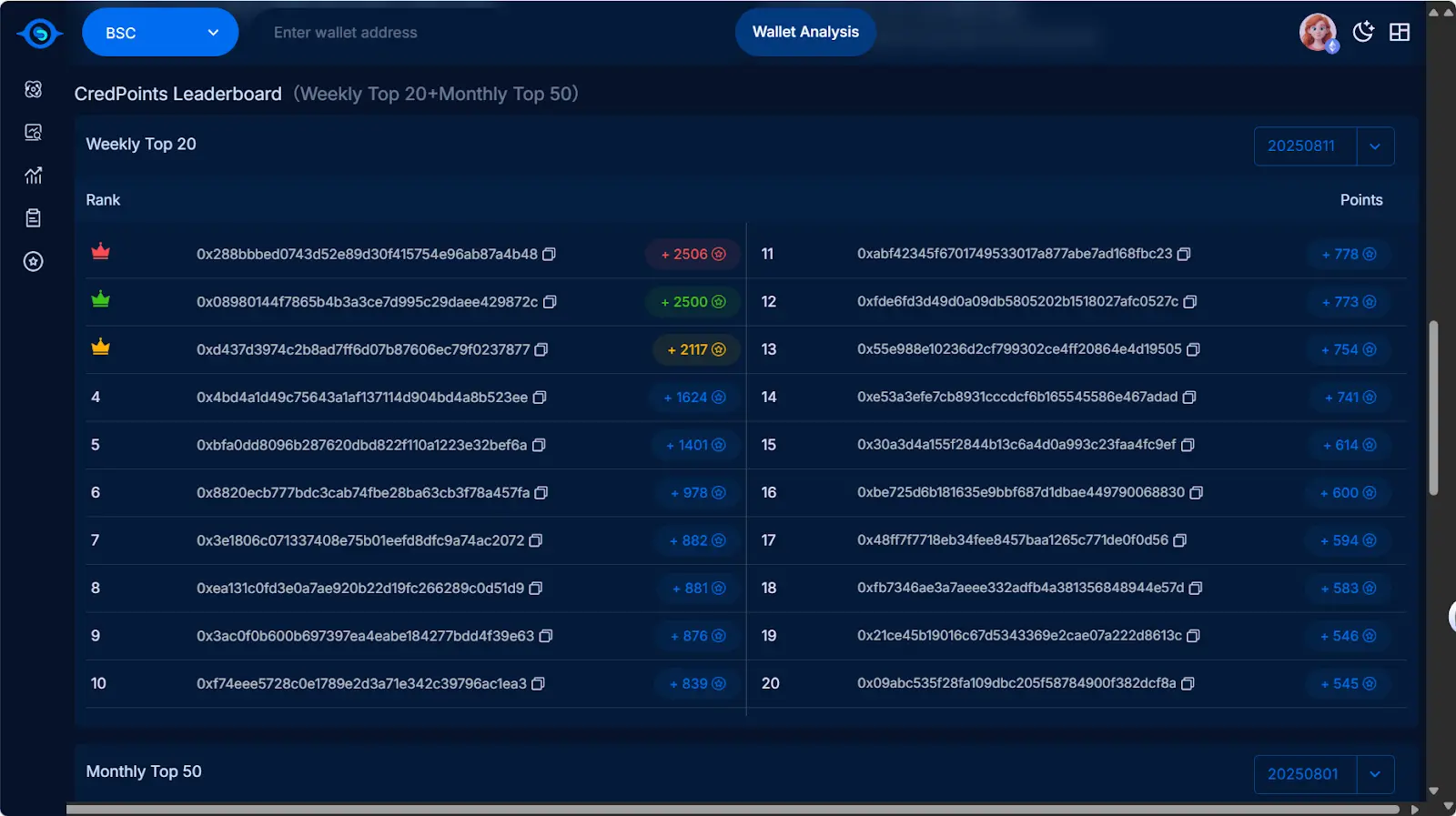

3. Credit Points System (CreditPoints): From Tool to Ecosystem

Creditlink has designed a CreditPoints points system:

-

Users can earn points by binding wallets, completing analysis tasks, and participating in community interactions;

-

Points can be redeemed for rewards and can also serve as qualification credentials for future platform activities.

This means that Creditlink is not just a “tool,” but is attempting to promote the ecological cycle of on-chain credit through an incentive mechanism.

Why Now? Why Creditlink?

The on-chain credit track is not a new concept, but there are not many projects that truly have practical scenarios and application closed loops.

The advantage of Creditlink is that it does not just solve a single point (such as wallet display or sentiment analysis), but forms a closed loop through data analysis + intelligent algorithms + points incentives, with the potential to evolve into a larger-scale credit ecosystem.

Conclusion: The Breaker of On-Chain Credit?

The construction of on-chain credit systems is moving from theoretical discussion to practical application. Whoever can first find a solution for “real user identification” will master the core entry point of Web3.

The emergence of Creditlink may be a signal worth paying attention to.

Beyond predecessors like DeBank and Trusta, will Creditlink become the breaker in the new track of on-chain credit? The market will provide the answer.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Prize pool of 60,000 USDT, “TRON ECO Holiday Odyssey” annual ecological exploration event is about to begin

TRON ECO is launching a major ecosystem collaboration event during Christmas and New Year, offering multiple luxurious benefits across the entire ecosystem experience!

Interpretation of the CoinShares 2026 Report: Bidding Farewell to Speculative Narratives and Embracing the First Year of Utility

2026 is expected to be the "year of utility wins," when digital assets will no longer attempt to replace the traditional financial system, but rather enhance and modernize existing systems.

Crypto Market Plummets as Fed’s Hawkish Stance Stuns Traders

In Brief Crypto market lost 3%, market cap fell to $3.1 trillion. Fed's hawkish rate cut intensified market pressure and volatility. Interest rate rise in Japan further destabilized crypto prices globally.