Navigating the New Frontier: Strategic Investment Opportunities in US Truck Manufacturing Amid Shifting Supply Chains

- US truck manufacturing supply chains face disruption from geopolitical tensions, labor shortages, and rising input costs, driving a nearshoring shift to Mexico and Texas. - Mexico's 38.7% FDI share in 2025 and Texas' $22.8B investment highlight key nearshoring hubs, with firms like NRS Logistics and Frisa expanding infrastructure and production capacity. - Federal policies like the Inflation Reduction Act and CHIPS Act incentivize domestic manufacturing, while 78% of companies adopt digital tools to enha

The global supply chain landscape for US truck manufacturing is undergoing a seismic shift, driven by geopolitical tensions, labor shortages, and the strategic pivot toward nearshoring. As companies recalibrate their operations to mitigate risks and capitalize on cost efficiencies, investors are presented with a unique opportunity to align with the next phase of industrial innovation. This article explores the key drivers of this transformation and identifies actionable investment opportunities in nearshoring and alternative manufacturing hubs.

The Perfect Storm: Challenges Reshaping the Industry

The past two years have exposed vulnerabilities in global supply chains. Shipping delays caused by Houthi attacks in the Red Sea and low water levels in the Panama Canal have disrupted the flow of raw materials and components. Meanwhile, labor shortages—particularly in trucking and dockwork—have exacerbated bottlenecks. A 2024 survey revealed that 80% of manufacturers reported labor turnover disrupting production, directly impacting delivery timelines.

Compounding these issues, input costs for steel, aluminum, and electronics are projected to rise by 2.7% over the next 12 months, according to the National Association of Manufacturers. These pressures are forcing truck manufacturers to prioritize resilience over cost optimization, a shift that aligns with the growing trend of nearshoring.

Nearshoring: A Strategic Pivot to Mexico and Texas

The US-Mexico border has emerged as a critical corridor for nearshoring, with U.S. companies investing heavily in Mexico to avoid tariffs and reduce lead times. In 2025, U.S. companies accounted for 38.7% of Mexico's foreign direct investment (FDI), with over 40% of this capital directed toward manufacturing.

Key players to watch:

- NRS Logistics America Inc. (a subsidiary of Tokyo-based NRS Corp.) recently opened a $90 million logistics hub in Arizona, catering to semiconductor and EV battery manufacturers. This facility exemplifies the demand for specialized infrastructure to support nearshoring.

- Frisa, a Mexican steelmaker, launched a $350 million hot rolling mill in Monterrey, expanding its capacity to supply aerospace and EV sectors. Its proximity to U.S. markets positions it as a strategic partner for truck manufacturers.

- Buhler Group is constructing its first U.S. plant in Torreón, Mexico, to support agricultural equipment production, signaling confidence in the region's industrial ecosystem.

Alternative Hubs: The Rise of the Southeast and Texas

While Mexico remains a cornerstone of nearshoring, U.S. states like Texas, Georgia, and Tennessee are emerging as alternative manufacturing hubs. Texas, for instance, attracted $22.8 billion in FDI in 2024, driven by its energy resources, business-friendly policies, and access to the USMCA trade network.

Georgia and Tennessee are also gaining traction, with Georgia securing $16.3 billion in manufacturing investment in 2024, largely in EV and battery production. Hyundai's $21 billion Metaplant in Georgia and General Motors' $4 billion shift from Mexico to Tennessee highlight the Southeast's growing appeal.

Investment opportunities in this region include:

- Texas Logistic and Fulfillment Services, which is establishing a climate-controlled 3PL hub in Houston to handle lithium batteries and temperature-sensitive goods.

- MTU Maintenance, a leader in aerospace maintenance, is expanding its Fort Worth, Texas facility to meet rising demand for engine repairs, a critical component for trucking fleets.

Policy Tailwinds: Incentives and Resilience

Federal policies like the Inflation Reduction Act (IRA) and CHIPS and Science Act are amplifying the case for domestic manufacturing. The IRA's 25% investment tax credit for advanced manufacturing facilities is particularly relevant for truck manufacturers seeking to reduce costs. Similarly, the CHIPS Act's focus on semiconductor production indirectly supports trucking by ensuring a stable supply of critical components.

States are also offering incentives. Texas, for example, provides energy cost advantages and complementary state-level grants, while Georgia's workforce development programs align with the industry's need for skilled labor in robotics and data analytics.

Digital Transformation: The New Supply Chain Imperative

As manufacturers adapt to volatility, 78% of companies are investing in supply chain planning software to enhance visibility and agility. This trend is creating opportunities for tech firms specializing in logistics analytics and AI-driven forecasting.

Investment Thesis: Where to Allocate Capital

- Mid-cap manufacturers in Texas and the Southeast: Companies like Hyundai's Metaplant and Frisa are positioned to benefit from regional incentives and growing demand for EV components.

- Logistics infrastructure providers: Firms like NRS Logistics America and Texas Logistic and Fulfillment Services are addressing the infrastructure gap in nearshoring.

- Steel and material suppliers: Producers like Frisa are critical to the supply chain, with expanding capacity to meet U.S. and global demand.

Conclusion: A Resilient Future Awaits

The US truck manufacturing sector is at a crossroads, with nearshoring and alternative hubs offering a path to resilience and growth. For investors, the key lies in identifying companies that are not only adapting to current challenges but also leveraging policy incentives and technological innovation to lead the next industrial wave. As the 2025 elections shape trade policies and tariffs, early movers in Texas, Georgia, and Mexico will likely outperform, making this an opportune moment to act.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is sandwich attack illegal too? MIT prodigy brothers who profited $25 million to stand trial

The victim is an MEV bot.

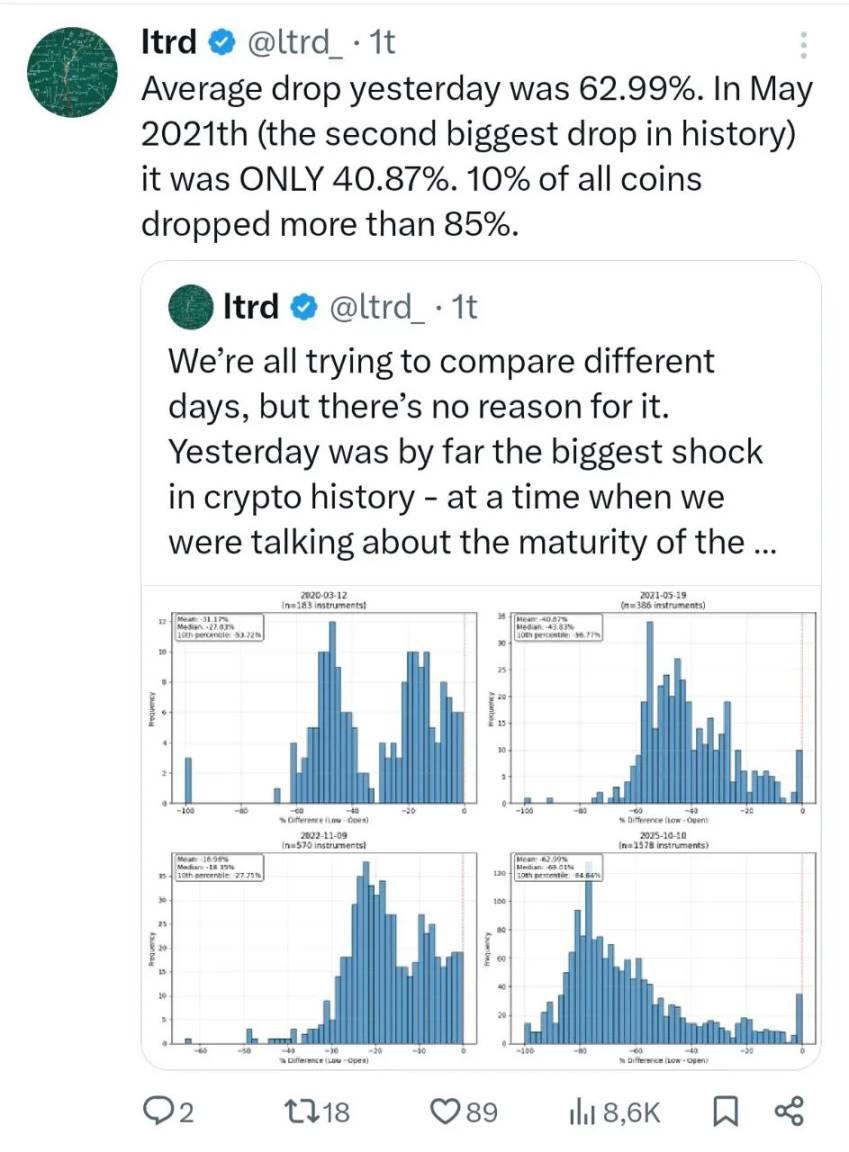

"10.11" Review and Survival Guide for the Survivors

In the post-crash era, where should cryptocurrency investment go from here?

From JPEG to AI Infrastructure, How Does AINFT Achieve a New Ecological Reconstruction?

AINFT aims to build a decentralized AI application aggregation ecosystem, allowing users to freely explore and utilize various AI Agent digital assistants just like using an "App Store."